Climate laggards start to bail on COP26; plus Moody's puts numbers to bank risk

Welcome to Callaway Climate Insights. Our investor outlook for COP26 is in two days. Register for free today to find out how to play the big climate summit.

Callaway Climate Insights publishes Tuesdays and Thursdays for everybody. To get our insights and analysis every day, please subscribe.

Pope Francis and Ahmed Mohamed Ahmed El-Tayeb, the Grand Imam of al-Azhar (at podium), met with dozens of religious leaders Monday, signing a joint appeal to governments to commit to ambitious targets at the upcoming COP26 U.N. climate conference. “We have inherited a garden; we must not leave a desert to our children,” said the appeal, which was signed at a formal ceremony in the Apostolic Palace before being handed over to the head of the COP26 conference, Alok Sharma. Photo: Vatican News via Twitter.

Here come the excuses. Less than four weeks before the world’s most important climate summit, leaders of some of the biggest polluting countries are starting to look for ways to beg off.

South African President Cyril Ramaphosa said over the weekend he’ll skip COP26 in Glasgow next month to attend to municipal elections in his country. Municipal elections? Australian Prime Minister Scott Morrison said yesterday he needs to first explain his climate position to his countrymen before talking to “people overseas.” China’s Xi Jinping still hasn’t responded to his invite from Britain’s Boris Johnson, nor has Russia’s Vladimir Putin.

While leaders of many smaller countries in Africa and South America struggle to find ways just to get to Glasgow and get vaccinated, the countries responsible for the pollution that threatens smaller nations are turning away. Both South Africa and Australia depend largely on coal for their energy, and have been rated “highly insufficient” by Climate Action Tracker in terms of meeting their climate pledges.

No national leader wants to travel halfway around the world to get dumped on in front of their voters, or screamed at by protesters. More than 100 leaders are expected to attend, including Queen Elizabeth and Pope Francis. But if the biggest problem countries don’t attend, it begs the question whether the event can have the impact it needs.

Lots of arm twisting in days ahead, as a backdrop of the largest international energy crisis in a generation adds to the drama. Investors watching for progress should note oil at its highest levels in seven years this week, as well UK carbon futures on the European Trading System, which rose above $100 a ton (£75) for the first time last week.

More insights below. . . .

Mark your calendar for Thursday, Oct. 7

Callaway Climate Insights is proud to host ‘Countdown to COP26: everything investors need to know about the world’s most important climate summit,” on Thursday, Oct. 7, at 9 a.m. Eastern. Speakers include Citi Chief Sustainability Officer Val Smith, EY’s Julie Tiegland, investors Jeff Gitterman and Tim Dunn, and Hannon Armstrong CEO Jeff Eckel. Get more information on this free event and register here.

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Tuesday’s subscriber insights: The China challenge, offshore whirlwinds, and Congress vs. the companies

. . . . Basically, fighting climate change all comes down to China. First, it is the world’s biggest polluter and, second, it has been dragging its feet. But there are some promising signs. In addition, it has to realize that its global ambitions will be hampered if it continues to be seen as the world’s dirtiest nation. Read more here . . . .

. . . . Offshore wind power projects are growing like a whirlwind, with nine times the current capacity already in the pipeline. Breezy Britain has been leading the charge, but China is soon going to overtake it with a massive investment in projects. Offshore, where wind is more constant, tends to be more reliable than onshore and doesn’t scar the landscape. Read more here. . . .

. . . . As Congress battles over efforts to combat global warming, companies are ramping up their opposition, saying one thing about climate change (we want to fight it) and doing another (undermining efforts to combat it). Ironically, just about the only company that is not hypocritical is Exxon, which has announced no plans to go net-zero. Read more here. . . .

. . . . The current fossil fuel crunch is raising solar panel costs, with the latest problem centering on China’s polysilicon production, which is already hampered by human rights concerns and a U.S.-China trade war. Like the chip crisis, this one may take awhile. Some say mid-2023. No wonder oil is at seven-year highs. Read more here. . . .

Editor’s picks: SoCal oil spill; Moody’s says climate risk’s a bigger threat to bank portfolios

California beaches closed, wildlife devastated by oil spill

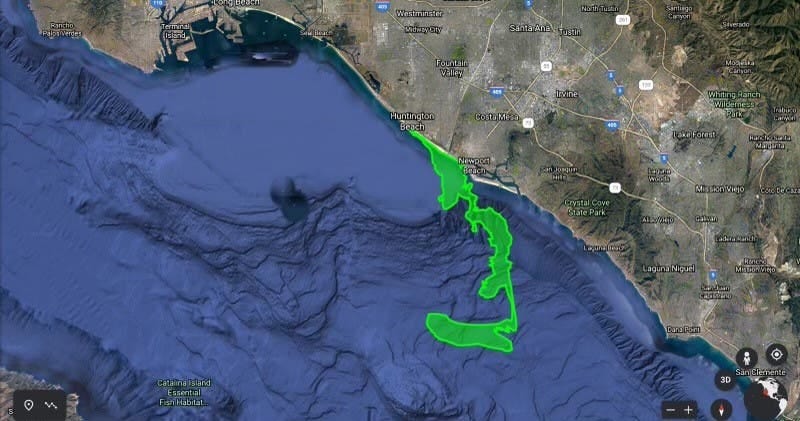

A break in an oil pipeline off the coast of Southern California has dumped an estimated 126,000 gallons of oil into the Pacific, fouled Orange County beaches and devastated wildlife and their habitats. The leak reportedly has been stopped and officials are trying to remove the oil. The pipeline is owned by the Houston-based oil and gas company Amplify Energy (AMPY). The company’s stock fell almost 44% on Monday and was down another 2% at midday Tuesday. The Los Angeles Times reported Amplify Energy emerged from bankruptcy just four years ago and “amassed a long record of federal noncompliance incidents and violations.”

Moody's: Climate risk a major threat to banks’ loan quality

Moody’s Investors Service says under the worst climate scenario, banks’ corporate loan losses could be significantly worse than anticipated. Moody’s has released a new report assessing the expected impact of climate change and the transition to a low-carbon economy on banks’ loan portfolios, and warning of significant potential losses, particularly if the banks fail to reduce their climate exposure. ESG Today reports that Moody’s looks at three climate scenarios, based on previous work done by the European Central Bank, assessing the expected impacts on four European banks with varying levels of climate exposures based on carbon-intensity in their lending, and to sectors with different levels of vulnerability to physical and transition risk. Under the most extreme “hot house” scenario, under which delayed transition policies lead to extremely high physical damage, all of the banks would experience significant hits to profitability, with loan losses in some cases growing more than 20% from the baseline scenario of limiting global temperature increase to 1.5°C. above pre-industrial levels.

Data driven: Shine on, Earthshine

. . . . Earth is reflecting less light as a result of climate change, according to new research. Scientists at Big Bear Solar Observatory in Southern California have been studying two decades’ worth of a phenomenon called “earthshine,” described as the light Earth reflects onto the surface of the dark side of the moon, combined with satellite observations of Earth’s reflectivity, or albedo, and the sun’s brightness. In the new research, scientists combined that data with observations from NASA’s Clouds and the Earth’s Radiant Energy System (CERES) project. In short, Earth’s reflectivity has dropped over the past 20 years, and it could be due to a decline in shiny, low cloud cover over the Pacific Ocean. LiveScience.com notes that because light not reflected out to space is trapped in the Earth system, the change in brightness also could potentially result in an increase in the pace of human-caused climate change. . . .