Countdown to COP26: Investor checklist

Welcome to Callaway Climate Insights. Please enjoy this special investor report on the COP26 global climate summit.

(David Callaway is founder and Editor-in-Chief of Callaway Climate Insights. He is the former president of the World Editors Forum, Editor-in-Chief of USA Today and MarketWatch, and CEO of TheStreet Inc.)

SAN FRANCISCO (Callaway Climate Insights) — It’s billed as the most important global summit of the year, and the most pivotal climate conference of all time. This year’s COP26 in Glasgow in November will either set the stage for a dramatic decade-long sprint to zero climate emissions by the world’s biggest polluting countries, or degenerate into a calamity of finger pointing and political bickering.

Climate advocates are not optimistic. Six years after the Paris Accord secured commitments from countries around the world to start reducing greenhouse gases, few have met their promises. Some, like Brazil and Australia, are going the wrong direction. Others, such as China, are big on promises but still plan to continue polluting for at least another 10 to 15 years.

Investors are bullish on climate solutions, however, and a surge in environmental, social and governance investing in the past two years underscores a belief that technology will prevail in finding ways to reduce emissions and pull harmful carbon from the atmosphere and seas.

In the big picture, any global agreements that further reduce the use of coal, especially by China, and include financing of renewable energy projects in smaller, poorer countries by the wealthier ones, will be viewed as a big success.

Global sustainable fund assets reached $3.2 trillion in the first half of this year, according to Morningstar. The Vanguard Social Index Fund (VFTAX) is up more than 18% year-to-date, while the iShares MSCI USA ESG Select ETF (SUSA) is up almost 22%. One of the more popular ETFs, the iShares Global Clean Energy ETF (ICLN), is down 18%, giving back most of its gains from 2020 amid concern about solar supply chains and the health of electric grids. The discrepancy shows that while investors are eager for more ESG exposure, this rising tide will not float all boats.

The Callaway Climate Insights Index is down 10.4% year-to-date.

Parsing the universe of public companies tied to climate solutions is becoming increasingly sophisticated, as many ESG funds also contain large tech companies — and sometimes even oil and gas companies — based on their stated climate intentions.

In general, we can break these investments into specific industries: electric vehicles, solar, wind and natural resources, battery, fuel cell, and vehicle radar.

In this special report, we’ll take a look at each of these industries along with the potential for them to be impacted positively or negatively by events at COP26. As of this writing, the UK government still plans to have the conference in person, despite Covid concerns and the inability of representatives from small countries to make it to Scotland.

The best that can be said of expectations is that it will be a miracle if it is pulled off in this format, and even more so if there is genuine agreement on a way forward. For investors, we offer this quick checklist on what to watch for.

Electric vehicles

Of all the ESG industries that could be impacted by COP26, electric vehicles are at the forefront. More than 10 million EVs are currently on the road, according to Pew Research. Of them, more than 40% are in China, 30% in Europe, and about 10% in the U.S.

Europe is heavily invested in transforming its fleet to electric, with sales of plug-in and hybrid vehicles tripling in 2020 to more than 1 million vehicles, or about 11% of all cars sold. The U.S., despite the Tesla (TSLA) phenomenon, remains lower, with sales down last year amid Covid, and the dropping of some subsidies tied to plug-ins.

EVs are a major part of President Joe Biden’s infrastructure plans though, and shares of electric vehicle makers both established and new have had a volatile run. Production problems in China and delays in the U.S. have hurt Tesla shares this year, and two start-up EV makers, Nikola (NKLA) and Lordstown Motors (RIDE), who have seen their shares and strategies attacked by short-sellers, have held sentiment back in the area after a red hot 2020 made electric vehicles the darlings of special purpose acquisition companies, or SPACs.

UK Prime Minister Boris Johnson is also focused on EVs, including them in his “coal, cars, cash and trees” slogan for priorities in the COP26 talks.

