Fusion mania rapidly catching up to data centers except that . . .

Welcome to Callaway Climate Insights, your daily guide to global climate finance news and analysis. Please enjoy, and send to a friend.

Today’s edition of Callaway Climate Insights is free for all our readers. We really want to bring you the best and latest in climate finance from around the world. Please subscribe now.

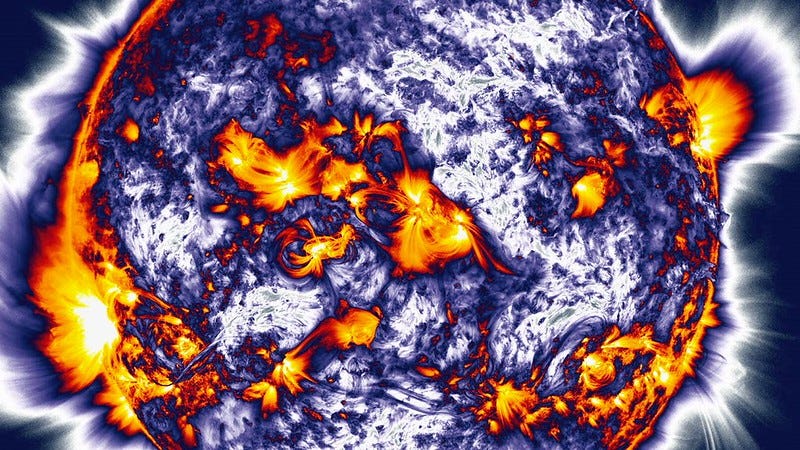

U.S. Energy Secretary Chris Wright, who has led President Donald Trump’s charge against wind and solar energy, this week released a roadmap for fusion science and technology in public-funded labs to complement the private growth of the new technology.

Wright said the White House is all in on fusion as America races China to make the nascent technology work and reap the benefits for the global AI arms race. Reading the summaries of the event, it occurred to us that if scientists can ever find a way to take fusion — the combining of atoms to form energy vs. the splitting (fission) — from a brief success in the lab to a scalable commercial project that rivals the energy of the stars, the promise of AI will be a mere afterthought.

So we are all in on hoping fusion works. For one thing, it will help the world mitigate climate change once and for all. But the hype surrounding it, and the handful of companies behind it, is certainly now rivaling that of AI and the ubiquitous chatter of more and more data centers.

Our good friend and former colleague Herb Greenberg, in his On the Street newsletter, this week cited the soaring disconnect between the number of data centers being announced this year and the number actually under construction. It’s a delightful read and if you don’t already subscribe to Herb, you should — especially for contrarian investment analysis.

The point he was trying to make is that the term data centers is such a hot button for investors today that public relations folks can’t use it enough in their announcements and earnings discussions. It’s a lot like ESG was five years ago, or carbon capture, or the rush among companies to attach dot-com to their names 25 years ago. It’s also spreading to the fusion business.

Reports that China is doubling down on fusion means the White House won’t let this one go, but until anyone demonstrates any scientific way to make it work, all the plans announced for selling billions of dollars of energy created by it — for now — are just news releases. Meanwhile, overlooked solar stocks are suddenly catching fire as investors realize that until and if we get to fusion, we’ll need actually workable forms of creating new energy.

As the overall financial sector settles in for the run to the end of the year, with potentially more interest rate cuts, it’s tempting to leap on these investment bandwagons, which might have a lot farther to go.

But investors must remember, as we said in our Zeus column yesterday, that if any new technologies look so promising that everybody is throwing money at them, inevitably we are all missing something.

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

Zeus: As AI boom builds, an uncomfortable anniversary looms

. . . . This month marks the 24th anniversary of the beginning of the collapse of Enron, the energy giant that at one time in the late 1990s was seen as not only the future of energy trading but a shining example of a new era of innovation, writes David Callaway. Looking into the background of Enron’s collapse, Callaway found many differences between then and today’s AI mania, but also some striking similarities — including charismatic CEOs, interlocking corporate relationships, and above all, rampant fund raising. There is one phenomenon, however, that marked the Internet bubble and the hubris of Enron, that has so far not appeared in today’s rally, he writes. Check out Zeus to find out.

