Hawaii Electric, PG&E, and the new climate risk to utilities

Plus, the most harmful emissions from the 1% aren't from their private jets.

In today’s edition:

— As utilities reel from higher rates, a new era in climate risk threatens a popular dividend

— All sustainable investments are not created equal. Or even similar, Mark Hulbert finds

— It’s not just private jets. Investments are the most harmful emissions of the super rich

— Looking for a compromise in solar imports as new U.S. tariffs set to hit next year

— A cargo ship with sails? Believe it. Introducing WindWings

— Rio Grande river joins list of important waterways drying up

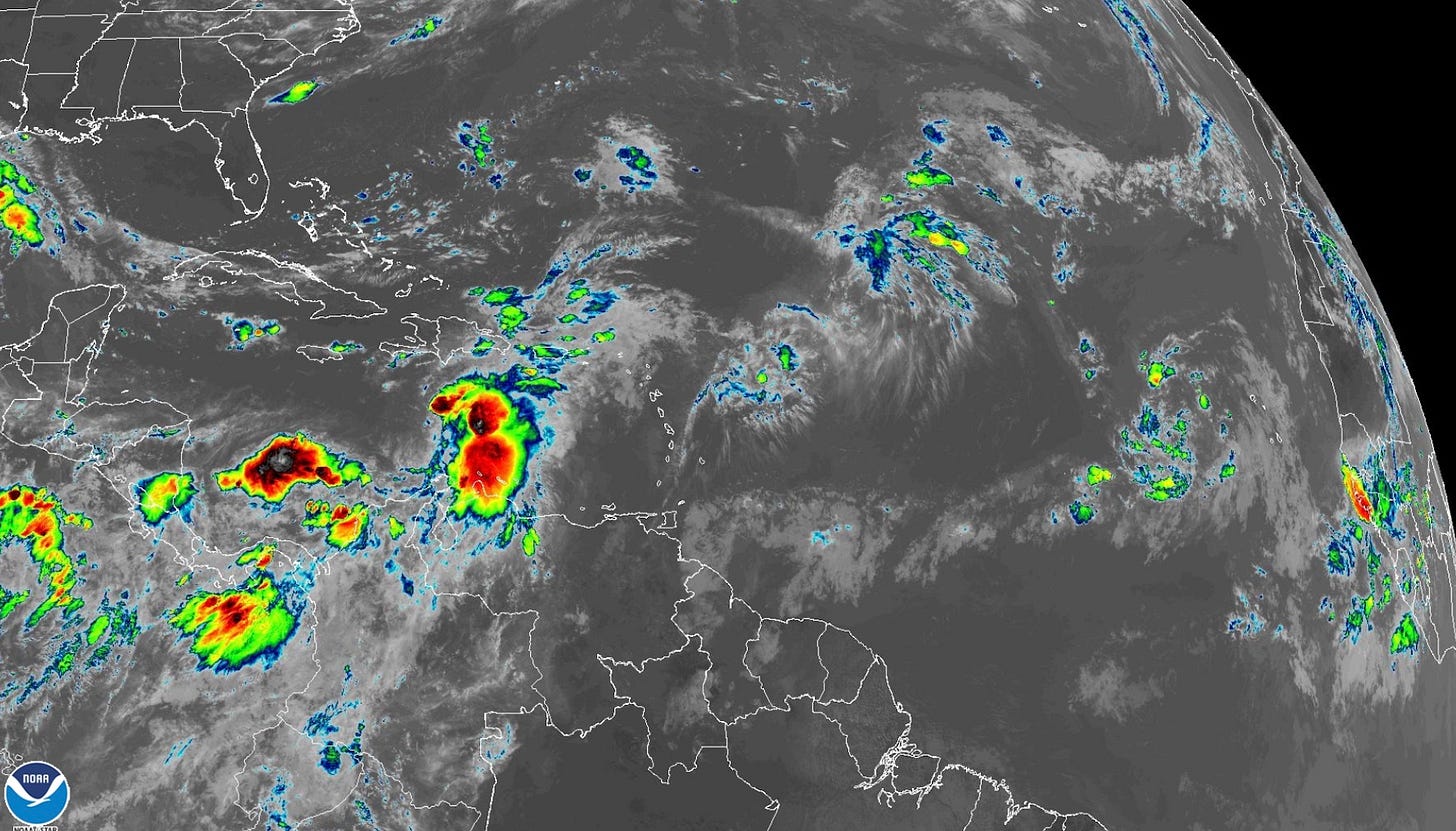

They’re lining up: The National Hurricane Center is issuing advisories on Tropical Storm Franklin, located over the east-central Caribbean Sea, on Tropical Depression Gert, located a few hundred miles east-southeast of the northern Leeward Islands, and on Tropical Storm Harold, located just offshore of south Texas. Last week, NOAA upped its hurricane forecast for the remainder of the 2023 season.

The collapse in shares of Hawaiian Electric Industries HE 0.00%↑ last week and the bankruptcy of California’s PG&E PCG 0.00%↑ almost five years ago after its downed wires sparked deadly wildfires are driving home a new dynamic to utility investors just as demands for a new grid infrastructure reach a frenzy.

While the opportunities in rebuilding the nation’s grid of some 1,600 public and private utilities to expand renewable energy usage are enormous, the fires in California and now in Maui are stark reminders that a new era of climate risk tied to existing infrastructure is outpacing innovation.

The nation’s top utility funds are all down about 7% year-to-date, mostly because utilities tend to flourish in falling interest rate environments, which make their healthy dividends more attractive. With rates now rising, funds such as Fidelity Select Utilities (FSUTX), Franklin Utilities (FKUTX) and MFS Utilities (MMUFX) have underperformed. Shares of Consolidated Edison ED 0.00%↑ , one of the nation’s largest utilities, are also down 7%, while PG&E shares are up 2% this year.

While ambitious investors might see this as a perfect buying opportunity for some utilities, the new era of wildfire risk to wind-blown utility poles certainly underscores the need for more rapid transition of these once plodding businesses. This is likely to come at the expense of consumers, both in higher rates and in potentially more blackouts as utilities try to avoid the next Maui-like crisis by cutting power to transmission lines during violent windstorms.

Investors should expect that any such transition will come with a period of rapid consolidation as well, all in all making the utilities sector over the next decade anything but boring.

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

The huge differences in funds calling themselves ‘sustainable’

. . . . Think all sustainable funds are the same? Think again. Mark Hulbert shows how the incredible diversity in sustainable strategies, definitions, and returns, proves that the sustainability sector is not even an investment category by standard definitions. The differences shouldn’t be surprising, Hulbert contends, as even the definition of what is sustainable itself depends on who is defining it. For investors, this means that choosing to be a sustainable investor is just a first step, not a last one. It’s still a stock-pickers market, even for sustainable funds. . .

Tuesday’s subscriber-only insights

That super-polluting private jet? Turns out it’s just a tiny part of rich folks' pollution

Keep reading with a 7-day free trial

Subscribe to Callaway Climate Insights to keep reading this post and get 7 days of free access to the full post archives.