ESG is dead, long live ESG: the end of a bear market

Welcome to Callaway Climate Insights. We'll be reporting from Dublin this week at The Climate Summit. Details below.

In today’s edition:

— Those writing the obits of ESG may be missing a broader shift in climate investing.

— Long overlooked on a global stage, sustainable agriculture gets its chance at COP28

— The emerging new market for used EVs

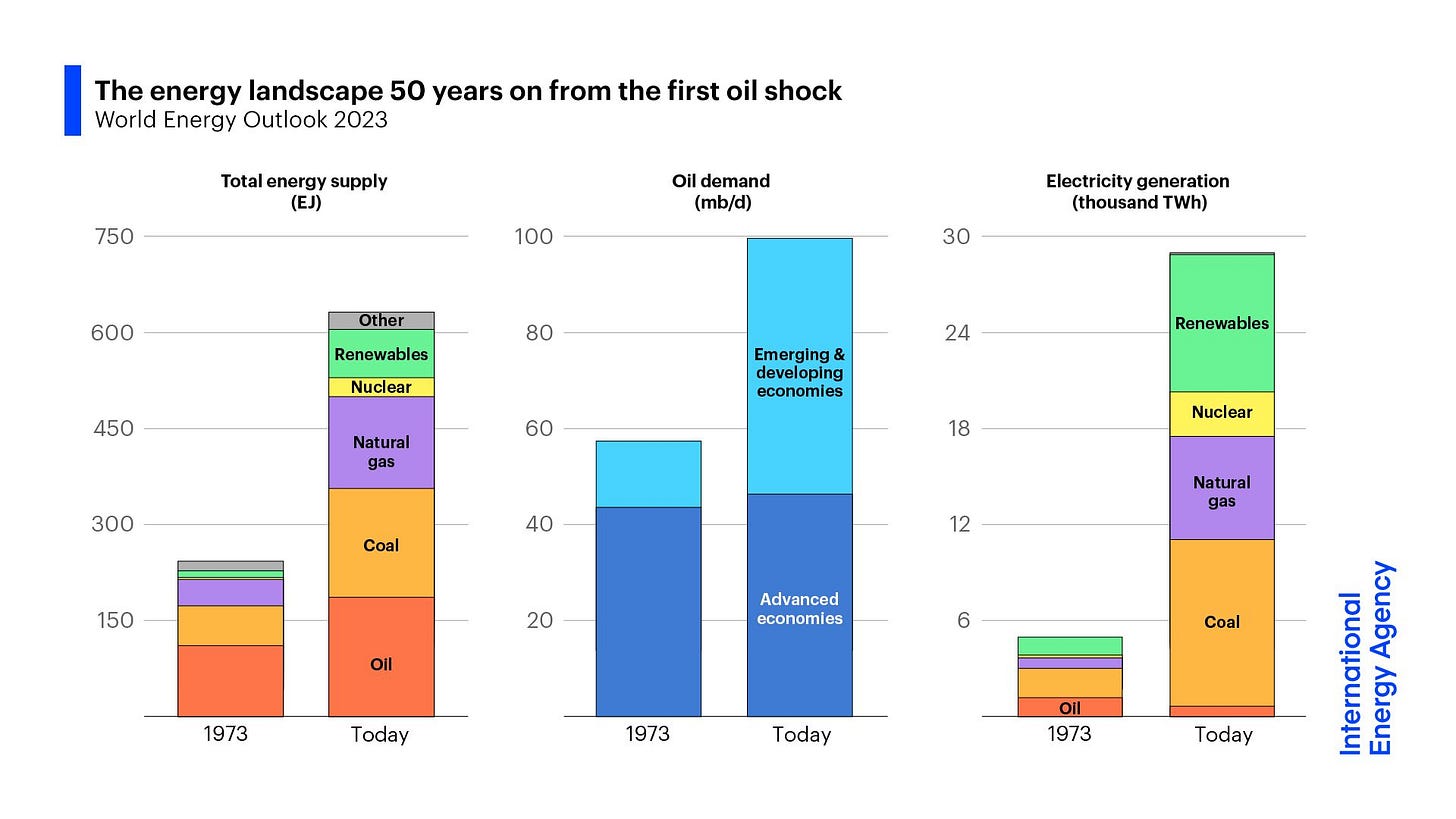

— Oil shock from Gaza turmoil may be speed shift to renewables, says International Energy Agency head, citing lessons from energy crisis of 1973

— Colin Kaepernick signs with Sanchali Pal’s Commons as strategic adviser

— Even as renewable energy stocks fall, usage of wind and solar power is growing across the U.S.

— Lloyds warns insurers the worst of climate losses are yet to come

With geopolitical tensions in the Middle East refocusing attention on energy security, the IEA’s World Energy Outlook shows clean energy offers the lasting solutions to energy and climate challenges, says Fatih Birol, IEA executive director.

In every bear market there is a bottom that most investors miss, usually marked by a headline, speech of some kind or bold proclamation that claims this time the end has finally arrived. For the bear market in clean tech stocks in the past year, that moment might have finally arrived over the weekend with the publication of a Financial Times story that started: ESG is beyond redemption, may it RIP.

The FT wasn’t the first to call the death of ESG. But coming after a week that saw a report from PwC state that venture capital funding for green startups is down 50% this year and private market equity funding down 40%, it had a certain timely authority.

Indeed, a combination of surging interest rates and prohibitive supply chain costs has struck more than $280 billion in market valuations from renewable energy stocks this year, according to calculations from Bloomberg. Wind and solar stocks have taken the brunt of the selloff, which has led to painful delays and even cancelations of vital projects to transition the U.S. power supply to sustainable energy. All this as climate disasters continue to proliferate around the world in what is expected to be the hottest year in history.

With geopolitical tensions at dangerous highs, fueled by the Middle East turmoil and Russia’s aggression in Ukraine, it’s only natural to despair. But if I learned anything in my 40 years in the news business, it’s usually in periods of maximum despair or maximum euphoria that conditions change, and most investors miss them.

Environmental, social and governance (ESG) investing was never going to save the world. The acronym itself may well be consigned to the dustbin of Wall Street fads along with meme stocks, cryptocurrencies or the BRICs. But the basic concept that there is opportunity in hedging climate risk and backing new forms of sustainable energy remains intact. Indeed, the PwC report also said more money is going into emission-reduction opportunities than ever before.

Like Internet stocks, clean tech stocks are simply morphing into a new era of acceptance and shedding the skin of outdated hype. Calling the bottom is impossible. But the more people who give up, the closer it gets.

The Climate Summit in Dublin

We’ll be speaking and moderating at The Climate Summit in Dublin this Thursday, Oct. 26, along with Ireland’s deputy prime minister, Micheal Martin; President of the Eurogroup, Paschal Donohoe, Jonathan Maxwell of Sustainable Capital Development LLC, Danny McCoy and Jackie King of Ibec, and our own columnist and European bureau chief, Stephen Rae. You can register for free here: The Climate Summit 2023, Dublin - Tickets

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

Tuesday’s subscriber-only insights

Mooving up: Big role of farming in global warming gets on COP28 agenda

Keep reading with a 7-day free trial

Subscribe to Callaway Climate Insights to keep reading this post and get 7 days of free access to the full post archives.