The UK’s Secretary of State for Business, Energy and Industrial Strategy, Alok Sharma, who is also president of COP26, has said that electric vehicle sales need to double globally in order for countries to meet their Paris Agreement targets. The UK has set a plan to end the sale of new gasoline and diesel cars by 2035, and investors should look for any signs that more countries will tighten their EV commitments, especially since it is an easy pledge to make and hard to be responsible for.

Still, a spate of new commitments could boost the industry. Stocks that could benefit would include some of the more pure play EV makers such as Fisker (FSR) and Workhorse Group (WKHS), Nio (NIO), as well as Tesla. But also some of the major auto companies who are charging into electric vehicles, such as General Motors (GM), Ford (F), or Volkswagen (VWAGY).

Charging station plays include Blink Charging (BLNK), EVgo Inc. (EVGO) and Chargepoint Holdings (CHPT), though interestingly, none of those stocks have performed well this year. It’s hard to demonstrate they can make money when the jury is still out on how people will recharge their EVs. Some have looked at battery-swapping as a quicker alternative to waiting hours to charge. Until that is resolved, the charging station companies remain a flyer.

Other winners in the group could be the established semiconductor makers, as the industry gets over the chip shortage, or the materials makers, such as Nano Dimension (NNDM), which makes EV electronic components, or Albemarle (ALB), which makes specialty chemicals, including lithium compounds for batteries.

Europe should continue to lead mass adoption of EVs, but the U.S. won’t be far behind if the retooling of the big automakers is any indication.

Solar

Solar financings were the stars of a record $174 billion invested in renewable energy worldwide in the first half of 2021, according to BloombergNEF. Almost $80 billion of that was in solar projects, with China and the U.S. accounting for the biggest hits.

In the U.S., more than $6.4 billion was invested in solar projects in the second quarter, up from $5.3 billion in the first quarter, BloombergNEF said. In early September, President Biden announced a plan to dramatically increase solar panels in the U.S. to the point where solar energy makes up almost 50% of U.S. energy usage by 2050, up from about 4% today.

