Grid warfare, Biden's carbon price miss, and who wants to be a climate trillionaire

Welcome to Callaway Climate Insights. Today we introduce the CCI stock index. Please enjoy and share.

An ominous report over the weekend that China had infected India’s power grid with malware and actually blacked out Mumbai one night last year as a warning to its rival sets the stage for what could be a dangerous era of power grid warfare. As U.S. investigators struggle to learn the extent of the damage of Russia’s SolarWinds hack, and Texans recover from their massive grid failure two weeks ago, the prospects of cyberattacks on grids is becoming very real.

Russia has experimented with blackouts in the past in Ukraine, and the U.S. has signaled it’s not unprepared should a grid attack come. But the fragile and centralized state of many of the world’s grids makes them glaringly exposed to cyberwarfare. It also underscores the fact that fighting climate change is a national security issue as well as a financial and scientific challenge.

Indeed, renewable forms of energy such as solar and wind become all the more important in this scenario. An arms race in climate technologies is inevitable, but at a time when major countries are dramatically missing their Paris targets, as detailed by Climate Tracker below, the use of cyber espionage to shut off each other’s national power sources is a dangerous detour from the global challenge of adapting to an over-heating world.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Monday’s insights: Buffett’s ESG omission, Biden’s carbon price miss, and the race to be a climate trillionaire

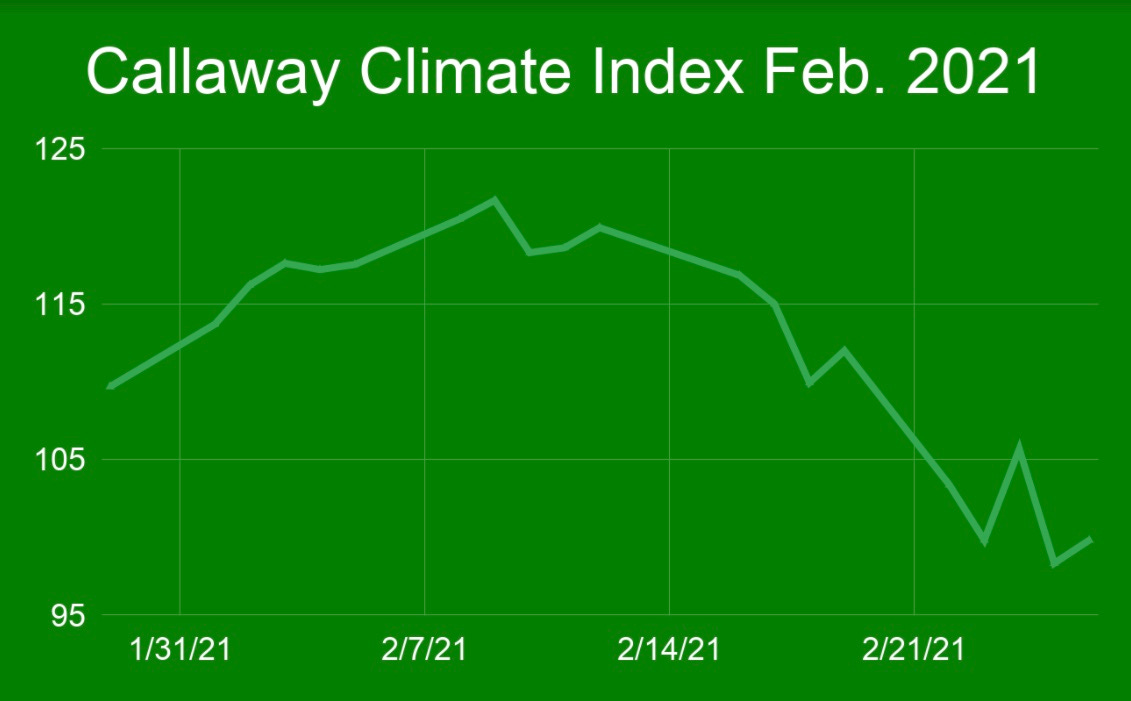

The CCI Climate Index fell 9.87 points, or 9% for the month of February, to 99.82. Thirteen stocks in the index rose, while 42 fell. Among standout moves, MicroVision (MVIS), which develops laser beam scanning technology used in automotive systems, rose $7.76, or 109.1%, to $14.87. Fisker (FSR) rose $13.47, or 89.6%, to $28.50. MP Materials (MP) rose $12.86, or 44.1%, to $42.03. The CCI Solar Index fell 7.39 points, or 6.8% for the month, to 101.88. The Callaway Climate Insights indexes are price-weighted averages drawn from a list of 55 notable companies in climate-related sectors.

. . . . Warren Buffett has never been much for market fads, but the glaring omission in his annual letter of anything relating to environmental, social or governance strategies or funds is reminiscent of his spectacular diss of Internet stocks back in the original bubble, and we know how that turned out. Read more here. . . .

. . . . The Biden administration punted late Friday on one of its biggest chances this year to create a revolution in carbon emission reduction, when it resorted to an interim price on the social cost of carbon that simply restored the price to what it was during the Obama era. The indecision is a significant set back to U.S. climate credentials. Read more here. . . .

. . . . The World Bank and International Monetary Fund vowed more financial aid to struggling third-world countries over the weekend by tying green strings to lending, but with the world’s three largest carbon emitters missing their targets, no amount of new aide will help the world meet its Paris targets. Read more here. . . .

. . . . ExxonMobil bowed to activist pressure Monday and appointed two new board members with ESG credentials, although activist Engine No. 1 said the oil giant did not go far enough. Read more here. . . .

