The deal BP and Shell shareholders really want

Plus, Australia's Albanese chalks up second win for climate voters in two weeks

In today’s edition:

— BP shareholders need more than an acquisition from Shell, and they’re showing it

— Why Australia’s Albanese will keep the country’s climate transition going after re-election

— A glimpse into experimental climate products that might be investable in a few years

— Meta backing Sunraycer Solar projects in Texas

— Demand for minerals, led by lithium for EVs, to double or triple in next five years

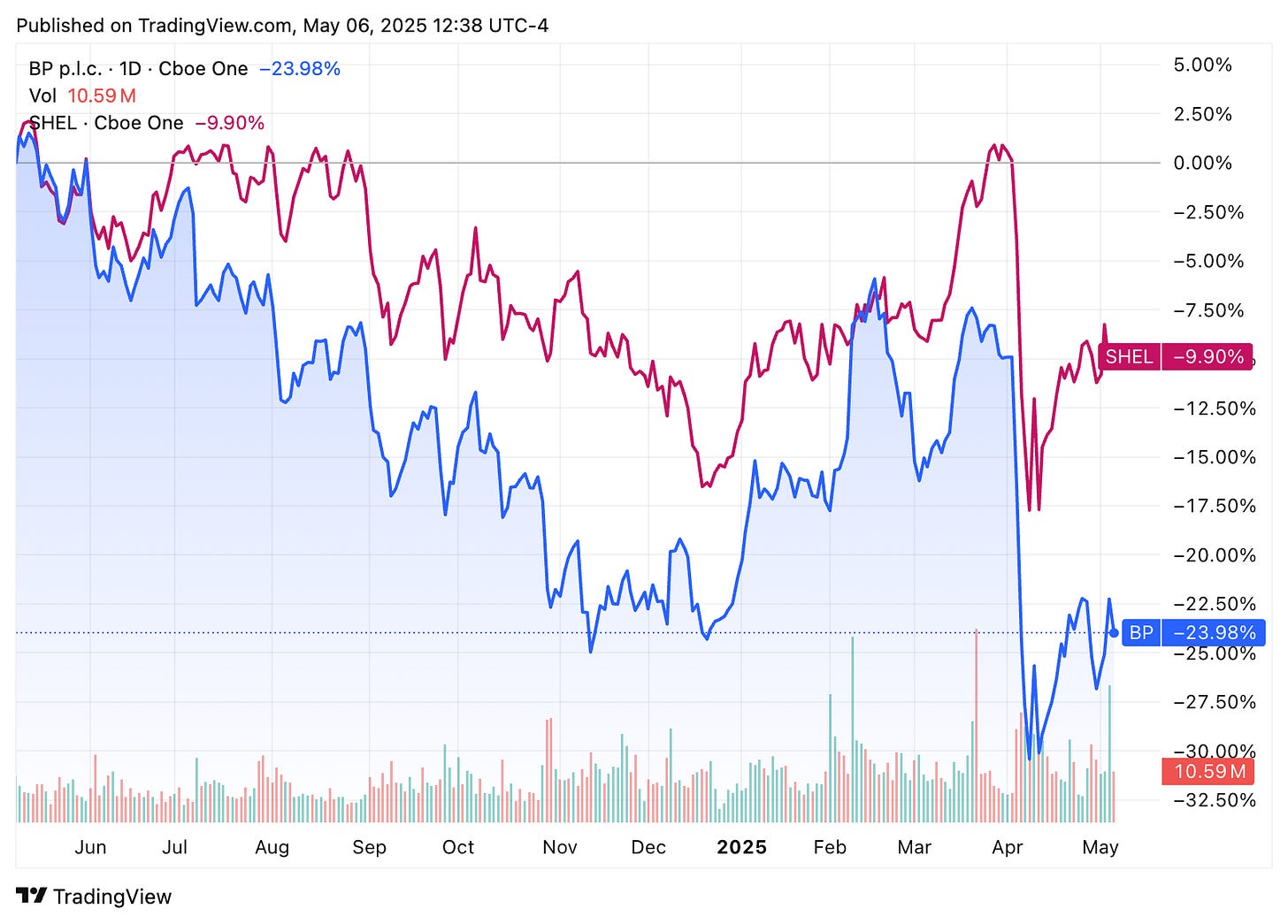

Judging from the circus in the financial media around a possible takeover of BP Plc BP 0.00%↑ by Shell PLC SHEL 0.00%↑ over the past few days, a bid of more than $100 billion seems inevitable. Judging from the market reaction in their stock prices, it seems shareholders for both would much prefer a jump in oil prices.

BP is in trouble. Its shares are down more than a third in the past year. It attracted the unwanted attention of shareholder activist Elliott Management, which has a 5% stake and is pushing for it to rewire its structure to cut back on all renewable investments in favor of more oil. Its net debt is rising, and its first-quarter earnings came in below expectations last week, leading to the takeover speculation.

Shell, which is about twice the size of BP, is reportedly considering a bid. Exxon XOM 0.00%↑ and Chevron CVX 0.00%↑ may or may not be circling too, if you believe the reports. Any deal would likely be the largest oil deal in history, exceeding the $80 billion Exxon-Mobil deal in 1999.

The oil industry is certainly consolidating. No doubt every oil major has bankers looking at any combination of deals going forward, either as an offensive or defensive maneuver. Like any good management team, when a rival is in trouble, Shell is looking at its options.

But in the absence of any rational outlook for higher oil prices in the world of U.S. tariffs and OPEC intransigence, not to mention Russia’s situation with the EU, it’s hard to see how a massive deal that would yield enormous regulatory concerns and only result in a bigger oil company reliant on what could be a peaking commodity makes much sense.

Unless — unless — it’s a way for Shell to acquire BP’s renewable assets before the company disposes of them at fire sale prices to appease shareholders. Apart from BP, Shell is the most interested oil major in renewables, though like the others it has weakened its targets in recent months.

It is more than likely that Shell is preparing a valuation and a strategy for acquiring BP, but only should it become available through further price declines, or if another bid emerges. Without a sustainable outlook for oil prices in the next four years, all other bets in the industry are only just bets.

Don’t forget to contact me directly if you have suggestions or ideas dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

Tuesday’s investor insights

Australia’s Albanese chalks up second win for climate voters in two weeks

Keep reading with a 7-day free trial

Subscribe to Callaway Climate Insights to keep reading this post and get 7 days of free access to the full post archives.