As world kickstarts oil again, climate is destroying Australia under our noses

Welcome to Callaway Climate Insights. Stay tuned for big news on our latest climate conference, coming next week.

To read all our insights, news and in-depth interviews, please subscribe and support our great climate finance journalism. Callaway Climate Insights publishes Tuesdays and Thursdays for everybody.

(David Callaway is founder and Editor-in-Chief of Callaway Climate Insights. He is the former president of the World Editors Forum, Editor-in-Chief of USA Today and MarketWatch, and CEO of TheStreet Inc.)

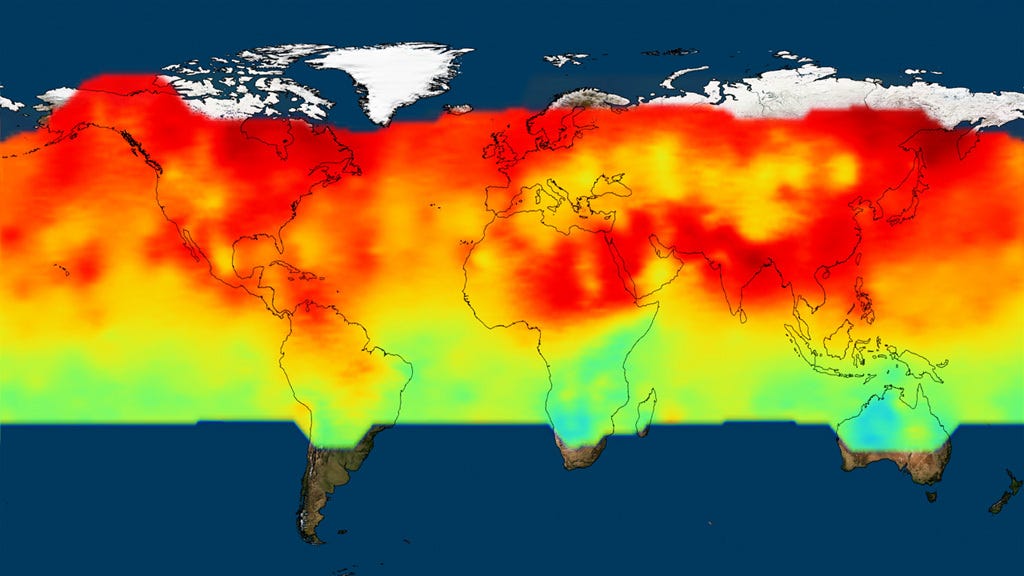

Without a doubt the most under-reported story of the past month, as Russia started a new war, has been the impact of devastating floods in Australia and some of its largest cities. As the U.S. and European governments prepare to dramatically increase usage of oil and gas and coal to fight crippling energy price increases, what may be the worst climate disaster yet is laying waste to the eastern half of an entire continent.

Thousands were hit with mandatory evacuations this week in Sydney, Australia’s financial capital. Insurance companies report being buffeted with claims, as streets are turned into rivers and an overflowing dam threatens hundreds of homes in Sydney suburb Manly. Entire small towns in New South Wales and Queensland have been submerged, according to reports.

The floods, caused by torrential rains dubbed “bomb rains” because of the speed and intensity of the downpours, are set to be the most costly natural disaster in Australian history. The costs to business, insurance, and the associated rise in inflation are changing the political and financial dynamic in a country known for its anti-climate-change government and historic reliance on energy and mining.

Coming just a few years after a series of wildfires laid waste to millions of acres, the floods are a dramatic example of how climate change — unchecked — will soon hit other parts of the world, such as Africa, and Latin America.

The irony of the rest of the world doubling-down on oil and gas as global warming takes another victim won’t be lost on historians. Climate change is no longer a slow-motion disaster, but even in the face of a major national emergency such as the floods in Australia, the rest of the world still seems to find some reason to look the other way.

More insights below . . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Check out the new Substack app. It’s never been easier to stay up-to-date with the latest news, insights, columns and special reports from Callaway Climate Insights.

Brussels kickstarts Green New Deal to ditch most Russian fuel by end of year

. . . . The European Union kickstarted its Green New Deal this week to move faster to transition to renewable energy with plans to ditch up to two-thirds of Russian oil and gas by the end of the year, writes Alisha Houlihan from Dublin. Climate Commissioner Frans Timmermans conceded, though, that quickly moving away from Russian gas would likely result in a jump in coal usage, something the European block had been firmly trying to avoid. Ministers must now debate regulatory measures to shield some member countries from crippling price increases. . . .

