Exxon vote a critical climate test for Wall Street; plus inflation disables solar

Welcome to Callaway Climate Insights. And congrats to Phil Mickelson, who proved anything is possible.

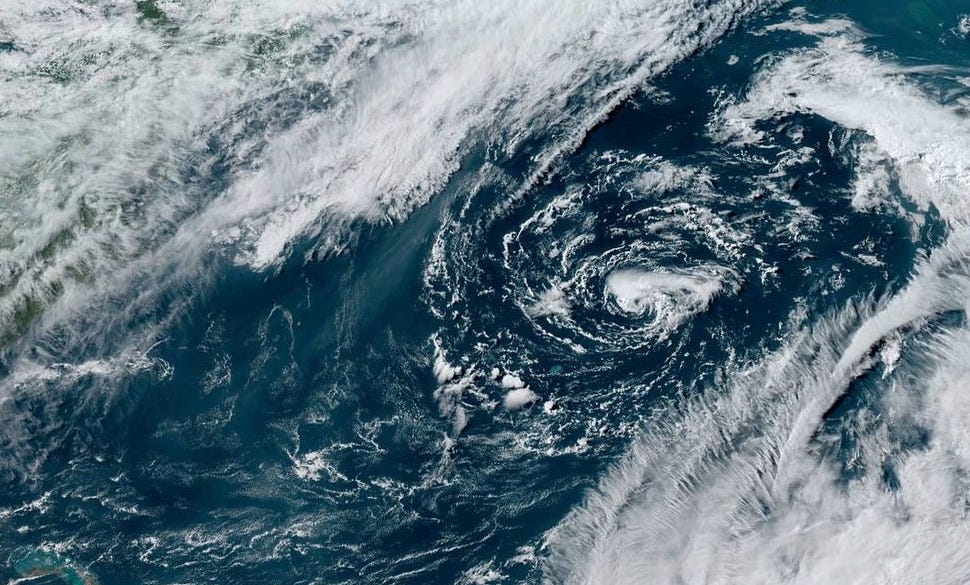

Ana was the first named storm in the Atlantic this year, even though hurricane season doesn’t officially start until June 1. It formed as a subtropical storm early Saturday, then became a tropical storm on Sunday, bringing rain and wind to Bermuda, according to the National Weather Service. President Biden pledged Monday to double funding to FEMA to prepare for hurricane season, with up to 20 named storms expected.

A more dramatic test of Wall Street’s commitment to financing a climate transition to renewable energy couldn’t have been devised this week, even by Hollywood or the network sports programmers who brought us the PGA Championship Sunday.

The ExxonMobil (XOM) shareholder vote Wednesday on a climate dissident’s proposed slate of four directors will lay bare whether the giant fund companies depended on to push corporate America to fight global warming are truly on board or whether they will succumb to the easy path of rising oil prices and status quo.

Coming days after President Joe Biden ordered an overhaul of how the finance industry tracks climate risk, and a week after the International Energy Agency — born of the original oil shock 50 years ago — said all new fossil fuel projects should halt, the vote could not be more high-stakes.

While the oil transition will be slower than most want, the importance of setting the right direction this year cannot be overstated. While many large Exxon shareholders — including CalPERS and the New York State Pension Fund — have already sided with dissident Engine No. 1’s slate of directors, three of the largest have not yet showed their cards. BlackRock (BLK), State Street (STT) and Vanguard are all in play.

Exxon shares are up almost 44% this year as oil prices have rebounded. The company announced this morning its intention to nominate two climate-friendly board directors itself over the next 12 months, which could be seen as a bow to the inevitable or a last-minute desperate attempt to reshape the vote. Or both. If anything, it indicates the big three have not yet weighed in.

The temptation to stick with management’s recommendations and try to influence from the inside must be great. But the signal the vote will send to the rest of Big Oil — and to the global climate community — of Wall Street’s true intentions will be one of the most important moments of the 2021 climate calendar.

It’s time to put up or shut up.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Monday’s subscriber insights: Inflation catches up with renewable energy, and Biden’s climate report card

. . . . It was only a matter of time before inflation caught up with renewable energy, and analysts are saying it’s appearing in prices for solar panels, which have climbed 20% so far this year. A decade of falling renewable costs, and with them arguments for transitioning from fossil fuels, are suddenly at risk. Read more here. . . .

. . . . Four months into the Biden Administration, the first report card on its climate efforts is out this morning, with the Bulletin of the Atomic Scientists scoring it on nine pledges the president made during his campaign. Climate finance is one of the incompletes. Read more here. . . .

. . . . The nascent U.S. offshore wind market has become a big investor attraction — for Europeans. British and German companies are the latest to jump on the bandwagon. Which begs the question, where are the U.S. players? Read more here. . . .

See all our insights each week with a 30-day free trial.

Editor’s picks: Hurricane season 2021; G7 ministers promise to halt support for coal-fired power plants

Watch the video: Darwin’s Arch, a famous rock formation off the coast of the Galapagos Islands has collapsed into the ocean because of erosion. Images distributed by Ecuadorian officials show only the two stone columns remain of the natural structure which was considered a premier diving site.

Editor’s picks:

Hurricane season 2021: 13 to 20 named storms

G7 environmental ministers promise to end support for coal

Denver is building biggest sewer heat-recovery project in U.S.

Click here to read all the news briefs.

Data driven: Germany ramps up green bond sales

. . . . The German government totaled $14.8 billion in green spending in the 2019 fiscal year, according to their Green Bond Allocation report released April 20, 2021, and $13.8 billion of that was offset by the sale of federal green bonds in the following year. The government sold its first 10-year green bond in September 2020 ($7.8 billion) and its first five-year green bond two months later ($6 billion) and saw a green premium between three and five basis points, as well as oversubscription to their initial bond offering — George Barker. . . .