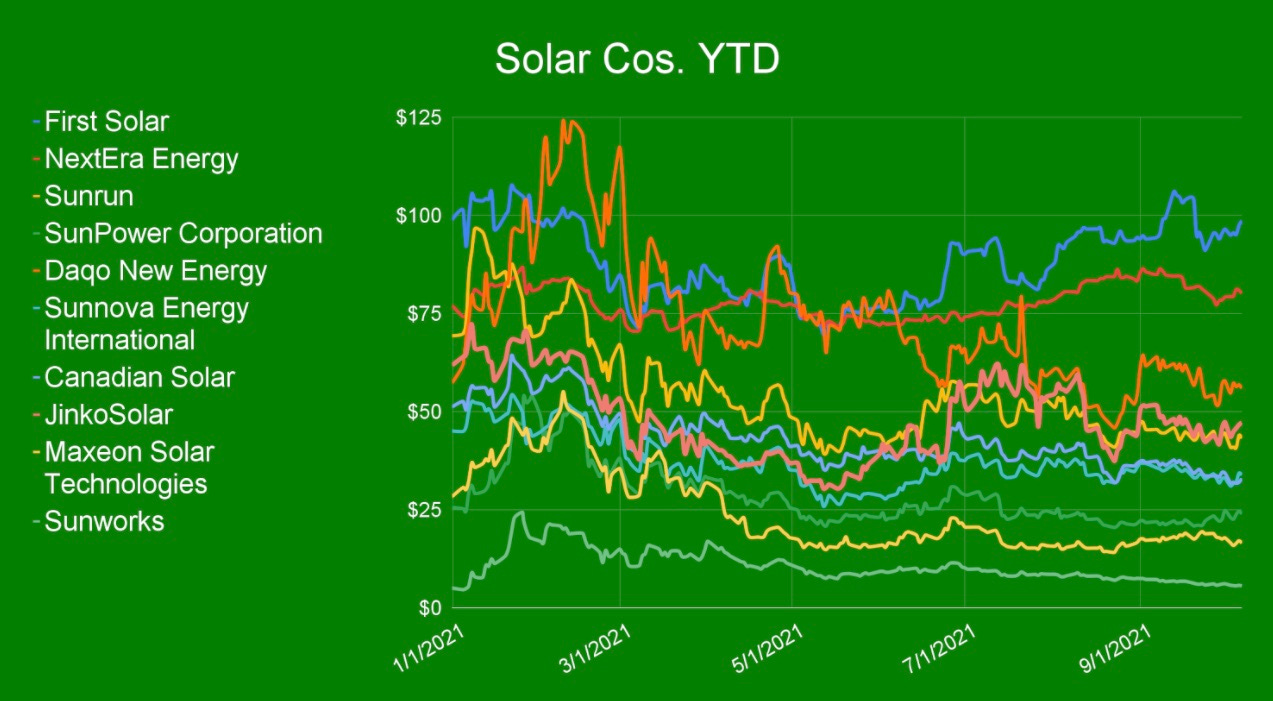

But supply chain woes and a steady drumbeat of inflation in the solar panels industry depressed stocks after a strong 2020. They have also suffered from inflation headlines and lack of priority in high-profile campaigns like Biden’s infrastructure bill. The Invesco Solar ETF (TAN) is down more than 16% year to date.

Stocks such as First Solar (FSLR) and NextEnergy Solar (NESF) are among the best performers in the sector this year, but even they are about 5% lower.

The potential for a breakthrough for solar stocks coming out of COP26 is really in what China brings to the table. If China can bring commitments to reduce its rabid coal consumption, and phase out coal usage quicker than its current estimates of a few decades from now, then it’s possible we’ll see some relief on China solar products in terms of favorable tax treatment.

Right now, China’s solar industry is often penalized over the country’s human rights violations, but as reducing its coal usage is so important, it’s possible a broader deal on coal will yield benefits in trade, and therefore relief on solar panel supply chains.

Any movement by Eastern Europe countries to commit to reducing coal usage — even in favor of nuclear — will be a positive for solar companies as well as wind companies. And while Biden’s infrastructure plan did not highlight solar companies, it does include language that could reduce solar installation delays by decentralizing authority over them.

The most important effort COP26 could yield, however, is a commitment by the richest countries, i.e. the biggest polluters, to finance the reduction of coal use by small countries. How much is pledged and how much is distributed will be closely watched by the renewable energy industry, as it would benefit all forms of renewables, including solar.

Wind energy

Wind energy providers, particularly the big European companies with growing offshore units in Europe and the U.S., could also see a bump from COP26, after a lackluster year defined by supply chain constraints and higher costs.

