Biz lobby rethinks carbon price as Biden plan released, plus ESG with Kristen O'Grady

Welcome to Callaway Climate Insights. Please enjoy and share with your friends and colleagues.

As the world’s greenhouse gas emissions return to pre-pandemic levels, the importance of putting a price on carbon to curb pollution rises to the forefront in Washington. While Congress dismissed such a plan a decade ago, now some of the idea’s fiercest opponents at that time are reluctantly falling into line.

The American Petroleum Institute is close to a statement supporting a price, according to The Wall Street Journal, following the Business Roundtable last year.

In a draft of Biden’s Clean Future Act, released Wednesday, there is an outline for a carbon mitigation fund, and wording that allows the Federal Energy Regulatory Commission power to approve a carbon pricing regime.

The administration is also considering “carbon border adjustment taxes” to send a message to polluters such as China, not just for their carbon use but in China’s case for its use of forced labor among Uighur Muslims.

A carbon tax on trade would be a light, and politically feasible, first step toward a more robust carbon tax, though we can expect big business will instead fight for something more along the lines of a market price, which Europe already uses and which China is planning.

As for the about face among the business lobbies, sometimes it makes sense to give a little to make sure you have a seat at the table for when the big decisions come.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Tuesday’s insights: UK budget’s green line, and John Kerry’s new man on Wall Street

. . . . UK Chancellor Rishi Sunak’s budget Wednesday, a Conservative hodge-podge of Covid recovery policies, won’t go down in history as the green revolution platform the world has been looking for. But it’s notable that the Chancellor has earmarked $80 million for green initiatives in Northeast Scotland, home of the UK’s traditional oil and gas industry. Read more about the proposed Aberdeen Energy Transition zone here. . . .

. . . . European companies and banks long on climate pledges and short on results have left the continent “running hot,” on emissions, with only one in 10 companies meeting their Paris targets, according to a new report by non-profit Carbon Disclosure Project. Read about their current trajectories here. . . .

. . . . As the Biden administration’s climate goals hit their limitations in Congress in coming months, more emphasis will shift to financial regulation, so despite concerns by progressives, it’s heartening to see new firepower being added to John Kerry’s team from private equity. Read more here. . . .

Kristen O'Grady on the evolution of socially responsible investing

Kristen O’Grady, the COO and Head of Product at Seeds Investor, describes the evolution of the socially responsible investing (SRI) industry and Seeds Investor’s efforts to empower advisers to create customized portfolios that align investor EPI, or “Earth, people, and corporate integrity” values with financial goals.

News briefs: Volvo’s EVs, a better U.S. grid, more

Editor’s picks:

Gates-led group hopes to spark greener U.S. power grid

Chinese power giant races to beat net-zero goals

Many in Greenland icy about rare earths mining

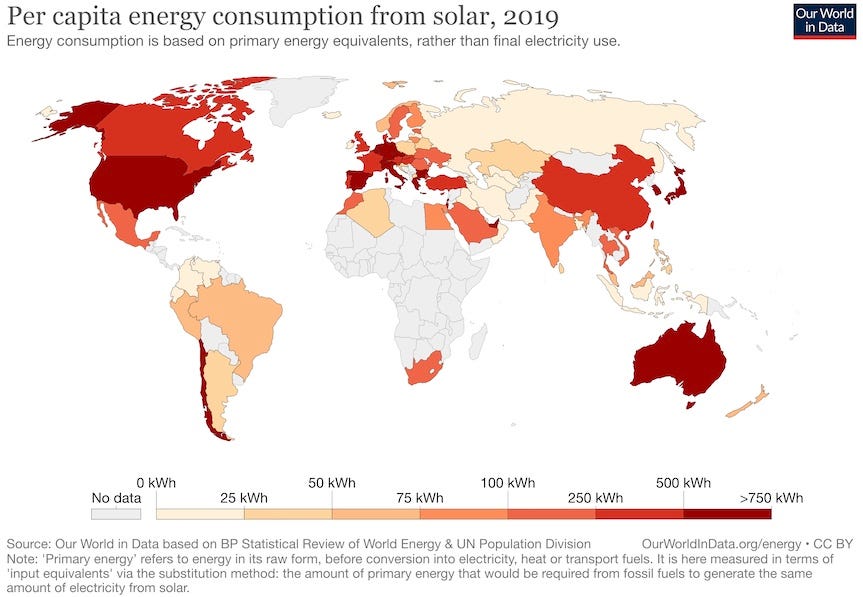

Data driven: Soaking up solar

. . . . That sunny land down under, Australia, was the world’s largest consumer of solar energy per capita in 2019, consuming 1,764kWh per capita, according to a report from Visual Capitalist. Read more about who came in second, and where the U.S. comes in among the other top 10 consumers of solar energy. . . .