Biden's Plan C on climate targets banks, relies on states; plus Putin out for COP26

Welcome to Callaway Climate Insights. And especially to our new subscribers this week. Only two weeks left until COP26.

Callaway Climate Insights publishes Tuesdays and Thursdays for everybody. To get our insights and analysis every day, please subscribe.

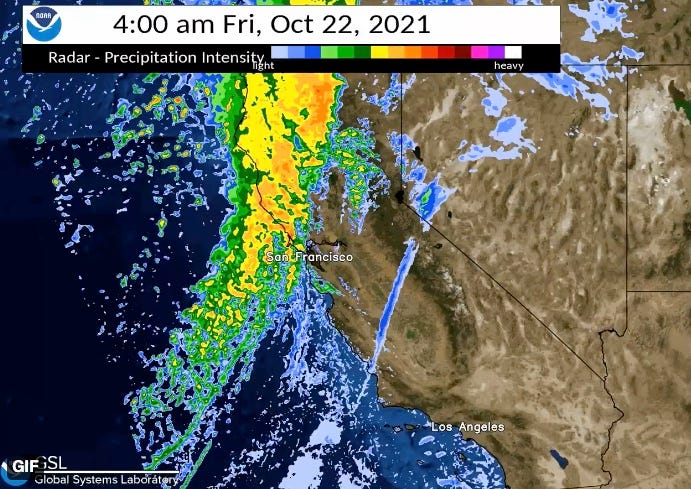

They call it an ‘atmospheric river.’ The National Weather Service is forecasting a series of storm systems will hit the West Coast through at least next Tuesday, bringing heavy rain totals — worrisome for wildfire burn scars — and high-elevation mountain snow. The heaviest rainfall looks to come in two waves, one Thursday and another Sunday into Monday.

Nothing comes easy on the climate front lines. After almost nine months without a drop of rain, the San Francisco Bay Area gets hit with an “atmospheric river” in the next several days that could dump half the amount of rain — more than four inches — than we had in all of last year.

According to the local newspaper, the last time it rained an appreciable amount in San Francisco was Jan. 28. While I admit to initially rejoicing, including standing out in the rain with my face up like a turkey, the deluge has now given way to collective fears of flooding and mudslides.

All that loose dirt and debris turned up by the fires this past summer is now a slide risk. And of course, new growth from the rains builds fuel for next year’s fires. But as for California’s historic drought, this week’s storms are a help.

In today’s issue, we look at two ways the U.S. can still move the needle on fighting global warming, despite gridlock in Washington caused by Democratic Sen. Joe Manchin. A new report on how some countries are jockeying behind the scenes to shut down progress at COP26 in Glasgow in two weeks. And the threat of global warming to the $3 billion fall foliage industry.

Enjoy the coverage and pass the umbrella.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

ZEUS: How the U.S. can overcome Biden's climate policy failure

. . . . Barring a miracle on Capitol Hill this week, President Joe Biden will head to Glasgow in 10 days for the UN global warming summit with what the British call a “dog’s breakfast” of a climate agenda, after coal-rich Sen. Joe Manchin blocked the most important renewable energy part of the president’s tax and spending legislation, writes David Callaway. While Biden will put on a brave face, it’s a clear embarrassment in front of the world. But it will begin a period where states and private enterprise will need to double down on their own efforts to offset the federal government’s inability to fund a robust transition from fossil fuels, if only to save their own natural assets. North Carolina set a good example this week. As for the future of Manchin’s West Virginia without the legislation he promised to block, see the image above. . . .

EU notebook: Energy crisis splits continent on green transition costs

. . . . The energy crisis ahead of winter in Europe has split the continent on EU proposals on spending on a green transition to renewable energy, writes Daniel Byrne from Dublin. Authorities in Eastern Europe are arguing against adding more costs while governments are still fighting Covid, and Western politicians want to push ahead with wind, solar, and hydrogen strategies despite the fuel lines and heating oil concern as delivery shortages plague the region. And, oh yeah, oil and gas production continues to rise, as high prices and strong demand push energy companies to continue pumping. . . .

Thursday’s subscriber insights: Saudi Arabia wants fossil fuel transition scrubbed from COP26. Are you surprised?

. . . . The BBC dropped a bombshell this morning with leaked documents showing several countries actively campaigning to weaken the UN global report on climate change last month, which is the basis for negotiations at the COP26 summit in Glasgow in two weeks. Saudi Arabia, Japan, and Australia, among many others, each tried — unsuccessfully — to soften recommendations that would affect them. Did you expect anything different? To see how this will go over, read more here. . . .

