A new $7 trillion price tag on natural markets highlights transition play

Welcome to Callaway Climate Insights. Not a subscriber yet? If you enjoy this free edition, subscribe to get it four days a week.

Today’s edition is free. To read our insights and support our great climate finance journalism four days a week, subscribe now for full access.

A new report this week has slapped a value estimate on natural markets such as agriculture, carbon credits and conservation projects for the first time — a whopping $7 trillion that underscores the economic and investment potential of the coming transition to renewable energy.

The Taskforce on Nature Markets, funded by the Mava Foundation, a Swiss philanthropy started 28 years ago by the late conservationist Dr. Luc Hoffmann, co-founder of the World Wildlife Fund, said in the report titled Nature in an era of Crises, that the current value of those markets is already equivalent to 8.6% of global GDP, which would make it the third largest economy in the world after China and the U.S.

The taskforce, which includes former U.S. Treasury Secretary Hank Paulson and Kate Hampton, chair of the Children’s Investment Fund Foundation, is seeking to develop a taxonomy for these markets, which are already booming in areas of credit and commodities but lack a focus on economic prosperity as well as natural preservation.

The report is an interesting addition to dozens of private attempts by Wall Street and other financial centers to put a value on the opportunity of environmental, social, and governance (ESG) investing opportunities. But it is just a first attempt at trying to envision what a complete transition to a renewable and sustainable economy might look like two decades from now.

Still, in this current era of confusion and disinformation about climate agendas, it is a welcome reminder that ESG and environmental investing in general is more than just a trend.

More insights below . . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Here’s one way to solve the ESG culture wars with red states

. . . . The culture wars around ESG investing refuse to subside, even with climate change wreaking havoc on places such as Florida this week. Mark Hulbert takes a look at the folly of ignoring climate risk in investment decisions and comes up with a unique compromise that might satisfy clean tech investors and red state politicians alike. And more importantly, allow everybody to hedge climate risk and seek returns on new renewable strategies. . . .

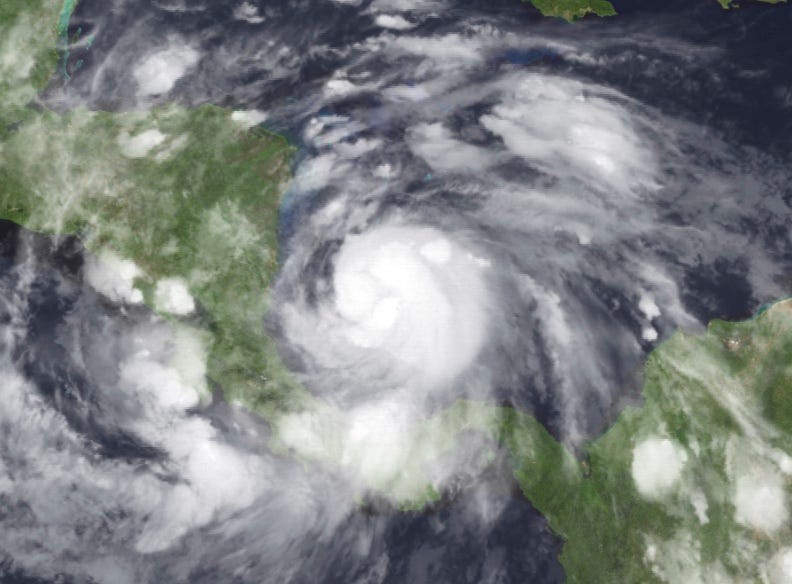

New global weather report on climate change points finger at Latin America

. . . . Warming trends and extreme weather disasters made 2021 the worst year in history for climate disasters, particularly in Latin America, according to a new report out of Cartagena, Columbia. Michael Molinski looks at which insurers were most impacted, along with several other industries, from oil exploration to tourism. The report also breaks down which parts of Latin America are getting hit the hardest, and the impact of deforestation in the Amazon Basin, which doubled last year over 2020. . . .

Book review: The Displacements tells the story of the next hurricane to hit Florida

. . . . The destruction from Hurricane Ian is only beginning to be counted, but everybody agrees it won’t be the last hurricane to hit Florida. In his review of a timely new book called “The Displacements,” by Bruce Holsinger, our correspondent Jack Hamilton looks at how Ian’s wrath may be just a preview to what the first Category 6 hurricane might look like, and its impact on the lives of the people in its path. The story of Daphne Larsen-Hall, a wealthy Coral Gables resident left homeless and broke by a hurricane, is not one to be missed. . . .

A selection of this week’s subscriber-only insights

. . . . Russia’s invasion of Ukraine has been a tragedy — and an economic pain in the butt for the rest of the world. But it may have a silver lining: that it is expected, after a relatively brief turn to fossil fuels, to speed up the adoption of renewables. Here’s how it could play out. Read more. . . .

. . . . It used to be in times of war that a country’s infrastructure was pretty much self-contained and could only be taken out by bombing or, in relatively rare cases, sabotage. But now international pipelines proliferate, wind turbines and oil rigs sit in the sea and the rise of computers means facilities can be attacked remotely. With global tensions rising, is enough attention being paid to these dangers? Read more. . . .