Ukraine war throws lifeline to Big Oil

. . . . Putin’s War may yet be the catalyst for the world more quickly adopting renewable energy, but in the short term it’s driving energy prices higher worldwide, throwing a lifeline to big oil companies and effectively crippling President Joe Biden’s climate agenda, writes Bill Sternberg from Washington, D.C. The potential for shortages of gas and oil is also enhancing the argument for nuclear energy as a renewable transition fuel, despite the potential dangers, illustrated just last week with the Russian attack on the Zaporizhzhia plant in southeastern Ukraine. . . .

Thursday’s subscriber insights: Record offshore wind auction turns political

. . . . When an auction of seabed rights for offshore wind turbines in the New York/New Jersey Bight raised record amounts last week of more than $4.4 billion, some raised concerns about permits, pointing to the 10-year permitting process experienced by the Vineyard Wind project in Massachusetts. A week later, we’re beginning to see some of the same issues in the Garden State, where local hearings have started amid some, uh, colorful objections. Read more here. . . .

. . . . Goldman Sachs became the first major Wall Street financial firm to pull out of Russia this morning, providing cover for others to follow, including maybe one of the biggest Russian players, JPMorgan Chase & Co. (JPM). Goldman (GS) reportedly has less than $1 billion in assets in Russia, but the move is symbolic of Wall Street joining many other companies around the world in suspending Russian business in protest of its invasion of the Ukraine. As we told subscribers earlier this week, expect more to follow suit, especially since financial lifelines have been cut on a global scale. . . .

. . . . Last month, Ford revealed that its new F-150 Lightning EV truck could send power into people’s homes if they need it. Now it appears GM has gone a step further by doing the same thing but having it integrated with the electricity grid. A pilot program in California, one of the biggest adopters of electric vehicles — but also where a huge debate about net-metering from solar homes to the grid is happening — is due to begin soon. In any event, the bar has just been set a bit higher in the EV world. Read more here. . . .

. . . . The White House announcement this week that it is restoring California’s ability to set its auto emissions regulations is a big breakthrough. After all, vehicles are the biggest U.S. polluter. Also, the Golden State’s regulations are increasingly being adopted by other states, a process that will soon make it not worthwhile for automakers to produce two types of cars. Read more here. . . .

. . . . In a novel lawsuit, salmon are suing cities in Washington state, saying that their rights are being impinged by dams that have been constructed and blocked their natural habitats. Sound fishy? Read more here. . . .

Editor’s picks: A bad day for bees; omnibus bill brimming with water resource, flood projects

A bad day for bees

The Environmental Protection Agency is expected to go ahead with a plan to extend for 15 years the use on American farmlands of four types of neonicotinoid chemicals known to be dangerous to bees and other insects. A report in the Guardian notes the European Union is moving to ban the use of these toxins, which have been blamed for widespread insect declines. According to the report, the EPA will extend the use of imidacloprid, thiamethoxam, clothianidin and dinotefuran despite the fact the agency has acknowledged “ecological risks of concern, particularly to pollinators and aquatic invertebrates.” The Guardian reports that an EPA spokeswoman said that review decisions for the neonicotinoids will be issued late this year and that mitigation rules for their use are being considered.

Omnibus bill flooded with water and resource projects

E&E News reports the $1.5 trillion fiscal 2022 spending deal is “awash in cash for water and natural resources projects, including a number of Republican proposals to gird coastal communities against the effects of climate change.” The report notes this is the first time in years the omnibus package includes congressionally directed spending, or earmarks. This bill includes about $4 billion in requested earmarks, including restoration work in South Florida, a levee and flood control project southwest of New Orleans, and more flood mitigation projects in the Mississippi Delta. The bill could fund as many as 2,700 projects. The House late Wednesday passed the bill, which will keep the government running through the end of September and which includes to keep the government running through the end of September and includes $13.6 billion in emergency assistance to Ukraine and NATO allies. President Joe Biden is expected to sign the bill today or Friday.

Latest findings: New research, studies and projects

Ranking S&P 500 companies on corporate GHG emissions reports

The SEC is poised to announce a decision on corporate social responsibility reporting, and the decision could “break the impasse over whether reporting should be solely for the benefit of investors — single materiality — or for the benefit of investors and the public — double materiality,” says Lynn M. LoPucki, of the UCLA School of Law, author of Corporate Greenhouse Gas Disclosures, a comprehensive study of corporate greenhouse gas reporting under the GHG Protocol. “Public use of the GHG data will be possible only through rankings by trusted intermediaries. This Article proposes methods for ranking S&P 500 companies based on corporate GHG emissions reports. It demonstrates those methods by ranking the studied companies,” LoPucki writes in the abstract.

More of the latest research:

Words to live by . . . .

“Fossil fuels are a dead end — for our planet, for humanity and for economies.” — António Guterres, secretary general of the United Nations.