. . . . A panel of U.S. government regulators has, for the first time, cited climate change as a systemic risk to the financial system in a much-anticipated report on how Wall Street will need to prepare for more climate disclosure and regulation. The report from the Financial Stability Oversight Council identifies climate change as an emerging and increasing threat to financial stability. This is too long in coming but is welcome ahead of the climate summit and will at least blow the starting whistle on some of the important changes to come. . . .

. . . . Russian President Vladimir Putin formally put the boot in the COP26 climate summit this morning, becoming the latest global leader to bail on the crucial climate talks and casting a further shadow over the British-hosted affair in Glasgow. Putin wasn’t expected to show up, but his absence means the majority of the world’s biggest polluters are now out. A blow to UK Prime Minister Boris Johnson’s quest to save the world, and his government. . . .

. . . . The debate over charging of electric vehicles is nowhere near over. It’s still hard to make money there. But something hot is on the horizon, in the form of wireless EV charging. A host of new products is heading our way that could solve this dilemma once and for all. A look at who is leading the way. Read more here. . . .

. . . . Time was — just last year — that oil and coal companies seemed beleaguered, with oil trading at record lows as economies shut down. But fossil fuels are far from dead. Production is rising as the world rebounds from Covid and renewables are, in many cases, not yet there to match demand. A climate backlash is shaping up that could set the green transition back years. Read more here. . . .

Editor’s picks: Africa’s incredible shrinking glaciers; plus, Bill Gates predicts ‘10 Teslas, 1 Amazon, 1 Microsoft’

Africa’s glaciers melting rapidly

Africa’s glaciers will disappear in the next 20 years because of climate change, a new report warned Tuesday. The report from the World Meteorological Organization and other agencies, released ahead of COP26, the U.N. climate conference in Scotland that starts Oct. 31, forecasts major problems for the continent that contributes the least to global warming but will suffer from it most, Cara Anna reports for The Associated Press. The report notes that Africa’s 1.3 billion people remain “extremely vulnerable” as the continent warms more, and at a faster rate, than the global average. Africa’s 54 countries are responsible for less than 4% of global greenhouse gas emissions. The AP says the new report focuses on the shrinking glaciers of Mount Kilimanjaro, Mount Kenya and the Rwenzori Mountains in Uganda as symbols of the rapid and widespread changes to come. “Their current retreat rates are higher than the global average. If this continues, it will lead to total deglaciation by the 2040s,” it says.

Gates: Climate innovation will create ‘10 Teslas’

Bill Gates says in an interview that aired Wednesday as part of the virtual SOSV Climate Tech Summit that in the future “there will be eight Teslas, 10 Teslas.” CNBC reports the Microsoft (MSFT) founder also said he also expects climate innovation to lead to a Microsoft, a Google and an Amazon for investors. Gates founded Breakthrough Energy Ventures, which includes Amazon (AMZN) founder Jeff Bezos, Michael Bloomberg and Ray Dalio as investors. Gates said he’s bullish, but that “like the early days of software and computing,” referring to the dot-com bust. CNBC quoted him as saying for “somebody who can’t afford risk or if you expect near-term returns, I would look elsewhere.”

Latest findings: New research, studies and projects

Banks and climate governance

Major banks in the United States and globally have begun to assert an active role in the transition to a low-carbon economy and the reduction of climate risk through private environmental and climate governance, write authors Sarah E. Light, University of Pennsylvania, The Wharton School, Legal Studies & Business Ethics Department, and Christina Parajon Skinner, University of Pennsylvania - The Wharton School in Banks and Climate Governance, Columbia Law Review. In the abstract, they write “This essay situates these actions within historical and economic contexts: It explains how the legal foundations of banks’ sense of social purpose intersect with their economic incentives to finance major structural transitions in society. In doing so, this essay sheds light on the reasons why we can expect banks to be at the center of this contemporary transition. This essay then considers how banks have taken up this role to date. It proposes a novel taxonomy of the various forms of private environmental and climate governance emerging in the U.S. banking sector today. Finally, this essay offers a set of factors against which to normatively assess the value of these actions. While many scholars have focused on the role of shareholders and equity in private environmental and climate governance, this essay is the first to position these steps taken by banks within that larger context.”

More of the latest research:

Words to live by . . . .

“Climate change is the existential threat of our time. We have a moral obligation to do everything we can to protect our planet.” — U.S. Sen. Elizabeth Warren of Massachusetts.