Electric vehicles steal CES; Brexit's already testing EU climate policies, and Greta gets a stamp

Plus, why most new ESG funds are destined to fail; and global mining budgets declined in 2020

Just because most oil companies bowed out of bidding for new drilling leases in the Arctic National Wildlife Refuge last week, doesn’t mean they’re done drilling. A new investigative piece by the Associated Press this week shows how drilling applications surged in the few months before the election as energy companies locked in rights to drill on federal lands in the West throughout President-elect Joe Biden’s term.

States like Wyoming, Colorado and New Mexico saw the most activity, though curiously, California also saw gains in leases, even fracking ones last year. The leases will be a key part of the upcoming battle to ban drilling on federal lands, which Biden has promised. He’s appointed Rep. Deb Harland (D-NM) as the country’s first Native American secretary of the interior to help.

The activity shows that despite the collapse of oil prices in 2020, companies are hedging their bets against a rise in prices, which might make drilling more lucrative again in a year or two. Whether they will ever use them — or be allowed to — is another matter. That the companies were served by Trump administrators in pushing through the leases is not surprising. But it should be a lesson to those in the renewable camps about the determination of the fossil fuel opposition.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

ZEUS: Electric vehicles steal CES

. . . . The 54-year-old Consumer Electronics Show has been increasingly about cars in recent years. The high priest of annual tech events, in Vegas every January, has carved an important niche in the annual auto calendar, especially as tech and cars come closer together. Flying cars, autonomous cars, underwater cars. No idea is too crazy for a slick presentation. This year, virtual for the first time because of Covid, CES is about electric cars, writes David Callaway. As the hype from Tesla and Nio, and even General Motors, meets increasing demand for emissions-friendly transportation, the EV market now needs to stand up to the challenge it’s created if it wants to maintain the lofty market premiums it has achieved. Not just in production of these fanciful ideas, but in developing cars people can afford to buy. Investors — even in Vegas — are watching. . . .

EU Notebook: Climate policies an early test for Brexit; plus Greta goads on deforestation

. . . . One of the first tests of the new relationship between Britain and the European Union post-Brexit will be on climate-change policies. The British goals in coming years are even greater than the EU's, and maintaining lockstep on deals like the Paris Agreement and Europe’s Emissions Trading Scheme (ETS) are vital, writes Vish Gain. Energy traders are already worried the market will become fragmented if Britain doesn't adapt its own cap-and-trade plan, announced last month, to the Europe ETS plan. Progress will be closely watched in the run-up to global climate summit COP26 in Glasgow in November.

It has only been two weeks since the deal was implemented, but the divergence in policies has already started to become apparent. On some fronts, this divergence manifests itself in the form of UK’s higher ambitions — such as British Prime Minister Boris Johnson’s announcement of a ban on the sale of petrol and diesel cars by 2030, one-upping the EU.

But on the other hand, the divergence in ETS may be a cause of concern. British Conservative MP Alexander Stafford told Euractiv, “It is worth bearing in mind that the more the UK diverges, the harder linkage will become, so early action is crucial.”. . .

. . . . Great read on Institutional Investor this week on why most new ESG funds are destined for failure. Gabriel Karageorgiou from Arabesque Asset Management and George Serafeim from Harvard Business School argue that the hundreds of environmental, social and governance funds introduced in the past five years are destined for consolidation or failure because of lack of a track record and inability to achieve critical size of $100 million to $250 million, among other things. Comparing ESG to other fund groupings, they say the lack of capital and performance numbers will push new investors to established leaders, creating a hierarchy with a handful of big plays. They end with several recommendations for fund managers on how to differentiate new ESG offerings, including an old maxim: be authentic . . . .

. . . . Israeli energy storage company Augwind, which uses compressed air in a battery to generate electricity, won a government deal to build a renewable energy facility, the country’s first to use compressed air storage. In the race to build battery capacity to store energy for future projects, eight-year-old Augwind is betting that air compression will outperform lithium battery storage, arguing it is more environmentally friendly. The deal is for a plant that will combine the storage with solar energy. Excess solar power during the day will be used to send compressed air into a giant tank, which will then be released as electricity when needed. Critics have argued air compression is less efficient than other battery types, as energy escapes as heat. But Israel’s Ministry of Energy, which needs to reduce emissions by 80% by 2050, is apparently willing to take a chance on a local favorite. . . .

Data driven: Global metal exploration budgets fall, copper hit

Global metal exploration budgets dropped 11% from 2019 to 2020, with copper exploration suffering the largest budget decline — 24%, according to an analysis conducted by S&P Global Market Intelligence.

Gold and silver were the only two metals with exploration budget increases, both jumping 1%. All other mined materials analyzed by S&P Global Market Intelligence saw budget decreases, including nickel, zinc, diamond and lithium — despite a rebound by precious metals and building materials following an initial dip in March due to the pandemic. Gold peaked at $2,000 an ounce in August as investors sought out a safe haven, while copper steadily rose from March through December, moving from $4,790.50 per metric ton in late March to $7,985 per metric ton just before the end of the year.