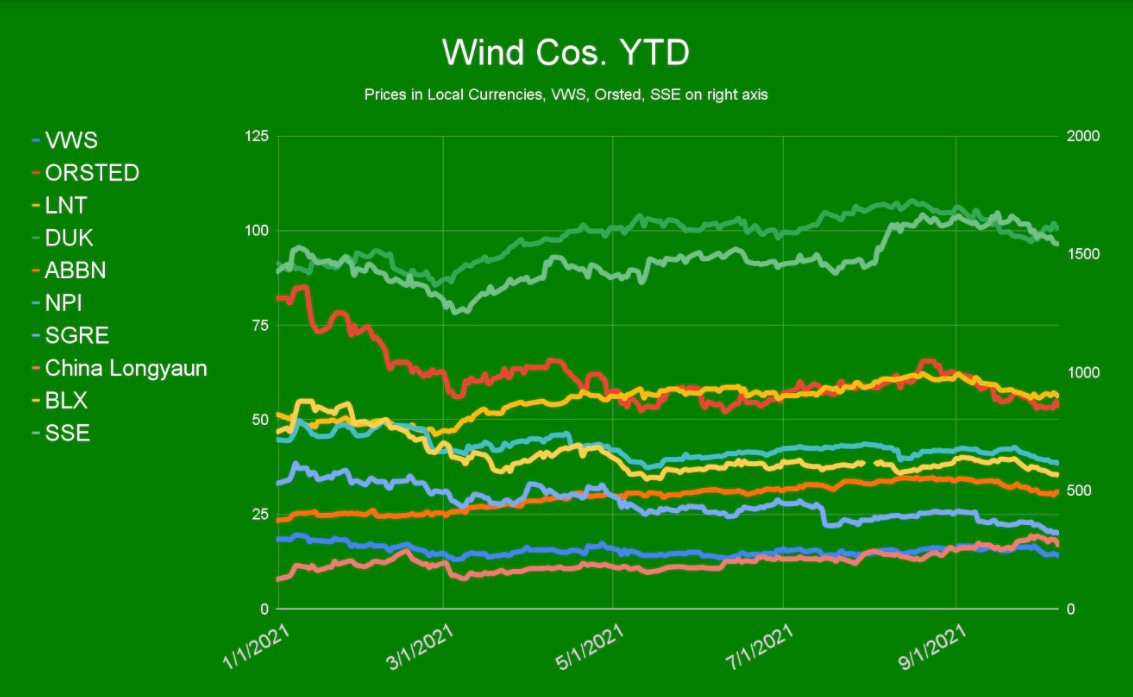

The First Trust Global Wind Energy ETF (FAN) is down about 10% this year, having peaked in January after a stellar run in 2020. Like many renewable stocks and funds, supply chain concerns, inflation, and economic spending coming out of the pandemic brought prices back to reality in the first quarter.

Danish renewable giant Orsted (ORSTED) shares are down more than 31% this year. The company warned earlier this month that lower wind speeds across its entire offshore portfolio would significantly affect results of that unit. Shares of Vestas Wind Systems (VWS), a Danish competitor, were down about 10% on supply chain and cost issues.

Shares of Siemens Gamesa (ES:SGRE) of Spain and a unit of Siemens Energy (XE:ENR) are down more than 10% amid profit warnings, while shares of Iberdrola SA (ES:IBE) are also down about 10%.

The companies tend to move in lockstep as they are affected by similar issues and all reliant on changing European regulations.

Europe, and particularly the UK, will be pointing to their offshore wind progress as a key influencer in the continent’s move toward renewable energy. The UK’s Johnson, who famously said in 2013 that wind farms “couldn’t pull the skin off a rice pudding,” has changed his tune. He pledged in October that wind energy would power every home in the UK by 2030.

Wind energy, onshore and offshore, is the fastest-growing form of renewable energy in Scotland, which last year generated 97% of its energy from renewables, just missing a 100% target. The UK’s largest wind farm, the Whitelee Windfarm, with more than 215 turbines, is located just outside Glasgow.

Earlier this year, the UK issued new offshore wind licenses for the first time in a decade, bringing in almost 900 million pounds ($1.2 billion) amid intense competition from energy companies, including a couple of oil companies.

So with a sector that has suffered this year like many manufacturing sectors, the publicity around wind from COP26 being in Glasgow and hosted by the UK has the makings of a possible rally-maker.

