How Trump tech activism may spread to the energy industry

Welcome to Callaway Climate Insights, your daily guide to global climate finance. Upgrade your subscription now and take advantage of our big Labor Day sale.

Summer sale alert!

For the rest of this month, leading up to Labor Day in the U.S., Callaway Climate Insights will be available to new subscribers for less than $5 a month for the first year. Take advantage now to get the best of our daily global climate analysis. If you’re a free subscriber, upgrade now with the best deal of the year — our special Labor Day sale offer.

Much hand wringing and legal wrangling on Wall Street in the past few weeks as the White House talks about taking an ownership stake in Intel Corp. INTC 0.00%↑ and other chipmakers, and strong arms Nvidia NVDA 0.00%↑ and Advanced Micro Devices AMD 0.00%↑ into giving up 15% of their sales into China.

But an early warning came just last month when the Department of Defense announced a 15% stake in MP Materials MP 0.00%↑ for $400 million, causing shares in the rare earths company to leap almost 50% in one day. At the time, the DoD took pains to say this wasn’t the beginning of a nationalization of the business, but the moves on chipmakers in the past week challenge that assertion.

The idea of partial government ownership of a business is a very Chinese model of capitalism, and one fraught with dangers, as tech leaders in China themselves found out a decade ago when they were effectively silenced overnight. Ask Jack Ma of Alibaba Group BABA 0.00%↑ .

In the U.S., it’s clear the chipmakers are in the direct line of fire given the strategic importance of chips to the whole AI revolution. But as MP Materials showed, energy companies, particularly those tied to minerals, could also become targets.

Maybe that will boost the beleaguered shares of some of these companies but in the long run it’s a terrible idea. The government has long been the preferred client of any and all major manufacturers, from weapons companies to energy and tech. It has helped with subsidies and in many cases is the major customer of some of these businesses. But having the government take stakes and demand money for allowing business into certain markets smacks of extortion.

Big tech’s relationship with government has always been fraught. Not much better with energy companies, dating back to Enron Corp. But this is a treacherous path. CEOs and boards of any and all energy companies — from oil and gas to clean energy itself — should pay attention to what’s happening with the chipmakers. They could be next.

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

Hulbert: How climate change ultimately favors Democrats

. . . . The probability that the U.S. House of Representatives will pass a carbon pricing bill in 2050 is 9% higher than today. That might seem depressingly modest, given projections of how much hotter the climate will be in 2050. But you may nevertheless find some solace in the study’s implication that the current administration’s backtracking on environmental policy will only be temporary, writes Mark Hulbert, citing a new study from authors at Berkeley and Columbia universities. According to the research statistics, increases in both extreme heat and in green programs over time tend to lead to voting outcomes that provide a slight edge to Democrats. That might seem modest as well, especially given the current administration’s attempts to squelch green programs, but climate change is a long-term game.