The drop or flatness in budgets will come as somewhat of a relief to areas like the Amazon basin, where gold mining in particular has contributed to rapid deforestation in recent years, hurting the climate.

Read: Gold, oil, banks, and cattle rustling at heart of the 'Wild West' culture destroying the Amazon

Copper’s exploration budget decrease comes at an interesting moment, because if countries are to reach goals laid out in the Paris Agreement, copper supply will actually need to rise between 3% and 6% each year until 2030, according to a report from Bernstein Research. Copper plays a critical role in the production of wind farms, solar panels and electric cars, all of which are expected for transitioning countries to carbon neutrality. But as the copper supply needs to increase to meet rising demand, it appears to be contracting. Copper discovery has stagnated over the past two decades and forecasts of copper supply have dramatically outperformed reality during that same period. Copper produced per man hour has also steadily declined since its peak in the early 2000s.

With an increased demand seeming inevitable and multiple indicators of a dwindling supply, the market looking to buy copper could soon outstrip its supply. — George Barker for CCI

News briefs: Countries pledge biodiversity defense, Greta gets a stamp

Climate activist Greta Thunberg will appear on a postal stamp in her native Sweden, part of a series focusing on the environment. Image: Henning Trollback/Postnord.

Editor’s picks:

50 countries vow to protect 30% of land and sea by 2030

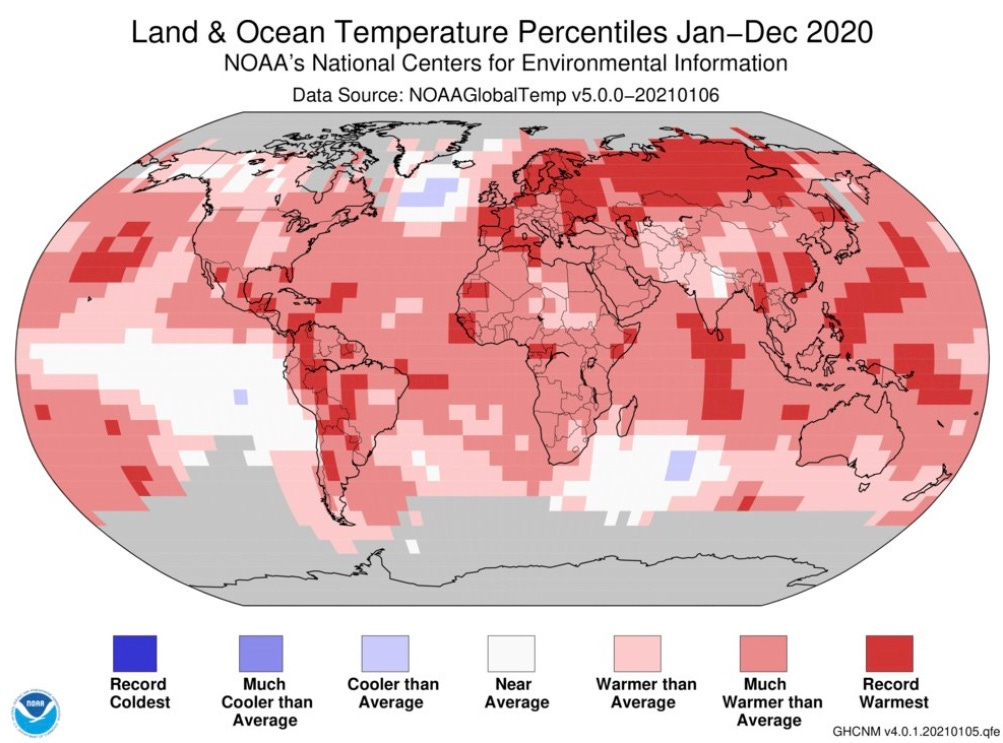

Record ocean temperatures in 2020 fueled extreme weather impacts

Can insurance-linked securities fuel investment in climate adaptation?

Latest findings: New research, studies and projects

Beyond shareholder value: a broader corporate purpose

From the abstract: The view of corporations as private creatures whose role consists mainly of offering enhanced economic efficiency has long dominated. More recent developments, however, suggest that a change may be underway. Starting with the global financial crisis, and in recent years influenced by climate change concerns, the idea of a broader, more stakeholder-oriented corporate purpose has been gaining traction. Yet, while there is a large body of scholarship on revised approaches to the corporate purpose, there has been much less emphasis recently on analyzing the justifications that may support such a shift. This paper explores these justifications and moves to discuss whether there is a business case for stakeholderism, and also engages with recent scholarship arguing that stakeholderism is harmful to stakeholders. Author: Martin Petrin, University College London Faculty of Laws; Western University. Available at SSRN.

More of the latest research:

Words to live by . . . .

“Nature bears long with those who wrong her. She is patient under abuse. But when abuse has gone too far, when the time of reckoning finally comes, she is equally slow to be appeased and to turn away her wrath.” — Nathaniel H. Egleston, writing in Harper's Magazine, 1882.