Natural resources

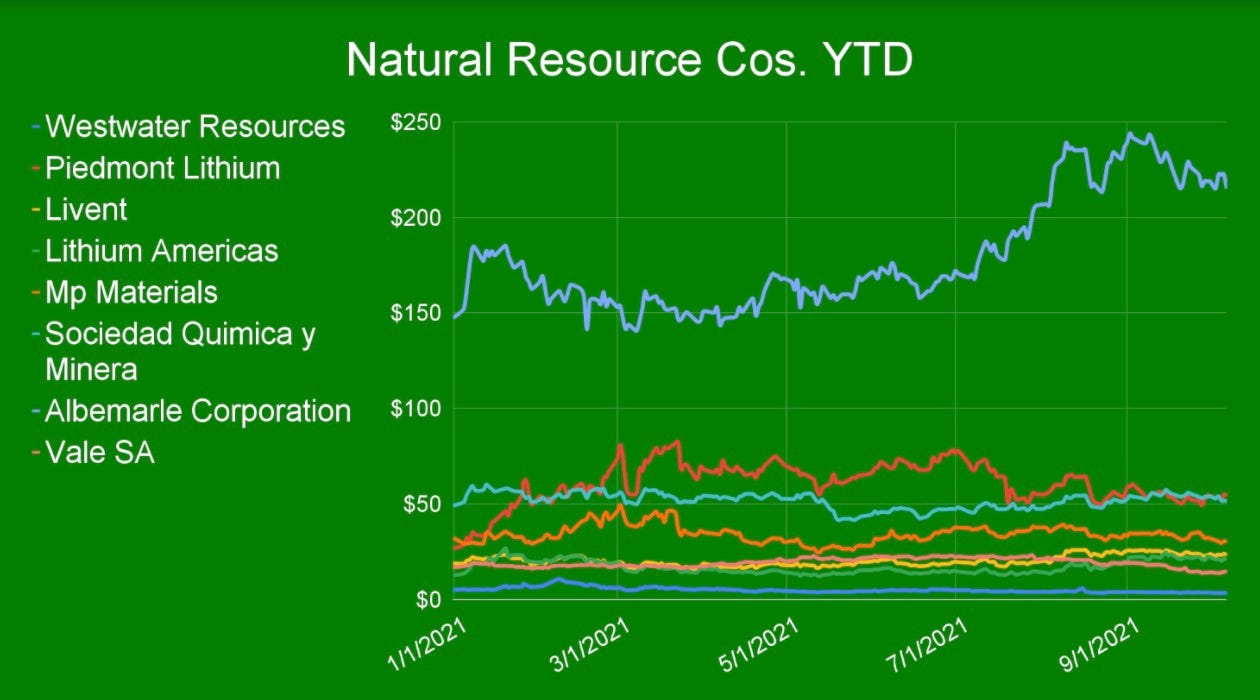

Among the best performers in the Callaway Climate Index this year are the natural resources companies, which are generally any company involved in minerals, water, or the development of natural products into chemicals for industrial usage.

Six of the top 10 performers in the index are categorized as natural resources companies, including Piedmont Lithium (PLL), the North-Carolina mineral exploration company; Westwater Resources (WWR) of Colorado; and Albemarle Corp. (ALB), also of North Carolina.

The advent of renewable energy and new brands of electric vehicles will place a strong demand on minerals such as lithium and copper. Any international agreements coming out of COP26 that protect natural resource areas or move the needle toward renewable energy from fossil fuels will be seen as a plus for the sector.

In particular, discussions about the Amazon Basin, parts of which earlier this year were classified for the first time as a net emitter of carbon, rather than a carbon sink, will see pressure on international companies doing business to clear land in the important rainforests. Some natural resource companies, which operate either in ways that will preserve the Amazon, or in other parts of the world, could benefit from any agreements to curtail mining and land development in Brazil.

Brazilian leader Jair Bolsonaro shocked the world earlier this year when he said he would continue to allow coal production to ramp up, defying international agreements. But in the past few months, progress has been made with Brazilian cabinet officials toward a deforestation agreement to be announced at COP26.

Eyes will also be on Australia, which has so far defied climate advocates by continuing to promote and push its mining industry, one of the largest in the world. Australia is somewhat of a climate pariah in international diplomatic circles, but at an event like COP26 it could make a splash with almost any sort of movement in the right direction.

Fuel cell companies

One of the most controversial subjects at COP26 will be the usage of hydrogen, green blue or normal grey, in the renewable energy transformation of many countries. Normal hydrogen is produced mostly with natural gas, which many climate advocates claim needs to go away with other fossil fuels.

