From COP27 to the World Cup: two hours fly time, six million tons of carbon emissions

Welcome to Callaway Climate Insights. COP27 ends, and the World Cup starts, this weekend.

Today’s edition is free. To read our insights and support our great climate finance journalism four days a week, subscribe now for full access.

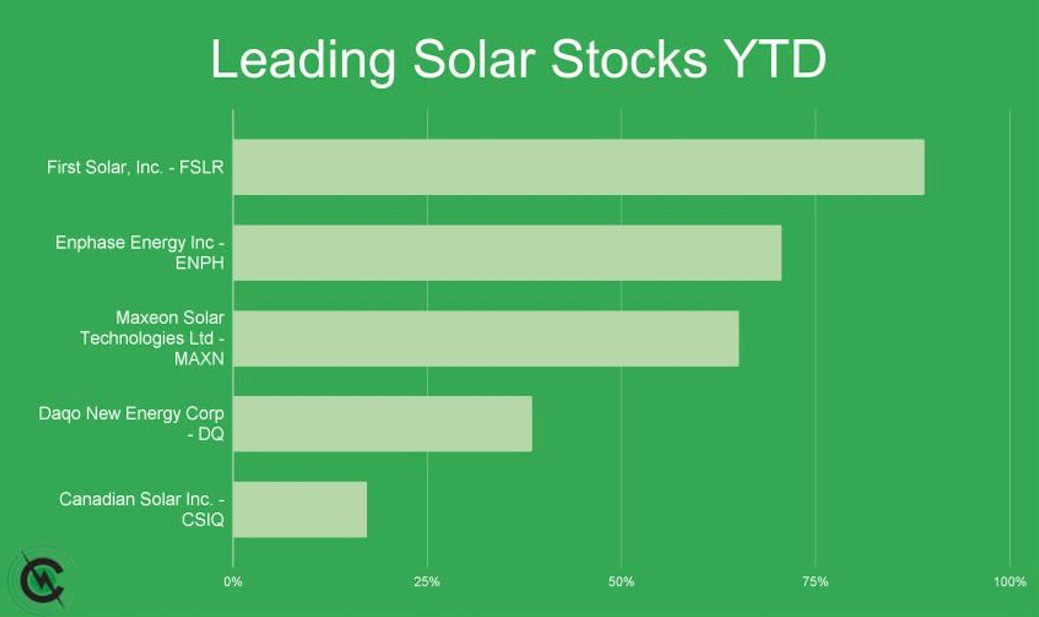

Climate-related stocks have had a mixed year, with the electric-vehicles sector lagging, while natural resources have risen sharply. The solar sector has struggled as well, but has regained positive territory for the year on the back of the Inflation Reduction Act. Among solar stocks monitored by Callaway Climate Insights, here’s a look at the five best performers so far. They're led by First Solar, Inc., up 88%. Two other names have seen better than 50% gains.

For delegates at COP27 in Sharm El-Sheikh in Egypt this weekend looking for some R&R after a miserable failure at the climate conference, the World Cup starts Sunday just a two-hour flight away in Qatar. And while we’re not sure how many of the 35,000 delegates will join two million soccer fans for the first World Cup since before Covid, we do know that just about everybody will be flying.

A more appropriate metaphor for the frustration of climate investors around this year’s COP summit could not be possible. Qatar and FIFA, organizer of the tournament, have estimated that total emissions from the World Cup will be 3.6 million tons of carbon, which they compared to the Rio Olympics in 2016. But Paris-based climate tech researcher Greenly estimates them closer to 6 million tons.

More than half of that will be travel, as hundreds of thousands of fans fly in from around the world to root for their national teams. The rest will come from a decade of construction on the eight stadiums for the tournament, which cost the lives of hundreds of laborers in the country’s extreme heat (why do you think the tournament this year is in November/December?), and from electricity from the hundreds of global broadcasters on hand for the event.

Qatar has said that it intends to make the tournament carbon-neutral by buying offsets, though critics have pointed out that the programs it has cited are not regulated or transparent enough to accurately measure the claim. And if climate activists at COP27 were disappointed by the more than 600 fossil fuel executives in attendance, wait until they get a load of Qatar, one of the most productive oil countries in the world, with the highest carbon emissions per person.

One major difference between the two events though is that at the end of the World Cup, most fans will be happy to have witnessed the competition and taken part in the thrills of the world’s most popular sport. For COP27, not so much.

More insights below . . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Zeus: ESG deals push through recession talk as investors look past election, bear market

Ocean breakthrough: Marine biologists from the Reef Restoration Foundation were proud to announce corals grown in Australia’s original offshore nursery spawned over the weekend for the first time on the Great Barrier Reef off Fitzroy Island, near Cairns. Photo: Reef Restoration Foundation.

