Fed's got climate risk wrong; it's up to the states now

Plus, new report names the dirty 57 oil entities making global warming worse for the next decade

Today’s edition is free. To read our insights and support our great climate finance journalism five days a week, subscribe now for full access.

. . . . Something tells us the Federal Reserve wouldn’t have blocked the influential Basel Committee on Banking Supervision this week from tightening climate disclosure requirements for global banks if Janet Yellen had been in charge.

Yellen, who is in China this week as U.S. Treasury Secretary warning authorities that the Biden Administration won’t put up with a flood of cheap green tech products much longer, was among the central bankers most tuned in back in her day to the idea that climate risk is investment risk for banks. After all, as large insurance companies continue to pull out of markets such as Florida and California, who do you think will be left holding the bag on scarred real estate assets?

But Fed Chairman Jerome Powell is more of a political animal than Yellen and he, ahead of the presidential election and for reasons known only to himself, won’t be deterred from the idea that inflation and banking supervision are the Fed’s only mandates. At least until there is a crisis.

In the meantime, and with the Securities and Exchange Commission effectively blocked by right-wing, anti-climate politicians, any action will be left up to the states. Such as New York, which today announced an agreement with three major banks, including JP Morgan (JPM) and Citi (C), to disclose their ratio of green energy investments to fossil fuels.

As the financial impact from global warming that is trickling through Wall Street turns into more of a gusher in coming years, we will marvel at how silly it was to argue about whether climate risk exists. But for now, it’s another huge step back for U.S. leadership on climate, and in banking.

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

What Shakespeare can teach climate-focused investors

. . . . A good CEO performance summary for investors is an art, though some might be getting too dramatic, writes Mark Hulbert. A new study has found a correlation between the tone a CEO adopts when talking about a company’s ESG plans and the subsequent financial performance of the firm. The more dramatic the ESG plans, the less the performance a year later, according to the study. Apparently acting lessons are not the answer to fiduciary prowess.

