Green loans are growing

Banks experiment with linking performance targets to coupon and interest payments to create added incentive.

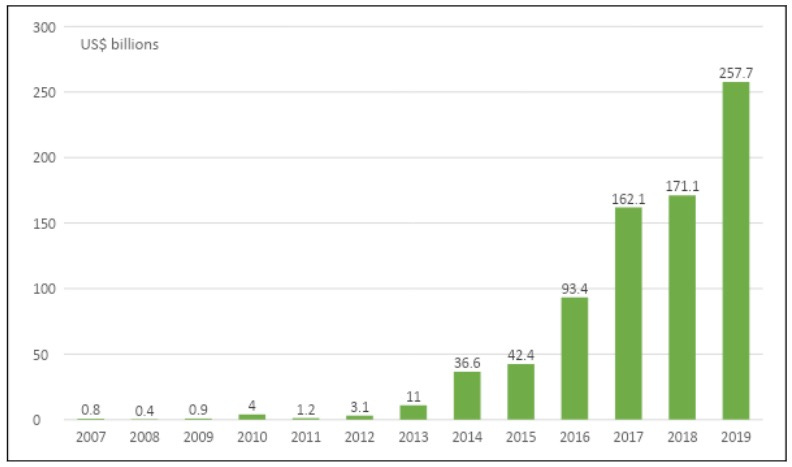

Annual green bond issuance ($billions), 2007 to 2019. Source: Moody’s Investors Service, Climate Bond Initiative, and other sources.

By Henry Shilling

(About the author: Henry Shilling is the director of research at Sustainable Research and Analysis LLC in New York. He is the author of The International Guide to Securities Market Indices. He formerly was with Moody's Investors, where he coordinated the firm's worldwide efforts to more transparently reflect the integration of ESG factors in research, ratings and analysis. He also developed and launched Moody's green bond assessment and published extensive research on this and related topics.)

NEW YORK (Callaway Climate Insights) — A recent development in the evolution of green bonds is the introduction of green loans, a complement to green bonds that covers green bilateral loans, green syndicated loans, green revolving credit facilities and green project financings.

Green loans function like green bonds, but the terms of the loan can be more easily structured to offer the borrower some form of incentive to achieve targets for improving environmental performance.

The U.K. supermarket chain, J. Sainsbury (LSE:SBRY), is credited with issuing the first-ever corporate green loan arranged by Lloyds Bank and Rabobank in 2014 to finance Sainsbury's environmental commitments, namely clean energy generation, energy efficiency and water savings projects. Since then, the green loan market has grown, benefiting from the issuance in March 2018 of the voluntary Green Loan Principles based on the Green Bond Principles.

A feature of green loans that has also been adopted by some green bonds, and more recently sustainability-linked bonds in particular, involves linking the coupon payment on the loan obligation to some carbon reduction or ESG target performance of the obligor.

An example of such a “positive incentive loan” includes a June 2019 transaction by Nokia. The firm issued a 5-year revolving credit facility in which the margin Nokia pays is contingent on performance relative to predetermined targets regarding greenhouse gas emissions connected with Nokia’s production and those that can be reasonably associated with customer use of Nokia products.

This latest innovation has been expanded beyond green bonds to include transition bonds, sustainability-linked bonds and social bonds that have become increasingly prominent following the onset of the coronavirus pandemic.

In September 2019, Enel, the Italian multinational manufacturer and distributor of electricity and gas, paved a new path by issuing through its Dutch-registered subsidiary the first of its kind United Nations Sustainable Development Goals (SDG)-linked bond. Unlike green bonds or green loans, the proceeds raised are not earmarked for a specific use but the coupon can step up in the event the company does not achieve targets set on the basis of specific key performance indicators.

Covid-19 and the green bond outlook

As attention in the first quarter of 2020 shifted to address the Covid-19 outbreak, issuers from sovereigns to corporates more than doubled their issuance of social bonds. According to HSBC, social bonds volume more than doubled in March to $4.3 billion due to several large pandemic-related bonds from development banks.

While this was at the expense of green bonds and green loan volumes, the intermediate-to-long-term outlook for green bond issuance is expected to remain strong, if not grow stronger, as governments and other issuers consider how to embed environmental priorities into their post-Covid-19 recovery plans. By some estimates, green bond volume in 2020 is expected to reach $225 billion to $275 billion.

Read Stephe Rae’s report: Quarter of €750 billion EU rescue package will be green

Since their launch, a cumulative total of $784.7 billion in green bonds and loans have been issued through the end of 2019. New green bond issuance has been gaining momentum, particularly since the adoption of the Paris Climate Agreement in 2015. From $42.4 billion issued that year, annual green bond issuance increased by 507.8% to $257.7 billion at the end of 2019, including $10 billion or 4% in green loans. Yet at this level, green bonds still represent just about 1% of global long-term bond market issuance.

The vast amount of investment needed to tackle the infrastructure and technological requirements to bring about a transition to a low-carbon greener economy, estimated at nearly $7 trillion a year through 2030, is such that there is a need for both private and public sector engagement, collaboration and funding.