German utility's $6.8 billion U.S. solar buy signals start of renewables deals wave

Welcome to Callaway Climate Insights. Especially to our new subscribers. Please enjoy and share with your colleagues.

In today’s issue:

— Wall Street’s relief rally highlights performance of solar, EV stocks year-to-date

— A weekend deal by Germany’s RWE to buy Con Ed’s renewables business ignites clean energy merger flame

— Nestle seeks to add green glow with coffee, packaging moves

— New York joins California in banning gas powered car sales from 2035

— Fat Bear Week is back! Who will be the champion of chonk?

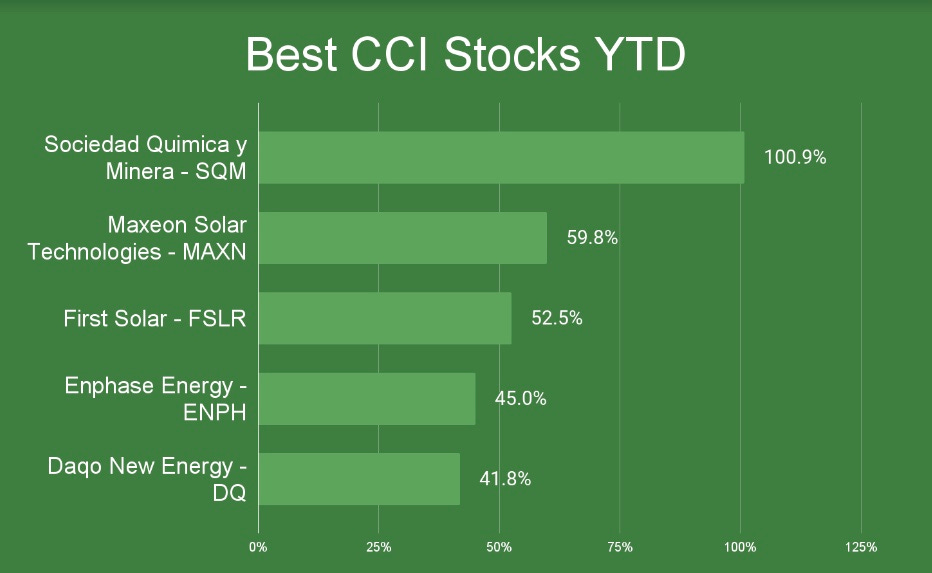

Climate-related stocks suffered with the rest of the broader markets in the third quarter, but more names have started to turn positive for the year. Resource stocks associated with the batteries to power electric vehicles remained well in the lead as mining company Sociedad Quimica y Minera de Chile SQM 0.00%↑ topped the winners with an 83.4% gain YTD. Maxeon Solar Technologies MAXN 0.00%↑ is running second, up 78.1%. The company’s shares started moving higher in late July after the introduction of the so-called inflation reduction act, which included key support for solar-related investments. First Solar FSLR 0.00%↑ and Enphase Energy ENPH 0.00%↑ tied for third at 56.7%. And Daqo New Energy DQ 0.00%↑ rounded out the top 5 with a 32.5% gain.

Lots of debate this first week of the fourth quarter about the seriousness of the stock market rally on Wall Street, but one deal over the weekend should be seen as a sign of better times ahead for clean energy investors.

Germany utility RWE’s $6.8 billion takeover of Consolidated Edison’s ED 0.00%↑ renewables portfolio, which more than doubles its portfolio and will instantly make it a major U.S. solar player, is notable for its timing, coming at the end of a painful month for U.S. markets. That a global player such as RWE would push the deal through despite an unstable market, instead of delaying, highlights the long-term potential of the renewables play here.

The deal caused some commotion in Germany, where some investors wondered why RWE is buying U.S. clean energy assets at a time when the country, and Europe, are entering an unprecedented energy crisis tied to Russia. Again, the potential for RWE to become a leader in the world’s second largest renewables market outweighed short-term concerns, even those tied to the war in Europe.

We’ve argued for months that the selloff in stocks will pave the way for a wave of mergers and takeovers in the renewables market, as big players, including oil giants, look to add promising climate transition businesses at cheap prices. Bloomberg reported on its professional service that French oil giant Total looked at the Con Ed assets also. And as you can see from our chart above, solar stocks in particular have attracted investors this summer.

For Con Ed, the deal signals a shift toward its main market of New York-area electricity markets, where it said it will continue to lead the green transition, ceding the rest of the country to RWE. Read our May profile: Con Edison, one of Wall Street’s oldest stocks, plots new path on Electric Avenue.

Relief rally or not this week, the rush for long-term renewables growth has begun.

More insights below . . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Keep reading with a 7-day free trial

Subscribe to Callaway Climate Insights to keep reading this post and get 7 days of free access to the full post archives.