Clean energy stocks: the Biden impact

Investing in electoral politics is not as cut and dried as it looks, as we see with the gains in renewable energy stocks this year.

(Mark Hulbert, an author and longtime investment columnist, is the founder of the Hulbert Financial Digest; his Hulbert Ratings audits investment newsletter returns.)

CHAPEL HILL, N.C. (Callaway Climate Insights) — Nearly everyone I speak to believes that clean-energy companies will do better if Joe Biden wins the presidency.

Far better.

I wish I could share their confidence. Despite searching high and low for stock-price data that supports this belief, I came up empty.

I was surprised by this, since I share the consensus view about Biden and the clean energy industry. He has proposed spending $2 trillion over a four-year period to promote the use of clean energy. President Trump, in contrast, has said he is not willing to sacrifice the abundant fossil fuel wealth of the U.S. on windmill “dreams.”

The contrast couldn’t be starker. Yet try telling that to investors on Wall Street.

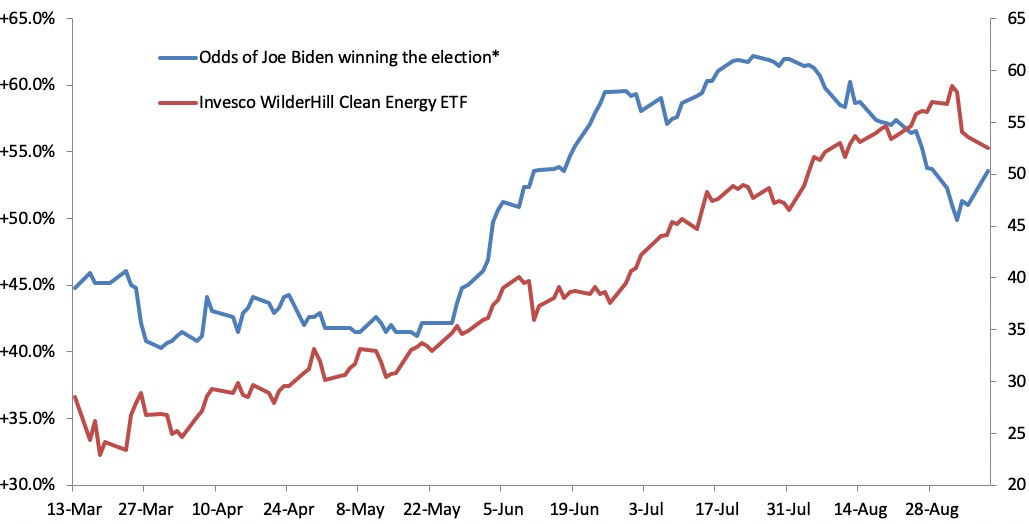

Consider clean energy companies’ stock price performance between July 24 and Sept. 2, when Biden’s chances of winning the presidency dropped precipitously — from over 62% to below 50%. (That’s according to Bonus.com, a website that aggregates the odds from four different electronic futures markets: Betfair, Betway, Smarkets and PredictIt.) Far from plummeting, which is what you’d expect if a Biden presidency would be so consequential to the industry, clean-energy stocks soared.

The Invesco Solar ETF (TAN), which invests in the stocks of solar-energy companies, gained 27% over this nearly six-week period. That was more than double the comparable return of the S&P 500. The Invesco WilderHill Clean Energy ETF (PBW), which invests in companies that promote clean energy and conservation, gained 22%.

Try to find a statistically significant pattern

Price history since mid-March

*Composite of odds from 4 electronic futures markets, compiled by Bonus.com. Source: Bonus.com, HulbertRatings.com

To be sure, however head-scratching these returns are, they are just two data points. For a more comprehensive analysis, I focused on daily and weekly changes in Biden’s election odds back to March, when almost all of his Democratic rivals dropped out of the face and endorsed him. I calculated the correlations between those odds and comparable changes in the prices of a dozen clean-energy ETFs. None of the correlations was significant at the 95% confidence level that statisticians often use when determining if a pattern is genuine.

Let me hasten to add that, just as correlation is not causation, the absence of a correlation does not mean the absence of causation. So it would be going too far to conclude that investors think it makes no difference to clean-energy companies who wins the presidential election in November.

But what these results do suggest is that there are more powerful factors affecting clean-energy stocks than electoral politics. The course of the Covid-19 pandemic is one obvious factor. But there are others, such as California’s extreme heat and raging wildfires, which make it even more obvious than it was previously that climate change is real.

Another less-obvious factor is the price of oil, since clean energy stocks tend to do better when the price of oil is higher. That’s ironic, since most environmentalists want the price of oil to decline — eventually to zero — as global economies hopefully shift away from a reliance on fossil fuels. Over the short and intermediate terms, however, a lower oil price means that alternative energy sources become less competitive.

The upshot is that you should not base your investment in clean energy companies on electoral politics. There are just too many different factors and too many complex interactions between those factors to draw a straight line between a particular electoral outcome and the stock market. Furthermore, insofar as you want the price of oil to fall, you should willingly embrace the underperformance of such companies’ stocks over the shorter, and even intermediate, terms.

That in turn means that at least in part your investment in these companies needs to be motivated by wanting to do the right thing.

This last comment is a recurrent theme in my columns, so it shouldn’t come as a surprise. Wall Street has sold us a bill of goods by leading us to believe that we can do well by doing good. It only sometimes works out that way.

If making money is your primary motivation to invest in climate-friendly companies, you are not a true friend to the environment. That’s because you are likely to throw in the towel when your clean-energy investments don’t make money over the short-term. Producing a better climate is a marathon, not a 100-yard dash.