Copper wars begin with $50 billion Teck deal

Plus, a shut-out in climate proxy victories casts pall over shareholder Democracy

In today’s edition:

— Anglo-American-Teck merger to trigger new era of copper deals as demand surges

— Shareholder climate proposals wiped out this past proxy season

— Scientists claim Energy Dept.’s new report on greenhouse gases ‘not scientifically credible’

— Fat Bear Week begins on Sept. 23. Get your brackets ready.

— Global tanker oil spills have declined dramatically since the 1970s despite increased production

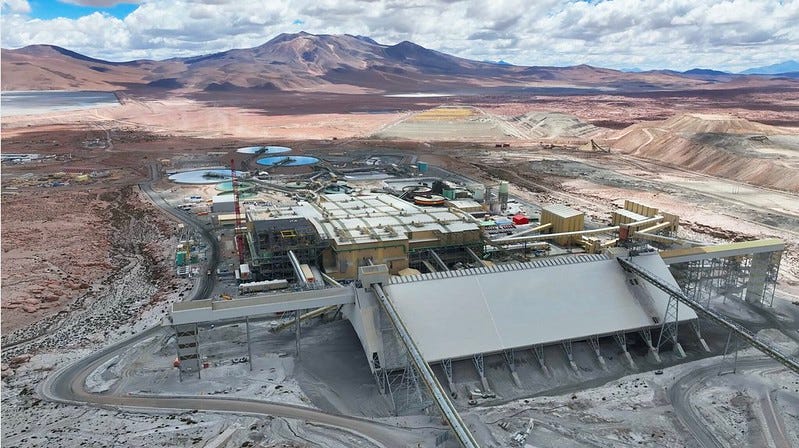

The lid on the long-simmering copper pot of global mining companies might have finally blown this week after British giant Anglo-American (UK:AAL) and Teck Resources TECK 0.00%↑ of Canada announced a $50 billion merger to take advantage of rising demand for one of the world’s most popular natural resources.

Several mining giants, including Rio Tinto RIO 0.00%↑, Glencore (UK:GLEN) and BHP BHP 0.00%↑ have circled each other in the past two years as copper has surged amid demand from electric vehicle companies, battery companies and electronic equipment for data centers. Now that two of the mid-tier companies have managed to secure an agreement, we expect a flurry of activity as larger buyers weigh making bids for either of them or even bigger deals with each other.

The deal comes as copper prices have soared in the past few years amid unprecedented demand, falling back to earth only last month after President Donald Trump attempted to impose 50% tariffs on copper imports. The price began to come back after that attempt collapsed and copper futures are now up about 7% over last year.

The deal for Teck, structured as a merger of equals and set to house the headquarters of the new company, Anglo-Teck, in Vancouver also is a win for Canada and for Prime Minister Mark Carney’s attempts to energize Canadian business in the face of aggressive talk and tariffs from Trump. It further isolates American interests from the action in mining, short of a move by U.S. mining champion Freeport McMoRan FCX 0.00%↑.

With copper prices rising and gold at all-time highs because of weakness in the U.S. dollar, the mining industry is suddenly a Wild West of deal activity, as opposed to the oil and gas industry, which has been relatively stagnant as oil prices have struggled. The Teck deal was structured to get approval from Canada, which is likely, but there are still plenty of moves left among global players before anything is completed.

If you have ideas or suggestions for us, contact me directly at

dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

Tuesday’s investor insights

Investor climate proxy proposals wiped out this season

Keep reading with a 7-day free trial

Subscribe to Callaway Climate Insights to keep reading this post and get 7 days of free access to the full post archives.