California Gov. Newsom's new disclosure law hits budget reality

Welcome to Callaway Climate Insights. Especially to all our new subscribers who signed up over the holidays.

Today’s edition is free. To read our insights and support our great climate finance journalism five days a week, subscribe now for full access.

Concept electric vehicles from Honda, Kia, Vinfast, Sony Honda Mobility and others are turning heads at CES in Las Vegas.

California Gov. Gavin Newsom made global headlines late last year when he signed two new laws requiring big companies to disclose their greenhouse gas emissions and climate change risks.

The first-in-the-nation laws scooped a federal mandate investors have been waiting on for two years from the Securities and Exchange Commission, put California in line with disclosure laws in Europe, and more importantly, basked Newsom in climate glory with young voters as he toys with running for president someday.

All of that came crashing down in a heap of budget reality this week when Newsom was forced to withhold funding for the new laws because of a $38 billion shortfall. The laws are not set to take effect until 2025, so there is still hope that the multi-million funding can still be found, if not this year, then next.

But the reality is that the lack of money simply casts the badly needed disclosure laws into a pile of dreams that so often sound good here in California but never quite get done. And it casts a pall over Newsom at a pivotal time as headlines begin to question whether President Joe Biden will actually complete his campaign for November’s election.

As for the SEC mandate, that is now being talked about for April, but we’ll believe it when we see it.

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

What the ‘Streisand Effect’ has to with climate investing

. . . . The negative political attention tied to ESG investing in the past couple of years might actually be bringing more investors around to look at the downtrodden sector, writes Mark Hulbert. Using a theory that ties stock performance to a company’s cost of capital, Hulbert explains not only why oil and gas stocks have outperformed the past few years but why renewable energy shares might be poised for a rebound as well. And what does this have to do with Barbra Streisand?

Thursday’s subscriber insights

Will the world meet its green goals? Beijing will likely be the key

. . . . Good news, bad news. The good is that green energy grew at a record pace last year; the bad is that it is not fast enough to meet climate change targets. But there are other factors: China, for instance, is racing ahead with renewables but at the same time burning more coal. India, too. To root for lower coal usage we need to root for a decline in those economies. A tough choice for a global investor. Read more here. . . .

Uranium prices spike on Dept. of Energy demand notice

. . . . Uranium prices spiked this week to their highest levels since Japan’s Fukushima nuclear disaster in 2011, approaching $100 a pound after the Dept. of Energy put out a notice it is seeking new sources of 20% enriched uranium for nuclear reactors.

Our long-time news partner, Thom Calandra, has more in his daily commodities newsletter, which attributes the demand to a combination of green initiatives in the Biden administration and some concern about continued uranium imports from Russia.

Uranium, which was trading around $94 this morning, has almost doubled from $50 in the past year. The bullish market is a sign that investors are taking to heart the government’s pronouncements about embracing more nuclear energy as part of the clean energy transition mix. . . .

Honda starts to get serious in the EV arena

. . . . Like its compatriot Toyota, Honda HMC 0.00%↑ has been late to the EV game. But now the Japanese giant — which was first to the market with a hybrid — is playing catch-up. As revealed at the CES event in Las Vegas, here’s what they have in mind. Read more here. . . .

Editor’s picks: Global risks rise; plastic pellets pollute Spain

Grim global risk report

The World Economic Forum’s new annual Global Risks Report, issued Wednesday, says its recent survey results “highlight a predominantly negative outlook for the world over the next two years that is expected to worsen over the next decade.” Results from the WEF’s Global Risks Perception Survey, or GRPS, show a majority of respondents (54%) anticipate some instability and a moderate risk of global catastrophes, while another 30% expect even more turbulent conditions. The outlook is markedly more negative over the 10-year time horizon, with nearly two-thirds of respondents expecting a stormy or turbulent outlook, the WEF says. Environmental risks continue to dominate the risks landscape over all three time frames. Two-thirds of GRPS respondents rank extreme weather as the top risk most likely to present a material crisis on a global scale in 2024. Second on the list of risks was AI-generated misinformation and disinformation, followed by societal and/or political polarization, cost-of-living crisis, and cyberattacks.