Thursday’s subscriber insights

EV sales drop off post-subsidies might not be as dramatic as first thought

. . . . The predicted surge in sales of electric vehicles before federal subsidies were canceled at the end of last month was everything car dealers had hoped for. But don’t expect a huge drop-off now that the subsidies are gone.

EV sales rose more than 40% in the third quarter from the second quarter as buyers rushed to get their vehicles before the Sept. 30 deadline to cut up to $7500 in subsidies imposed by the government, according to Cox Automotive. Companies such as General Motors GM 0.00%↑ and even Tesla TSLA 0.00%↑ all saw gains as dealers cleared out as much as they could of their inventory before the deadline.

Already, analysts are expecting a substantial drop off in Q4, with GM and Ford F 0.00%↑ each taking charges of more than $1.5 billion to their third-quarter earnings to prepare for drops in sales. But the declines might not be as bad as forecast. Buyers clearly want EVs, and although government cuts to subsidies are no longer available, the car companies all have the power to change prices as they see fit to push sales.

With Q4 and the important holiday season upon us, we expect dealers to do everything they can to try to offset the drop in subsidies in some ways to clear out the rest of their inventory that they didn’t get done by September. In 2027, everyone will start with more realistic sales and pricing ambitions.

Around the world EV sales are booming. We wrote last week about China’s BYD seeing huge gains in the UK, for example. Given a chance to afford them, consumers are voting for the EV experience. U.S. car companies can’t risk being outliers, if for no other reason than for their international sales. This isn’t over.

Editor’s picks: Duracell’s first-ever EV fast charger network; plus, the most energy-efficient state is…

Duracell, the hundred-year-old battery brand, is taking its copper top to the UK, where it will launch its first EV fast charging network. The project, called the Duracell E-Charge network, aims to open the first six charging sites later in 2025. Expansion will continue throughout 2026, with a long-term goal of more than 100 sites and 500 ultrafast chargers by 2030. Duracell, part of Berkshire Hathaway (BRK.A), said it will invest about $266 million in the project. Duracell has partnered with The EV Network, a UK charging-infrastructure developer, and newly formed operator Elektra Charge, which has been granted the license to manage the Duracell E-Charge brand. And, as you can see from the photo above, the chargers look like … batteries.

Most and least energy-efficient states

Vermont is the most energy-efficient state, closely followed by California. Those are some of the results of WalletHub’s 2025 report on the most and least energy efficient states. WalletHub’s report measured the efficiency of auto- and home-energy consumption in 48 U.S. states. Energy is one of the biggest household expenses for American consumers. The average U.S. family spends at least $2,000 per year on utilities, according to the U.S. Department of Energy, with heating and cooling of spaces alone accounting for about half the bill. In 2022, the average consumer spent another $3,120 on motor fuel and oil. So who pays the least and is most efficient? Vermonters, because, “in large part because it’s the most vehicle-fuel efficient in the country. Vermonters drive an average of around 21 mpg of gasoline, more than any other U.S. state. On top of that, Vermont has the seventh-lowest residential energy consumption per capita, along with the second-highest home energy efficiency,” said Chip Lupo, WalletHub analyst. California is next. It ranks second overall, 4th for home efficiency, 7th for vehicle-fuel efficiency, and 5th for transportation efficiency.