Blue, which uses carbon storage in the process but also comes from fossil fuels, and green, which uses electrolysis from renewable energy, are newer types but neither is yet manufactured at the capacity imagined by proponents such as the European Union, which is basing a lot of its climate-fighting hopes on them.

The vast majority of hydrogen power currently comes from fossil fuels, as it is cheaper than the renewable forms. But the EU wants to expand its production by eight-fold in the next decade, which it believes will bring the cost down significantly and transform hydrogen production to mostly renewables.

Some countries, such as Poland, want guarantees on hydrogen before they agree to abandon their reliance on nuclear energy, which is another political obstacle.

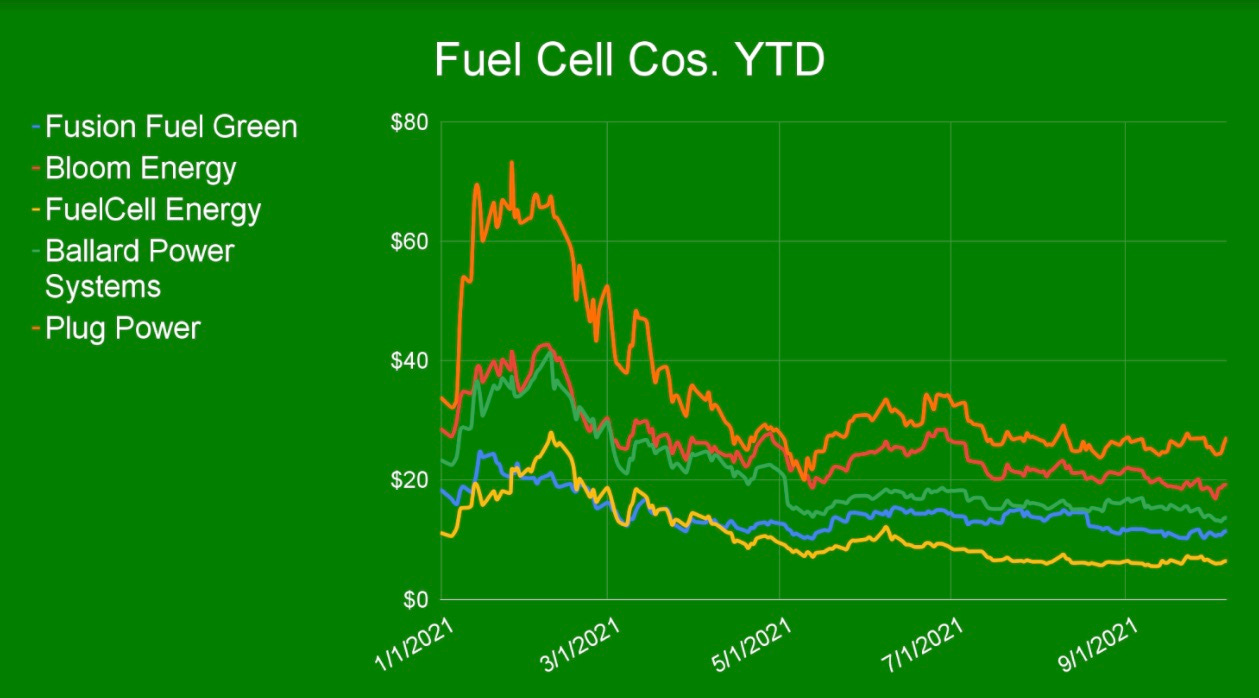

Judging from the performance of a lot of stocks in the sector this year, there is not a lot of confidence in any sort of grand deal on hydrogen coming out of COP26. The biggest players in the sector, Bloom Energy Corp. (BE), Fusion Fuel Green (HTOO), Plug Power (PLUG), and Ballard Power Systems (BLDP), are all lower on the year.

But the scope for an agreement becomes more clear when considered against the absolute need for a deal on coal, and to some extent, oil. A compromise that generates universal commitment to ending coal and reducing oil usage, but allows for nuclear and for natural gas in the capacity of usage for renewable hydrogen expansion, is entirely possible.