. . . . Young investors might find it hard to believe, but there was a time 20 years ago when Dow 30,000 was more of a joke than a realistic goal. Today, it’s a market floor. So when Oilprice.com said it expects climate change technologies will create the world’s first trillionaire, it doesn’t seen like so much of a stretch. The website says Elon Musk stands the best chance right now of making it, but its selection of a few promising companies whose technologies could pull it off will make any investor sit up and take notice. Read more here. . . .

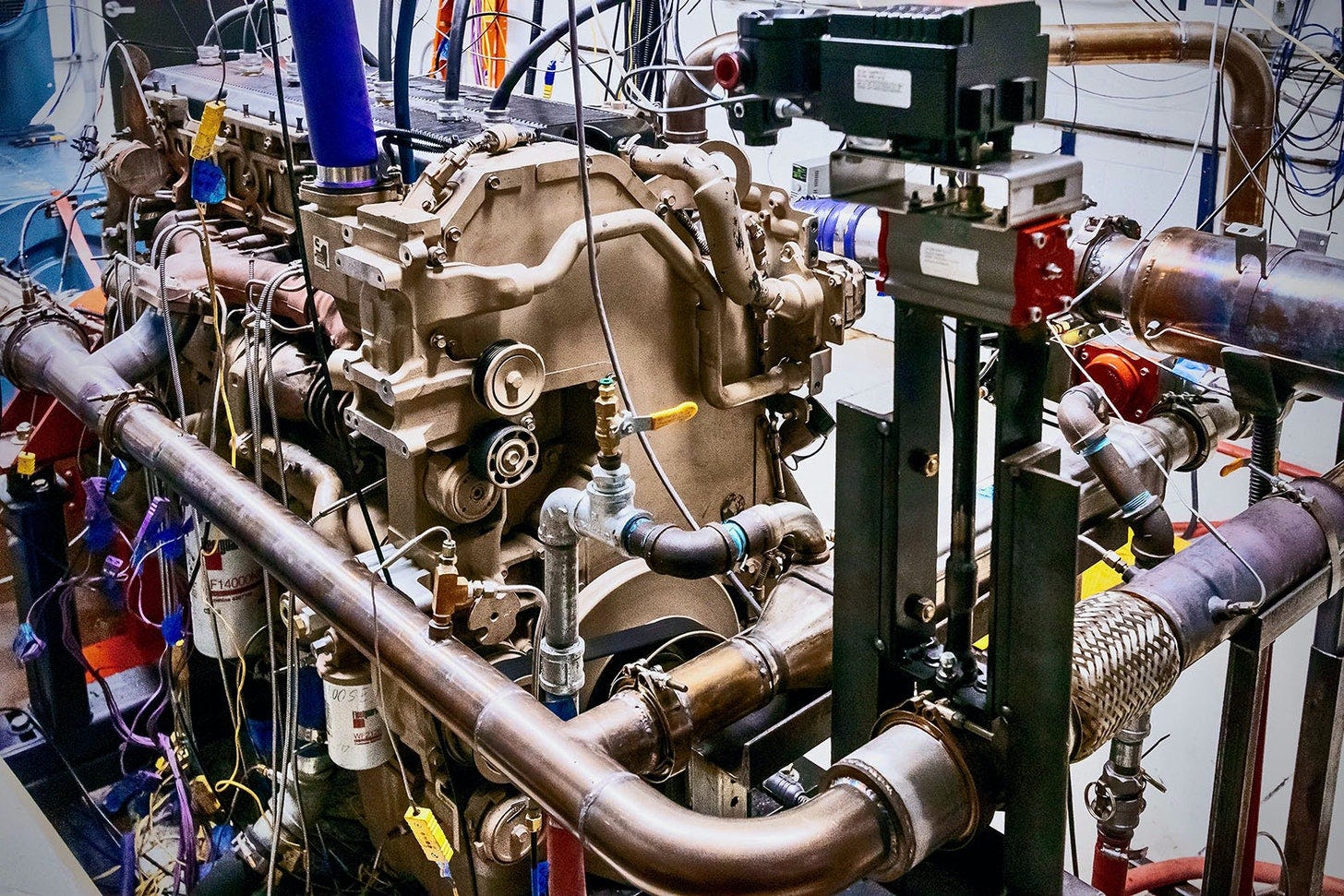

'What are the trucks of the future going to be?' ClearFlame is betting quite the same

. . . . BJ Johnson doesn’t want his startup to be a solution just viable 30 years from today, he wants it to matter right now. ClearFlame Engine Technologies, a company he co-founded with Julie Blumreiter, has developed technology to alter existing diesel engines to drastically reduce long-haul trucking’s emissions and air pollution footprint, while only requiring minor shifts to existing manufacturing practices, George Barker writes from Boston. Unlike fully electric or hydrogen fuel cell engines, their innovation doesn’t require massive infrastructure changes to become viable. “It’s funny; we’re disrupting the space by trying to be minimally disruptive to the manufacturing process. It’s the same level of modification, more or less, that it would take to get a natural gas big rig today or a propane school bus,” said Johnson. . . .

Data driven: Rising renewables

. . . . Even in a year marred by a pandemic, renewable energy projects continued to gain momentum in the U.S., with the rate of wind power construction jumping 47.5% from 2019 to 2020; Solar construction rose 28.9%. Read more about the energy transition in the U.S. . . .

News briefs: Crazy-rich Asians go gaga for green investments; new Citi CEO's net-zero pledge

Editor’s picks:

Crazy-rich Asians pour family cash into green startups

On first day, new Citi CEO vows net zero by 2050

China bigwigs press for carbon market kickoff

Wells Fargo ponies up with a new ESG chief