‘Beautiful’ bill contains ugly surprise for EV owners

Will new tax survive the Senate? That’s the $64 billion question.

This column is for Callaway Climate Insights subscribers only, but it’s OK to share once in a while. Was it shared with you? Please subscribe.

(Bill Sternberg is a veteran Washington journalist and former editorial page editor of USA Today.)

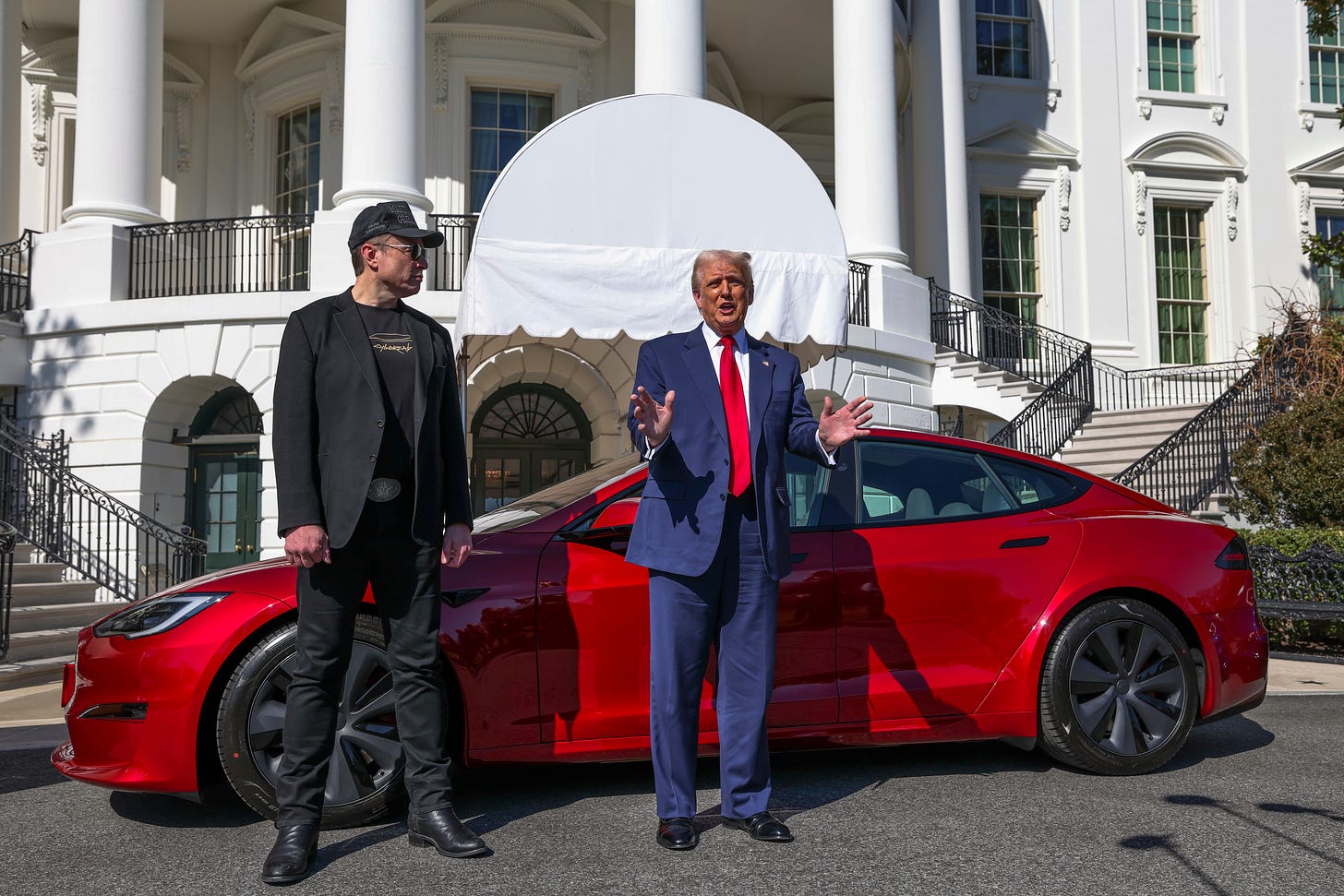

PORT ST. LUCIE, Fla. (Callaway Climate Insights) — President Donald Trump’s “big, beautiful” budget bill would extend tax cuts for corporations and wealthy individuals. It would reduce taxes for seniors, parents of young children, employees who earn tips, and people who work overtime. But members of one group are so out of favor in Washington, so lacking in political clout, that the budget bill would hit them with a significant tax increase: owners of electric vehicles.

Buried deep within the 1,000-plus page measure (Title X, Section 100003, to be precise) that the House of Representatives passed early on the morning of May 22, is a provision that would impose a new $250-a-year fee on EVs and a $100-a-year fee on hybrids. The fees would increase annually by the rate of inflation and, according to the Congressional Budget Office, rake in $64.3 billion over 10 years.

Keep reading with a 7-day free trial

Subscribe to Callaway Climate Insights to keep reading this post and get 7 days of free access to the full post archives.