Should any sort of commitment to hydrogen usage become more robust in Glasgow, then the fuel cell and hydrogen-generating stocks have a shot at a rebound.

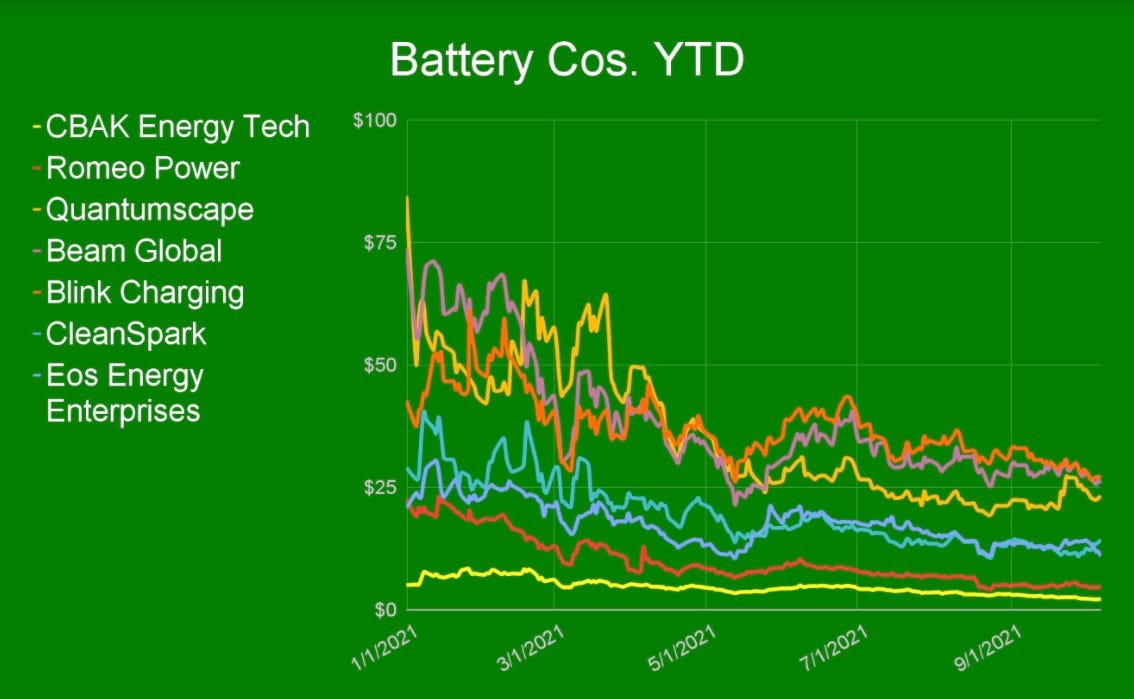

Battery companies

No sector of ESG companies holds more promise and importance than the battery sector, where technology advancements will be required for the world to transform to electric vehicles, airplanes, trains, boats, and the surge in demand for electricity in general as large parts of the earth grow hotter.

Yet even those stocks have had a difficult year after a hot 2020. Like the biotech sector 30 years ago, when the initial drugs were just starting to come out, lead times from product idea to market share are longer than many had hoped. These stocks can expect to see peaks and valleys over coming years as excitement over new advancements in storing electricity and in charging and recharging gives way to delays and regulatory red tape. Think Tesla.

Among the big players though, discussions at COP26 about electrification, and charging stations for EVs, there is scope for an end-of-year bounce. Companies to watch are CBAK Energy Technology (CBAT), QuantumScape Corp. (QS), Blink Charging Co. (BLNK), CleanSpark Inc. (CLSK), and EOS Energy Enterprises (EOSE).

Behind the public markets, though, funding into battery companies is soaring. CB Insights forecast this summer that funding could surpass $8 billion in 2021, up from $2.6 billion last year.