Thursday’s subscriber insights

Ukraine’s mineral treasures emerge a wildcard in peace talks

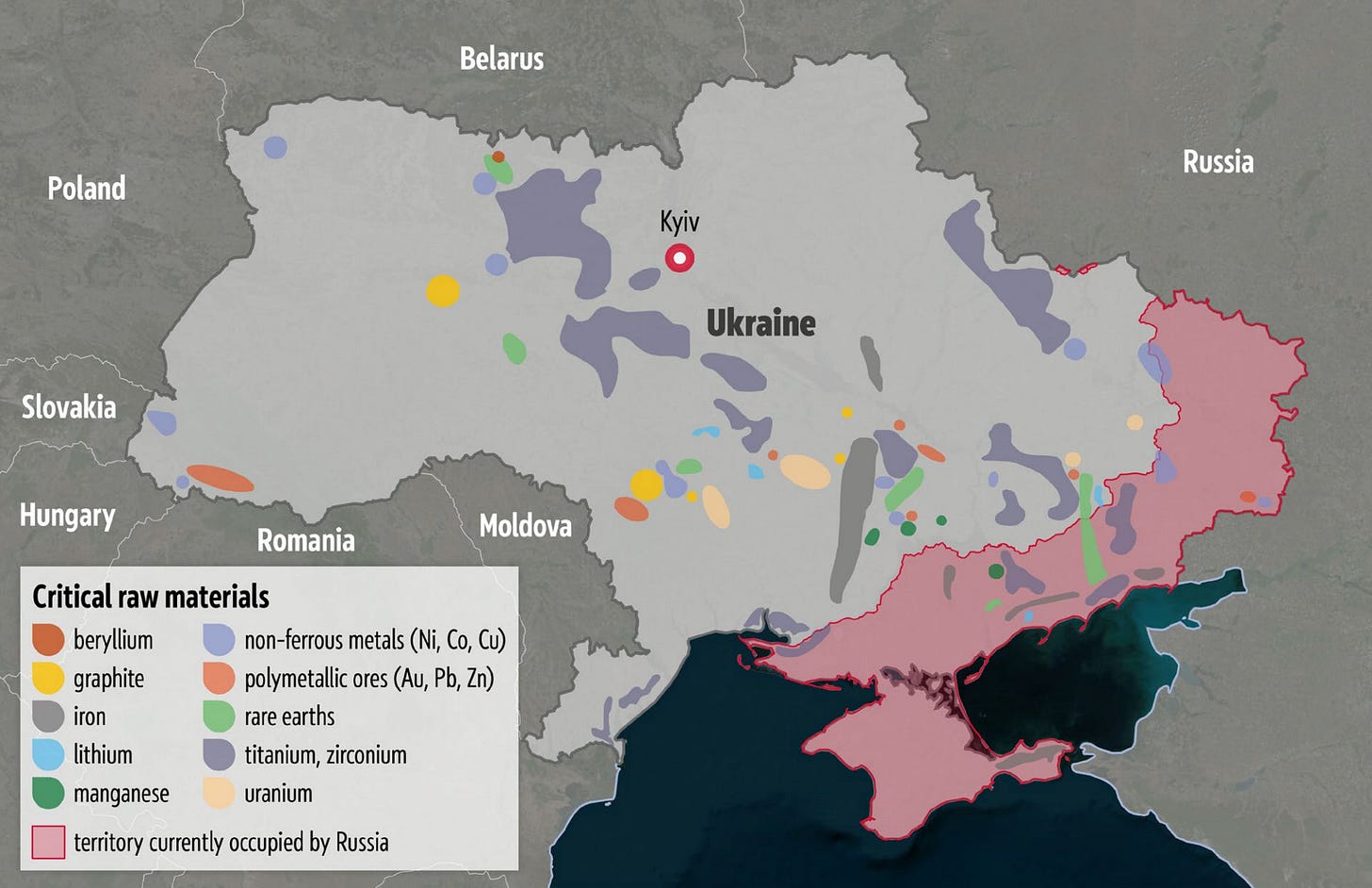

. . . . The fragile global dance in the past week to move the Ukraine war toward some sort of peace talks belies a rising greed from all sides, including Wall Street banks, for a chance to get at the potential trillions of dollars of minerals buried underneath disputed territory in the war-torn country.

Even before the first round of talks, which haven’t even been agreed, Wall Street banks and European governments are starting to draw up what would be a modern-day Marshall Plan for Ukraine, and underneath the prospects for peace is a race for digging rights for everything from lithium deposits to uranium and rare earths in the area of Donbas.

But a couple of major obstacles remain before banks, mining companies and investors can tap into these projected riches. One is that the territory that the minerals lie is under Russian control and heavily mined according to some reports. A bigger one is that current estimates claim it could take decades to find the minerals, bring them to the service, process them and use them in energy markets.

No wonder there is such interest in post-war security pledges from the U.S. and NATO even though the first ceasefire has yet to be declared. You can read more about these resources in my colleague Jonathan Maxwell’s excellent Substack, The Edge.

Indeed, Ukrainian mineral resources are certainly there and have made the area contested for decades. But the idea of instant treasure at the end of the war may end up similar to the idea of “weapons of mass destruction” in Iraq, a massive exaggeration to fight a war for something that never really materialized.

Editor’s picks: Erin brings smashing waves; plus, South Dakota’s new gold rush

Gold mining resurgence in South Dakota

South Dakota’s first gold rush brought miners to the Black Hills 150 years ago. Today, with gold prices around $3,000 an ounce, a new wave of miners is returning. There are hopes for an economic resurgence for the region, but some worry about how modern methods of gold mining could damage the environment. A report from The Associated Press reports one gold mine now operates in the Black Hills, but there are proposals for another, as well as exploratory drilling sites that companies hope will lead to productive mines. Native American tribes and environmentalists opposed the requests, arguing the projects and open pit mining are close to sacred sites, will contaminate waterways and permanently scar the landscape. Unlike 150 years ago, the mining companies now usually rely on massive trucks and diggers that create deep, multitiered pits and use chemicals like cyanide to extract the gold, the AP notes.

Latest findings: New research, studies and projects

Wildfire smoke pollution is hurting our health

Wildfire smoke pollution has surged in recent years, putting Americans’ health at risk. And emerging research shows that climate change is making it worse. That’s according to a new report from Climate Central on how climate change is worsening wildfire smoke. New research shows that wildfire smoke caused 164,000 premature deaths in the U.S. from 2006 to 2020 — and that climate change accounted for about 15,000 of those smoke-related deaths. Also, the report says per-person exposure to harmful wildfire smoke in the U.S. was four times higher during 2020-2024, on average each year, than during 2006-2019. Heat-trapping pollution fuels the hot, dry conditions that help fires spark and spread. Although wildfire smoke is most acute in the western U.S., it’s a nationwide air quality issue. Every county in the contiguous U.S. now sees at least 16 wildfire smoke days each year. Wildfire smoke is a complex mix of pollutants, but fine particulate matter (PM2.5) accounts for about 90% — and is the main threat to human health.

More of the latest research:

Words to live by . . . .

“This is a treaty that all but ensures that nothing will change. It gives in to petrostate and industry demands with weak, voluntary measures that guarantee we continue to produce plastic at increasing levels indefinitely, fail to safeguard human health, endanger the environment, and damn future generations.” — David Azoulay, head of the delegation for the Centre for International Environmental Law, speaking this week at the end of failed global plastic treaty talks in Geneva.