Latest findings: New research, studies and projects

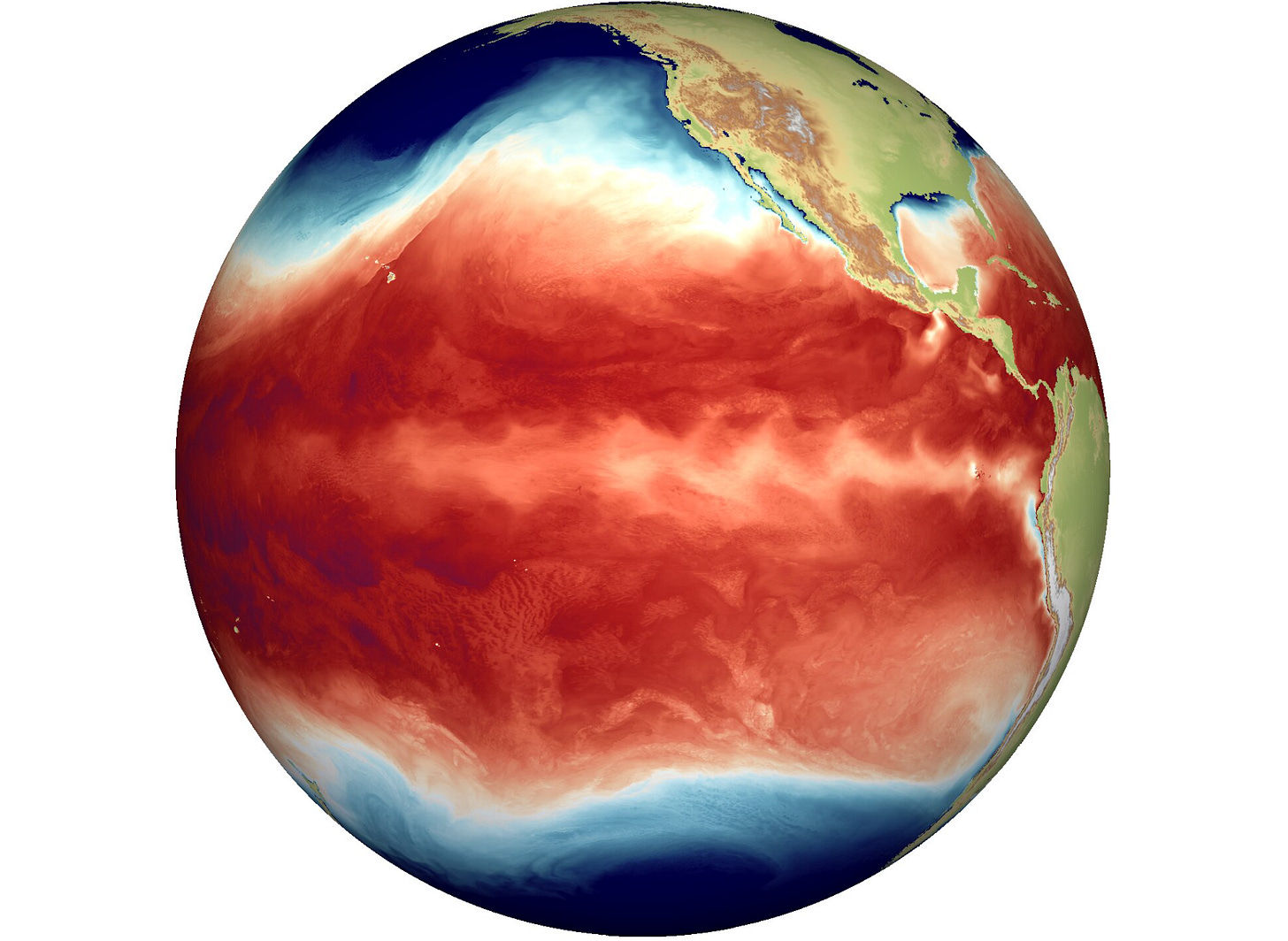

Intensifying El Niño cycles could cause climate whiplash

The El Niño-Southern Oscillation (ENSO), a key driver of global climate variability, is projected to undergo a dramatic transformation due to greenhouse warming, says a report in Phys.org. A new study published in the journal Nature Communications. Using high-resolution climate models, a team of researchers from South Korea, the U.S., Germany, and Ireland found that ENSO could intensify rapidly over the coming decades and synchronize with other major climate phenomena, reshaping global temperature and rainfall patterns by the end of the 21st century. The study projects an abrupt shift within the next 30 to 40 years from irregular El Niño-La Niña cycles to highly regular oscillations, characterized by amplified sea surface temperature (SST) fluctuations. “In a warmer world, the tropical Pacific can undergo a type of climate tipping point, switching from stable to unstable oscillatory behavior. This is the first time this type of transition has been identified unequivocally in a complex climate model,” Malte F. Stuecker, lead author of the study and director of the International Pacific Research Center at the University of Hawaiʻi at Mānoa, told Phys.org. “Enhanced air-sea coupling in a warming climate, combined with more variable weather in the tropics, leads to a transition in amplitude and regularity,” he adds.

More of the latest research:

Climate change is fueling extreme wildfire seasons across the Earth

Carbon dioxide in the atmosphere up by record amount in 2024

Words to live by . . . .

“It’s just Economics 101: When it’s free to pollute, you get more pollution. But when there’s a price to pay, industry will have an incentive to find low-cost carbon solutions.” — Fred Krupp, president of the Environmental Defense Fund.