With improvement in battery storage and recharging technologies, more demand will be in order for lithium, copper, and other minerals that many battery companies depend on. How the prices of those minerals, and the supply chains to deliver them, fare in coming months will help in part to determine the pace of innovation and the road to profit.

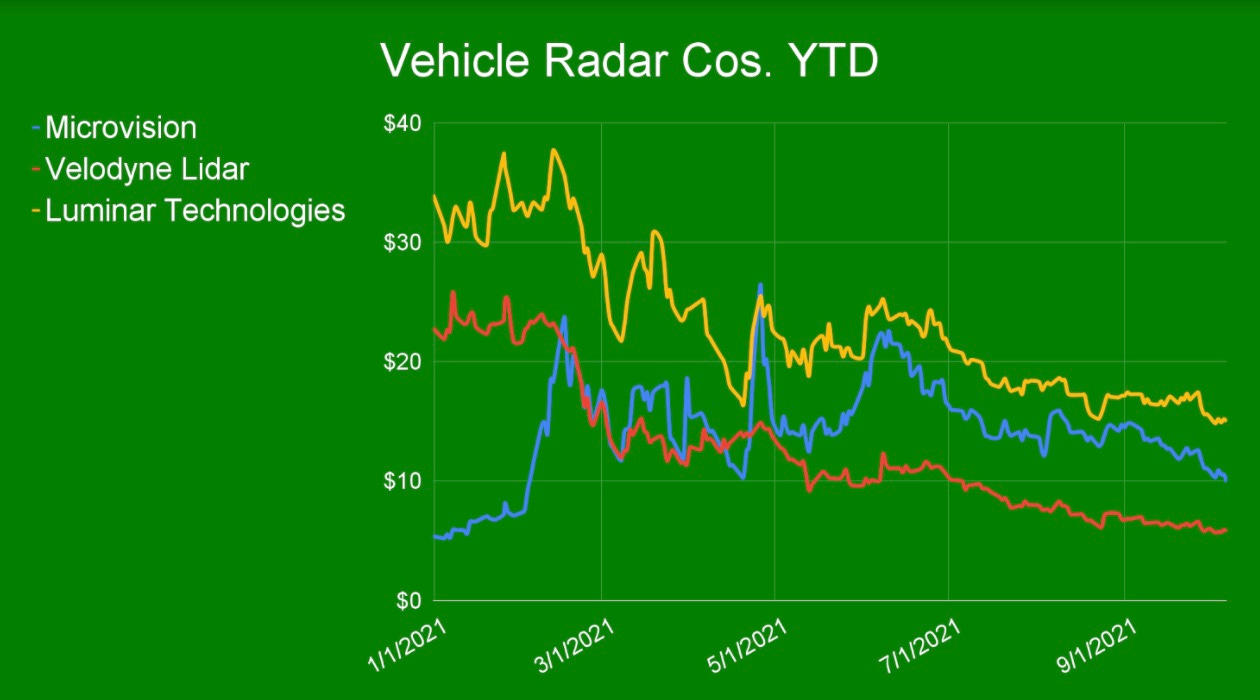

Vehicle radar companies

Any boost for EVs coming from COP26 is sure to help the vehicle radar companies, whose products range from laser sensors to other types of technology that moves cars and trucks toward autonomous driving. The three players from our index in this category include MicroVision Inc. (MVIS), Velodyne Lidar (VLDR), Luminar Technologies (LAZR).

Like EVs, their stocks are down this year, but also could benefit from any COP26-related deals or discussions that would improve the time horizon for the adoption of electric and autonomous vehicles.

Conclusion

As of this writing, we’re within two weeks of COP26, and despite some attempts to delay it and the makings of a hot mess in terms of logistics, it still looks set to take place. While the world will not solve climate change in Glasgow, it certainly still has the chance to take several big steps in the right direction.

Markets and investors, having primed themselves on ESG plays for two years, are looking for signs that the sector will keep rallying as the fossil fuel transition takes shape. COP26 may not be the last chance for that, but right now it’s the best.