Carbon markets eye expansion as emissions begin to bite

Welcome to Callaway Climate Insights. Especially to our new subscribers. Please enjoy and share with your colleagues. Not a subscriber? Check it out.

Today’s edition is free. To read our insights and support our great climate finance journalism five days a week, subscribe now for full access.

Almost half of the world’s migratory species are in decline, according to a new UN report. More than a fifth of the nearly 1,200 species monitored by the UN are threatened with extinction. Above, African elephant, sea turtle, Egyptian vulture, humpback whale.

On a podcast earlier this week with Doug McIntyre, our partner at the ClimateCrisis247 news site, the political idea of taxing oil companies for their pollution came up, which I derided as unrealistic.

Of course, some countries have tried windfall taxes or carbon border levies. But like state and local gas taxes, they are usually passed on to the consumer. Then I noticed a piece out of Australia, where two former government advisors have raised the idea again, after a similar levy was scrapped about a decade ago.

Taxes are an unpopular but sometimes necessary way to raise money for initiatives that are needed, such as the climate transition. They are politically explosive as well. But the Australian trial balloon, which would tie the levies to the price of carbon, does have value in that it at least opens the discussion again.

Carbon prices have become more common in many countries as trading in carbon permits grows. Even in last year’s weak markets, carbon trading grew to almost $1 trillion, up 2%, according to the London Stock Exchange Group. Even as carbon prices went from just under €100 ($107.27) at a peak last summer to €60 this week.

Pablo Berrutti, an investment specialist in Sydney for Stewart Investors, a global money manager out of Scotland, said that politics aside, the Australian government has been pushing hard to expand carbon trading markets as it realizes it must transition away from exports of fossil fuels and minerals.

The markets are still small, but as they grow and the cost of carbon becomes more standardized, we can expect more discussion about how to use the fossil fuel industry to help drive the transition. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

EVs collide with election-year politics

. . . . No space in the climate world is more politicized this election season than electric vehicles, which are openly derided by Donald Trump as playthings of the coastal elites and loudly supported by the Biden administration as necessary for the climate transition, writes Bill Sternberg. With a major consumer product suddenly a political football, the emerging EV industry can only watch in amazement as the country battles over what it means to the future of transportation. It promises to be a bumpy road for the publicly traded automakers, at least until November. . . .

