ESG fund inflows return to earth in Q3; plus Facebook's climate denier tipping point

Welcome to Callaway Climate Insights. All journalists and Nobel Prize Winners welcome.

Callaway Climate Insights publishes Tuesdays and Thursdays for everybody. To get our insights and analysis every day, please subscribe.

Huge congrats to my friend and journalism hero Maria Ressa, above, for winning the Nobel Peace Prize last week along with Dimitri Muratov for their work exposing dictators in the Philippines and Russia. They’re the first journalists to win since 1935, when a German reporter won for revealing the Nazis were secretly re-arming after World War I. It’s a big deal — and a long-time-in-coming honor for all journalists working in tough conditions worldwide. Hat tip!

Last month’s stock market selloff scuffed the last of the shine off an already weak third quarter for environmental, social and governance (ESG) funds, as inflows slowed to their lowest pace in a year.

Net buying of ESG funds was about $110 billion, with funds focused on emerging markets in Asia and Latin America doing the best, according to the Institute for International Finance.

Real estate and technology stocks helped funds post a generally positive performance, despite the selloff in September, in line and actually a touch above the performance of broader benchmarks. The Morningstar US Sustainability Leaders Index, which holds the 50 largest companies with the lowest ESG scores, was up 1.9%, compared with 0.23% by the S&P 500.

Without technology companies, which make a bigger deal of ESG than others but which often have mixed, or at least controversial, environmental profiles, the sustainable indexes would have been lower for the first time in almost two years.

As an emerging global energy crisis and supply-chain pressures grip world markets in the coming quarter, it’s hard to see how these stocks can sprint to the finish line. But a leveling off of Delta variant infections could set the stage for better economic growth than most currently expect.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Countdown to COP26

Callaway Climate Insights was proud to host “Countdown to COP26: everything investors need to know about the world’s most important climate summit,” last week, with speakers including Citi Chief Sustainability Officer Val Smith, EY’s Julie Tiegland, Hannon Armstrong CEO Jeff Eckel, Cervest CEO Iggy Bassi, and our own Bill Sternberg and Marsha Vande Berg. If you missed it, you can watch the webinar, Countdown to COP26, here for free.

Also, the good folks at Dataminr, my favorite breaking news resource, have asked me to speak at a their media event next week: “Covering the Climate Crisis: A Real-Time Emergency.”

You can register here:

Covering the Climate Crisis: A Real Time Emergency | Live Webinar (dataminr.com)

Tuesday’s subscriber insights: What does Google’s new prohibition of climate deniers mean for Facebook?

. . . . Google is putting its money where its mouth is. Lots of companies make climate pledges, but the action is often very slow and/or hard to see. Its striking new initiative to ban advertisers who promote climate denial from its platforms is both immediate self-sacrificing. An example for other companies. Troubled Facebook, meanwhile, had to be pushed kicking and screaming to stop its Marketplace section being used to sell land for clearance in the Amazon rainforest. Can Mark Zuckerberg resist this one? Read more here. . . .

. . . . The green paradox that is China: On one hand, it refuses to sign multinational pledges to cut methane emissions and declare a clean environment as a human right. On the other hand, its renewables projects are impressive in scale. It also, as it has proved with rail and other infrastructure projects, has shown itself capable of turning on a dime if it wants to. We can’t help thinking Xi Jinping has some sort of surprise in store for COP26. Read more here. . . .

. . . . A very interesting new Kiplinger poll finds that large numbers of investors are willing to sacrifice some level of return to achieve ESG goals. Is this like the old TV viewing poll question, where more people say PBS because they want to look good, or is it for real? We look into the numbers here. . . .

. . . . Big Oil bad boys Chevron and Exxon, under big pressure from investors, seem to be getting their acts together somewhat when it comes to fighting climate change. Chevron has set net-zero goals; meanwhile, Exxon is setting up a large project to recycle plastic into raw materials. Read more here. . . .

Editor’s picks: Open-water wave energy project; cash for your clunker

CalWave commissions open-water wave energy pilot

CalWave Power Technologies successfully commissioned its CalWave x1 earlier this month off the coast of San Diego. The company says the event marks the beginning of California’s first at-sea, long-duration wave energy pilot operating fully submerged. The CalWave x1 will be tested for six months with the goal of validating the performance and reliability of the system in open ocean, according to a report from Renewable Energy Magazine. The project is supported by a U.S. Dept. of Energy award with the goal of demonstrating CalWave’s scalable xWave technology. “CalWave’s long-duration deployment is a novel open water demonstration of a wave energy technology with active load management features,” said Jennifer Garson, acting director of the Dept. of Energy’s Water Power Technologies Office.

Bay Area clean car program tops up

Air quality officials in the San Francisco Bay Area recently announced a new round of funding for a program that pays residents up to $9,500 to trade in their old cars and replace them with newer, more energy efficient vehicles. According to a report in the San Jose Mercury News, the Bay Area Air Quality Management District has received $8.3 million in state funding to extend its “Clean Cars For All” program. “Not only is transportation the largest source of air pollution in the Bay Area, it accounts for 40% of our greenhouse gas emissions,” said Cindy Chavez, a Santa Clara County supervisor who also is chair of the air district board.

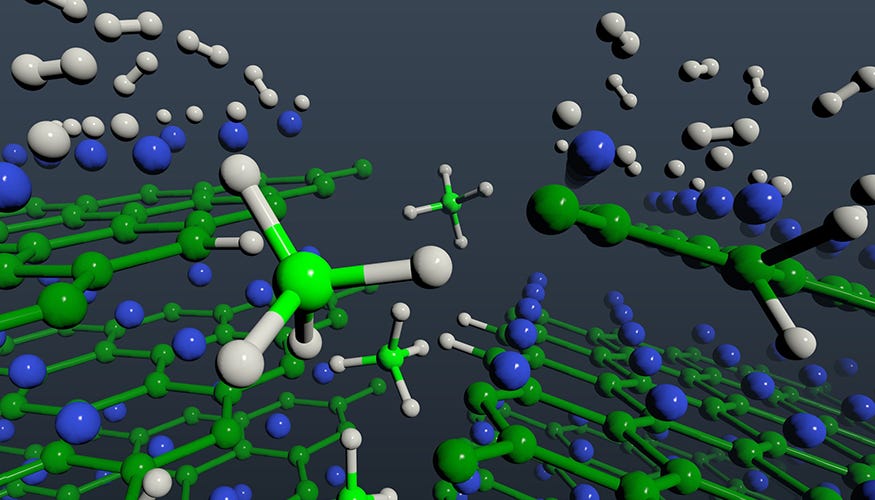

Data driven: Greening hydrogen

Hydrogen supplies becoming cleaner, but too slowly

Hydrogen demand stood at 90 megatonnes (Mt) in 2020, practically all for refining and industrial applications and produced almost exclusively from fossil fuels, resulting in close to 900 Mt of CO₂ emissions, according to the International Energy Agency’s recent Global Hydrogen Review 2021. “But there are encouraging signs of progress,” The IEA report says. “Global capacity of electrolyzers, which are needed to produce hydrogen from electricity, doubled over the past five years to reach just over 300 MW by mid-2021. Around 350 projects currently under development could bring global capacity up to 54 GW by 2030. Another 40 projects accounting for more than 35 GW of capacity are in early stages of development. If all those projects are realized, global hydrogen supply from electrolyzers could reach more than 8 Mt by 2030. While significant, this is still well below the 80 Mt required by that year in the pathway to net zero CO₂ emissions by 2050 set out in the IEA Roadmap for the Global Energy Sector.