Thursday’s subscriber insights

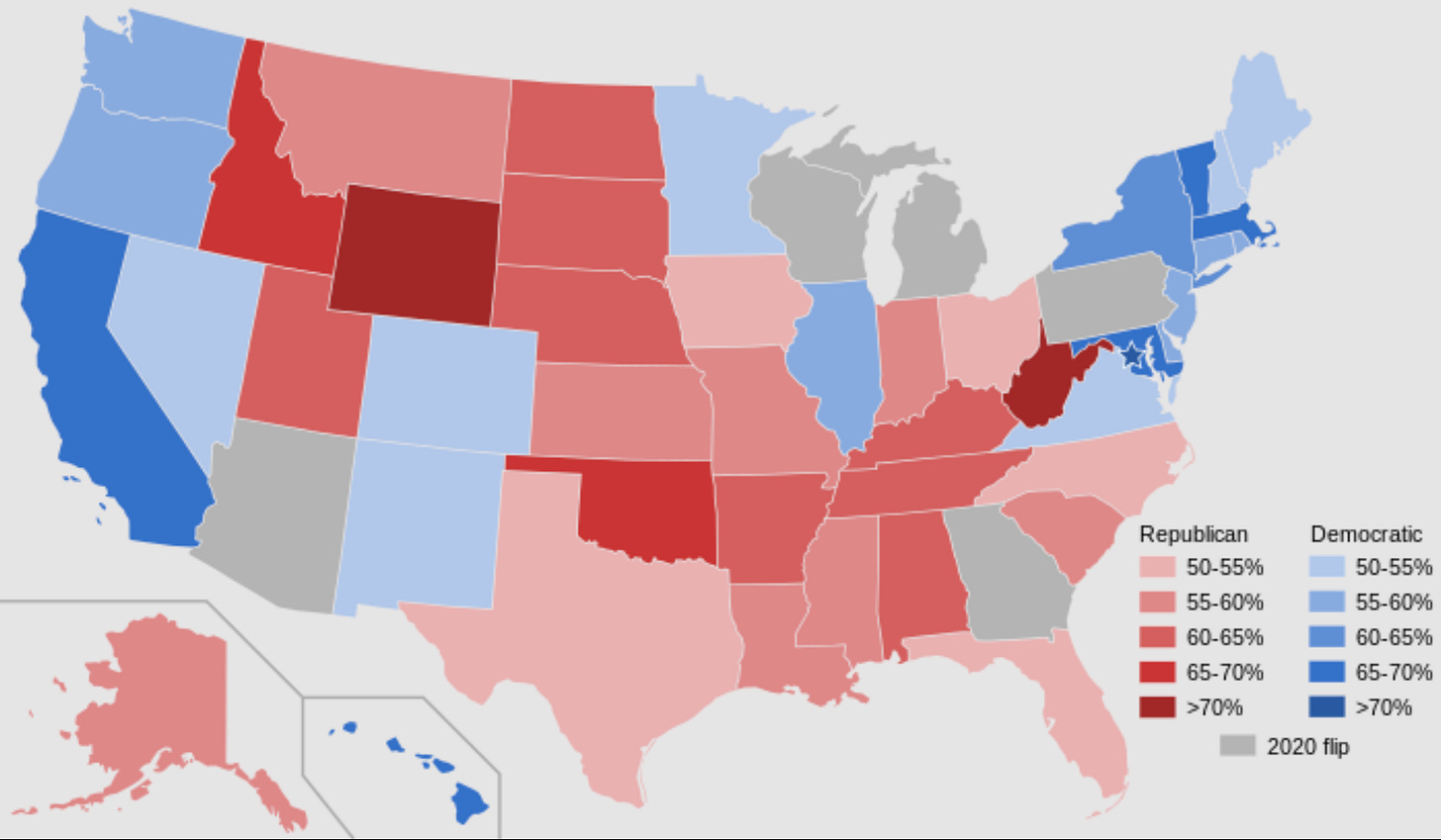

Climate-focused IRA seen as key in swing states

. . . . Since the Inflation Reduction Act was signed in August 2022, it’s been quite an irony that much of the resultant funding has ended up in deep red states. However, quite a lot has been steered to swing states, something that could help President Joe Biden and Democratic legislators get reelected. Read more here. . . .

Less than five dozen oil entities caused 80% of emissions since 2016

. . . . Some amazing — and frightening — figures just out show that just 57 oil, gas, coal and cement producers are directly linked to 80% of the world’s greenhouse gas emissions since the 2016 Paris climate agreement. Leading the pack is Exxon Mobil, responsible for 1.4% of the global total. We pull it together. Read more here. . . .

But what did those oil giants do for investors?

. . . . Many of the 57 polluting entities are tied to their states such as Russia’s Gazprom and Saudi Arabia’s Aramco, which only went public last year. But four of them — Exxon (XOM), Chevron (CVX), BP (BP), and TotalEnergies (CA:TOT) have stocks that go back to the Paris Accord of 2016, the starting point for the study.

Of those, Exxon is up about 43% since then, not counting dividends, splits, etc. Chevron is up 63%. BP is up about 45% and Total is down 24%. Clearly there is an argument for sticking with fossil fuels, at least for three of the four. How strong it will be a decade from now, when the pollution of the last eight years begins to have an impact, will be fascinating to see.

Now wonder the oil market is in a period of rapid consolidation. . . .

Editor’s picks: The power of K-pop; plus, calling kangaroos

K-pop fans force Hyundai to drop aluminum deal

A climate campaign backed by thousands of K-pop fans appears to have pushed South Korea’s Hyundai Motor Co. to end an aluminum supply deal because the metal was produced using coal power. According to a report from Reuters, Hyundai Motor said in a statement on Tuesday that it had ended its agreement with Adaro, a unit of Indonesia’s second-largest coal miner Adaro Energy Indonesia, at the end of last year. The report notes climate activist group K POP 4 Planet that had been calling for an end to Hyundai’s aluminum agreement and welcomed the decision by the carmaker. “It is the victory of thousands of K-pop fans who genuinely care about the climate crisis, especially in Indonesia,” K POP 4 Planet told Reuters, adding that it will continue to monitor Hyundai's sourcing of materials for its manufacturing.

Trials begin for VW’s kangaroo deterrent

Volkswagen Australia has partnered with scientists down under for a creative solution to a big road problem. “Every year on Australian roads, tens of thousands of drivers hit kangaroos,” the automaker says. “So, three years ago, we started a journey to create the world’s first scientifically proven vehicular kangaroo deterrent to help protect drivers and wildlife.” The answer is the “RooBadge,” a modification to the vehicle’s front VW-brand badge that helps deter … er, roos. It’s currently undergoing road tests. “RooBadge links to an in-car app that automatically activates the RooBadge when traveling through known kangaroo collision hotspots. The in-car app also syncs with the cloud, allowing for over-the-air updates.” It sort of uses kangaroo sounds, or language, to help them stay out of the way. They are also working on a license plate holder version. Partners on the project are the University of Melbourne and WIRES, Australia’s largest wildlife rescue organization.

Latest findings: New research, studies and projects

The link between institutional investors and climate change

Climate change has a significant impact on institutional investors, say the authors of a forthcoming Swiss Finance Institute research paper titled, Institutional investors and the fight against climate change. Simultaneously, they write, they demonstrate that institutional investors can have a significant positive impact on fighting climate change, particularly if they actively engage with portfolio firms to reduce carbon emissions. From the abstract: “For risk management reasons, this is in their own interest, and it is also in the interests of society. We highlight possible future research avenues on the link between institutional investors and climate change, emphasizing issues related to environmental, social, and governance rating agencies, greenwashing, and the risk of a loss of trust in ESG products. Climate change constitutes one of the grand challenges of our time, and substantially more research on the role of finance is required.” Authors: Thea Kolasa, University of Zurich - Department of Finance, Swiss Finance Institute; and Zacharias Sautner, University of Zurich - Department of Finance, Swiss Finance Institute, and the European Corporate Governance Institute.

More of the latest research:

Words to live by . . . .

“Sometimes we all need a little pick-me-up, a mood-booster, a breather, or some inspiration. Tap into the healing power of nature.” — National Park Service via Twitter.