Thursday’s subscriber insights

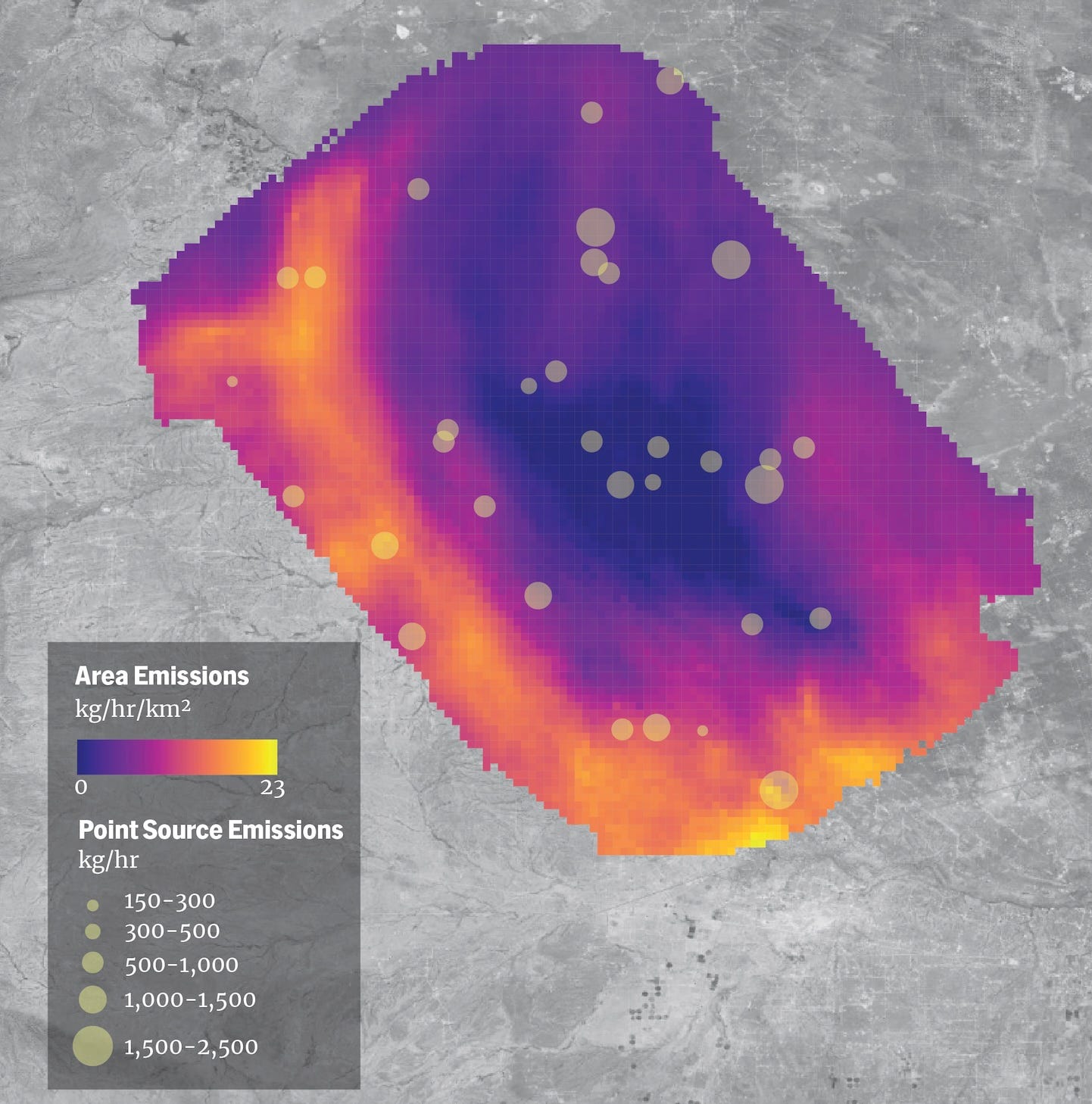

Mapping the menace of methane

. . . . One of the biggest drivers of global warming — particularly in the short terms — is methane emissions, especially from areas where it is extracted. Now, Google and the Environmental Defense Fund have teamed up for a picture of the problem from outer space, which it is hoped will help end the crisis. Read more here. . . .

BlackRock’s ESG asset growth may have AI to thank

. . . . BlackRock BLK 0.00%↑ , the world’s largest manager and also biggest manager of ESG investments, continues to see strong inflows into sustainable funds despite the backlash among red state politicians, according to a Bloomberg story this week, citing Morningstar data.

The growth is in part due to institutional funds coming from Europe, which has remained somewhat pro-carbon transition despite political headwinds. But according to the data, some of the more popular BlackRock funds seeing inflows are benefitting from heavy tech stock weightings, including shares of the AI crew such as Nvidia NVDA 0.00%↑ and Microsoft MSFT 0.00%↑ .

Nothing wrong with that. Many of these tech companies, despite their aggressive energy usage, are pushing sustainable strategies. It just explains the difference between fund strategies that include non-green transition companies, such as tech, and pure-play green companies, such as solar and wind, which have gotten crushed in the last two years by higher interest rates and rough supply chain pressures.

For BlackRock, which last week also started allowing investors in some of its funds to vote their own ways on proxy questions, it’s a great way to attract new money while also avoiding heavy fire from politicians looking for ESG scapegoats in an election year. Morningstar estimated that BlackRock ESG-related fund assets grew by 53% last year, to more than $320 billion, as ESG funds industry-wide saw only minor growth, and outflows in the last quarter. . . .

This time, it’s climate change sending plagues

. . . . Another result of climate change — biblical swarms of locusts that munch on crops. A study in Science Advances suggests that, if global warming isn’t curbed, west India and west central Asia could become locust hotspots in the decades ahead, threatening famine and food security. Read more here. . . .

Editor’s picks: How businesses navigate climate change

Watch the video: How can businesses navigate the complexities of climate change? Host Chris Linnane and Harvard Business School Prof. Forest Reinhardt delve into that question in this episode. They discuss the tragedy of the commons, explore the challenges of creating and selling a carbon-neutral beer, and answer listener questions about what responsibilities companies have to transition to sustainable practices.

Where the snowbirds are – and aren’t

The weather’s just fine in Florida, while winter holds on tight in the northeast. The National Weather Service Prediction Center in College Park, MD., reports the highest temperature in the contiguous U.S. yesterday was 82°F in Hollywood, Fla. and the same near Ochopee, Fla. Rio Grande Village in Texas also notched 82. A short hop north finds the lowest temperatures for the same period: -8°F at Mount Washington, N.H. and at Saranac Lake, N.Y.

Latest findings: New research, studies and projects

Carbon budgets and climate changes

What are the trade-offs between managing the financial sustainability of public debt and addressing climate change? In a Swiss Finance Institute research paper titled Sovereign debt sustainability, the carbon budget and climate damages, the author says evidence shows that failing to enforce a slowdown in emissions at a global level, and to stabilize climate damages, generates plunging debt limits in the medium-long-term and shrinking fiscal spaces for all countries, even for the few ones actuating the transition. But, “on the contrary, if the green transition is coordinated globally, debt limits converge to stable and higher levels, despite an initial and temporary decrease, given by the negative impact of emission reductions on GDP growth rates. From the evidence presented, it results as significantly more beneficial for countries to collaboratively and promptly transition towards mitigating climate impacts on growth and fiscal spaces. This will support sustainable public debt and the potential to finance the green evolution of our economies.” Author: Caterina Seghini, Swiss Finance Institute - University of Geneva; University of Geneva - Geneva Finance Research Institute.

More of the latest research:

Words to live by . . . .

“We know that we only have the possibility of avoiding a looming climate catastrophe if people like us refuse to give up.” — Harrison Ford, speaking at the Global Climate Action Summit.