. . . . Republican control of the House will ensure the anti-ESG backlash will continue into 2023, but investors are already looking past it, as shown by a spate of third-quarter deals and a surge in renewable energy stocks, writes David Callaway. Big renewable deals by BlackRock, Blackstone, and Carlyle underscore the optimism spurred by President Joe Biden’s Inflation Reduction Act that investing in ESG will be a long-term trend. . . .

A selection of this week’s subscriber-only insights

. . . . With a name like Lula, it’s pretty much that the new Brazilian president is a good guy when it comes to battling climate change. He’s promised to halt the speedy destruction of the Amazon rainforest and now he’s offering to host COP30. Read more. . . .

. . . . One doesn’t hear much about climate as it relates to Israel. And not much either about climate tech. But with that nation’s huge and flourishing background on new technologies, that is likely to change, both in league with companies in other nations and in standalone. Read more. . . .

. . . . Congrats to Richard Revesz, one of the nation’s leading experts on climate law, out of NYU, who this morning was approved by the Senate to become administrator of the government’s Office of Information and Regulatory Affairs, essentially overseeing the Biden administration’s regulatory operations. Revesz instantly becomes a key player in the tug-of-war between political parties regarding the authority and role of regulators, such as the EPA and the SEC. A friend of Callaway Climate Insights, expect to hear a lot more from him. . . .

Dispatches from COP27: New carbon offset rules threaten India's market lead

. . . . Lou Del Bello, our colleague who is reporting from COP27 for her newsletter Lights On, writes that COP27 action on rogue carbon credits is threatening India’s market lead. Weak regulations are flooding the voluntary carbon market with dodgy carbon credits, but negotiators are trying to fix that. Here’s how . . .

Editor’s picks: COP27 spotlights biodiversity risks

Energy woes weigh on European banks’ transition plans

Russia’s war on Ukraine has worsened or slowed the energy transition agenda at most of Europe’s major banks. According to new research, the current energy crisis has “dramatically” increased the energy sector’s need for working capital and fresh investment, “in part to address an immediate shortfall in fossil fuel availability,” according to a study conducted by the European Banking Federation and consulting firm EY, which surveyed 27 large European banks between Aug. 9 and Sept. 12. S&P Global Market Intelligence reports 42% of banks in the study said the gas supply crisis and increased usage of fossil fuels will put them under pressure to reassess their portfolio mix over the next 12 months. The report quotes Gill Lofts, global financial services sustainable finance leader at EY, as saying “We knew the transition was never going to be linear.”

Blades that bend but don’t break

Looking to the lowly palm tree for clues to how they bend but rarely break in a storm, researchers at the University of Colorado, Boulder are designing and testing turbine blades that are lighter and that are “not fighting, if you will, against the wind, but just kind of going with the flow of the wind,” says Lucy Pao, professor and Palmer Endowed Chair in electrical, computer and energy engineering. One difference is that the wind would come around the tower first and then through the blades rather than hitting the blades first. And because the blades are lighter, they may be more economical. Yale Climate Connections reports that Pao’s team has successfully tested one full-sized turbine. She says more research and development is needed, but the new design could enable turbines that are lighter and more resilient in extreme weather.

Latest findings: New research, studies and projects

The portfolio of economic policies needed to fight climate change

Pricing and green research and development support are good economics, but their implementation can be improved, according to the authors of The portfolio of economic policies needed to fight climate change, a working paper from the Peterson Institute for International Economics. “Even if carbon prices are generalized and given more substance, green R&D is still likely to be smaller than needed,” they write in the abstract. The authors also argue that domestic and international compensation is key to the acceptability of efficient policies. Finally, although a country’s emissions will not materially alter the course of climate change, individual countries can still show the way ahead: “They can develop technologies that can be used by other, poorer, countries. They can provide leadership/momentum on global agreements and on the need to fund climate change policies in developing economies.” Authors: Olivier J. Blanchard, National Bureau of Economic Research, Peterson Institute for International Economics; Christian Gollier, University of Toulouse, Industrial Economic Institute, CESifo; Jean Tirole, University of Toulouse, Industrial Economic Institute, Groupe de Recherche en Economie Mathématique et Quantitative, Centre for Economic Policy Research.

More of the latest research:

Climate-Benign Direct Air CO2 Capture, Utilization, and Storage

ESG Investors and Local Greenness: Evidence from Infrastructure Deals

Words to live by . . . .

“There has to be vision to protect and replant our oceans. If we don’t have sustainable oceans, we will never have a sustainable planet.” — Lídia Pereira, member of the European Parliament and COP27 delegate.