Plastic pellets polluting Spain’s shores

Calling it a “regrettable” incident, Danish shipping giant Maersk confirmed to CBS News that millions of plastic pellets fell out of a charter vessel last month and are now washing up on the shores of northwest Spain. According to the report, the ship is not owned or manned by Maersk, but the company was handling their containers. The Maersk spokesperson told CBS the vessel “lost six Maersk containers overboard in deep sea off the Galician coast in Spain.” Bags of the plastic pieces, called nurdles, were in one of the containers that went overboard. It’s those bags that are now washing up on Galicia’s shores. The plastic pollutes waterways and hurts marine life.

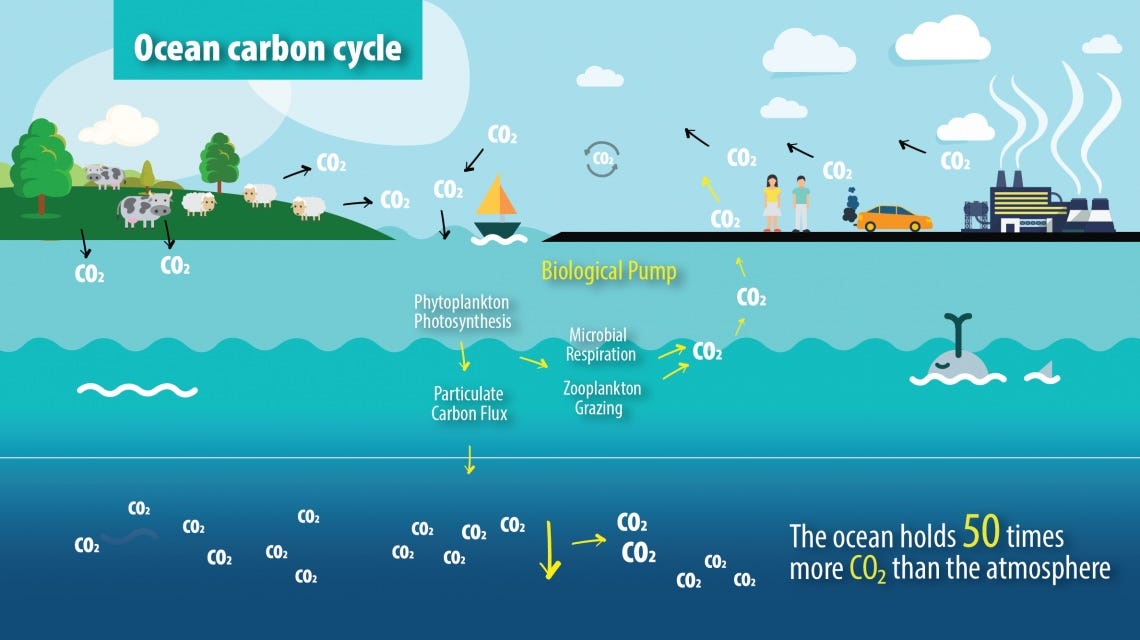

Explain that: The ocean carbon cycle

. . . Carbon moves constantly through different environmental compartments such as biota, the atmosphere, the ocean, soil and sediment, as part of what is called the global carbon cycle. The International Atomic Energy Agency says a change in any of these fluxes could have wide-ranging impacts on ecosystems and our climate. The IAEA Environment Laboratories apply nuclear and isotopic techniques to better understand the carbon cycle, to evaluate the ocean’s capacity to store carbon and to study how this might be impacted in future climate scenarios. “One quarter of this anthropogenic CO₂ released into the atmosphere is taken up by the ocean. Some of this CO₂ returns to the atmosphere, and some is exported to the deep ocean, where the reservoir of carbon is 50 times larger than that stored in the atmosphere. The ocean provides a vital service to our planet through this capacity to regulate atmospheric CO₂ levels and thereby limits climate change and its impacts.” Read more on the ocean carbon cycle from the IAEA.

Words to live by . . . .

“It’s as if the human race has received a terminal medical diagnosis and knows there is a cure, but has consciously decided not to save itself.” — Lesley Hughes, board member of the Climate Change Authority and an emeritus professor at Macquarie University, speaking to The Guardian.