. . . . In America, much focus lately has been on wind power, especially with the green lights given to offshore wind on the East Coast. In addition, supply chain issues and tensions with China have hampered solar. But it turns out solar is becoming the big kahuna of green energy, with, for instance, China’s sun-based renewable having now overtaken wind. And the same is true in other countries. Read more here. . . .

Editor’s picks: We’re not done with Ian yet

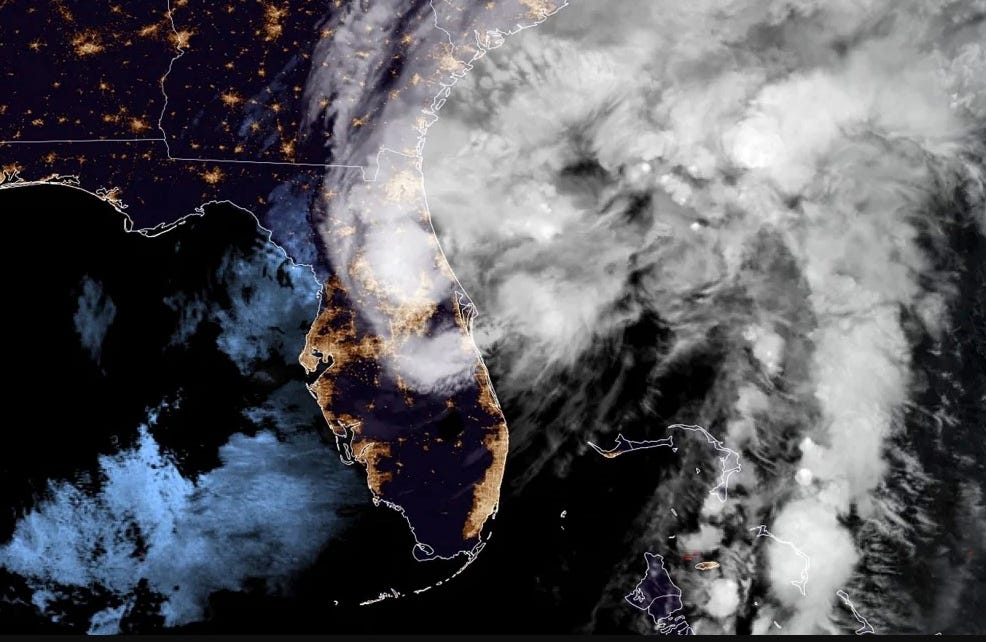

Ian restrengthens, heads north

Hurricane Ian was downgraded to tropical storm status Thursday morning as it continued its devastating and deadly path across Florida, but was expected to return to hurricane strength. Forecasters are now watching Ian as it moves out over the Atlantic and heads toward North Florida, Georgia and South Carolina. Ian will make another landfall near Charleston, S.C. on Friday afternoon. The hurricane has brought catastrophic flooding and wind damage across a wide swathe of Florida, and an unknown number of fatalities. A section of the Sanibel Causeway connecting Sanibel Island and Captiva with mainland Florida has been destroyed, cutting off all vehicle access. About 6,500 people live on Sanibel. More than 2.5 million people were without power statewide, with the most infrastructure damage occurring in Southwest Florida. President Joe Biden declared a major disaster for the state. Gov. Ron DeSantis, in an update from the state Emergency Operations Center in Tallahassee Thursday morning, said: “You’re looking at a storm that’s changed the character of a significant part of our state, and this is going to require, not just the emergency response now, and the days or weeks ahead, I mean this is going to require years of effort, to be able to rebuild, to come back.” Ian is expected to inflict as much as $40 billion in property damage claims and much more in total economic losses, RBC Capital Markets analysts calculated. The National Hurricane Center said Thursday that Ian is expected to move off the east-central coast of Florida later today and then approach the coast of South Carolina on Friday. “The center will move farther inland across the Carolinas Friday night and Saturday. … Some slight re-intensification is forecast, and Ian could be near hurricane strength when it approaches the coast of South Carolina on Friday.”

Latest findings: New research, studies and projects

Green tourism or dirty dancing?

Tourism was one of the fastest-growing sectors before the pandemic, accounting for about 10% of global GDP. But it has also created a number of challenges including environmental degradation, especially in small island countries where the carbon footprint of tourism constitutes a substantial share of carbon dioxide emissions, according to a new IMF paper titled Dirty Dance: Tourism and Environment. This study empirically investigates the impact of tourism on CO₂ emissions in a relatively homogenous panel of 15 Caribbean countries over the period 1960–2019. The results show that international tourist arrivals have a statistically and economically significant effect on CO₂ emissions, after controlling for other economic, institutional and social factors. Therefore, managing tourism sustainably requires a comprehensive set of policies and reforms aimed at reducing its impact on environmental quality and curbing excessive dependency on fossil fuel-based energy consumption. Author: Serhan Cevik, International Monetary Fund.

More of the latest research:

Words to live by . . . .

“Hurricane season brings a humbling reminder that, despite our technologies, most of nature remains unpredictable.” – Diane Ackerman, author.