Hurricane Milton's economic impact will be worse than early estimates

Welcome to Callaway Climate Insights, the daily guide to climate analysis and investing. Please enjoy and share with your colleagues.

Today’s edition of Callaway Climate Insights is free for all our readers. We really want to bring you the best and latest in climate finance from around the world. Please subscribe now.

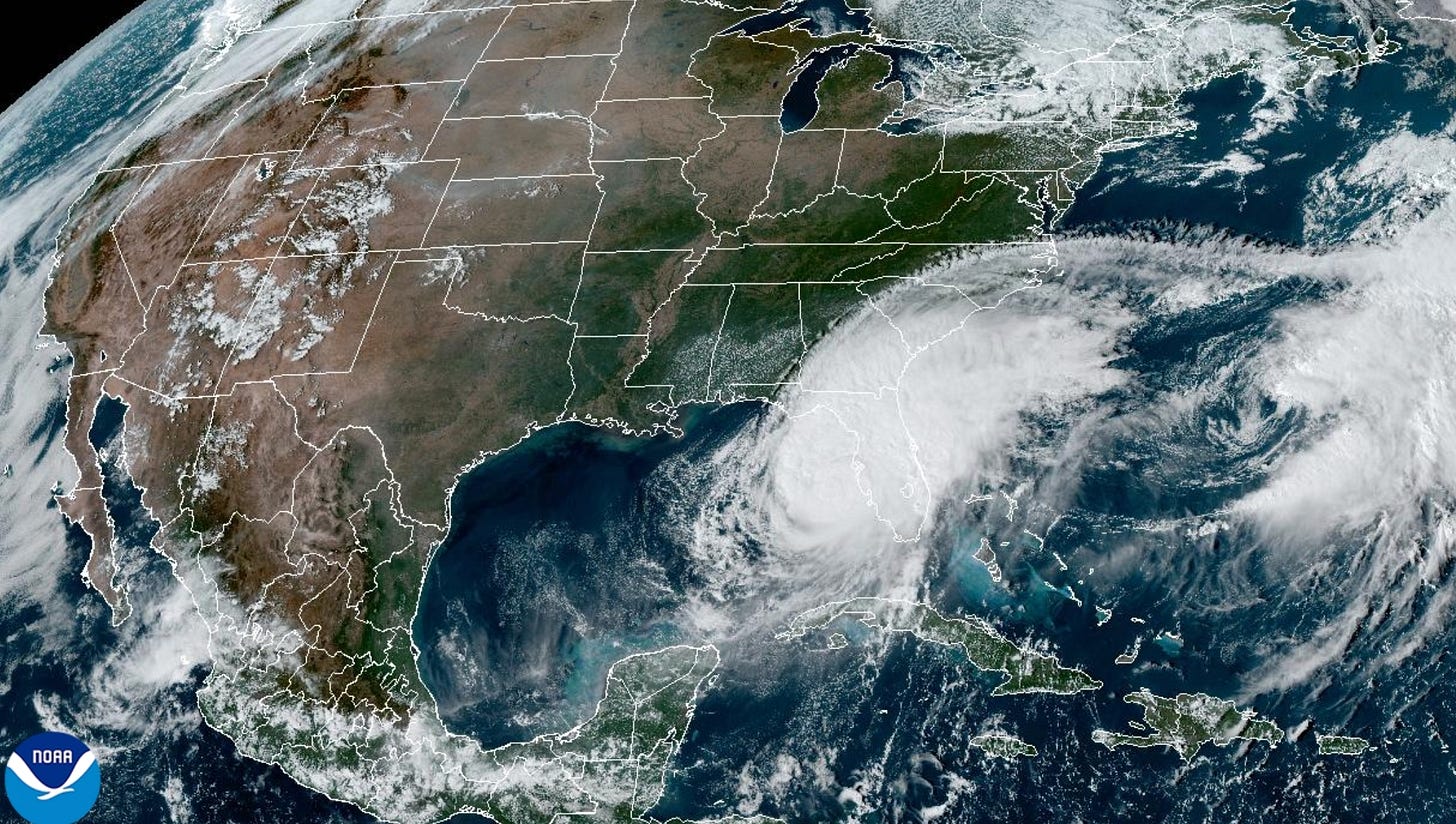

Insurance stocks rose and catastrophe bond investors breathed a sigh of relief Thursday morning as Hurricane Milton spared Tampa the worst of its impact by shifting just to the south before hitting land last night. But if Hurricane Helene’s destruction is any measure, the true economic impact of what was billed as the “storm of the century” is too soon to be tallied.

It’s normal for investors to jump on the first headlines after an event such as Milton and try to get ahead of the pack. Insurance shares had tumbled earlier this week and Cat bond losses were forecast as high as 15%, so any sign that the storm wasn’t as bad as expected would be regarded as bullish.

Similar headlines came out after Helene passed, but it wasn’t until the next day and the days afterward that the horrible scenes in Asheville, N.C. and the tales of life and death materialized. Milton’s storm surge in Tampa was below expectations, but nobody really expected the 20 or so tornadoes it spawned across the state, where some of the real destruction occurred.

Death tolls and damage tolls are certain to rise, as they did with Helene. In that case, damage estimates pretty much tripled in the week after the storm passed. When we’re dealing with unprecedented conditions in these storms, such as herds of tornadoes and record rainfall, it’s difficult to apply traditional economic forecasts.

At the moment, and from afar, Florida appears to have dodged a bullet. We’re certain it doesn’t look that way up close.

Don’t forget to contact me directly if you have suggestions or ideas dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

Zeus: Clean energy growth will change our electric systems forever

. . . . Clean energy production is soaring at such a rate that electricity produced by renewables such as solar, wind and battery will exceed what is produced by coal next year, the International Energy Agency said in its annual renewables report this week. David Callaway writes that the growth, which is expected to triple worldwide by 2030, is a rare piece of good climate news these days but underscores the challenges ahead in finding ways to distribute all that energy.

While energy production soars and demand leaps for electricity to fuel more and more data centers for AI, aging electric grids aren’t keeping up with the pace, Callaway says. That points to a coming new era in private and localized energy distribution, led by big tech companies and probably leaving government behind. Investors should pay heed to the challenges, and opportunities.

Thursday’s subscriber insights

Sales of electric vehicles bounce back from year-long slump

. . . . A funny thing happened on the way to the funeral for electric vehicles in the third quarter — sales jumped. A combination of lower borrowing rates and excessive supply pushed prices down to levels that caused consumers to react.

As a result, Ford F 0.00%↑, General Motors GM 0.00%↑ and Tesla TSLA 0.00%↑ all reported gains in the quarter, with Tesla enjoying a record quarter in China as the Chinese government kicked in a round of economic stimulus.

General Motors, with 32,195 EV sales in the quarter, surpassed Ford’s 23,509 sales to take the lead in the race among the big two. Tesla, with 462,890 sales in the quarter, is still running more than 10 times in front, though its sales only matched or came in slightly below analyst estimates.

While the politicians like to portray electric vehicles and hybrids as weapons in some rhetorical climate war, consumers are watching prices and borrowing costs. The EV slump was largely a result of higher interest rates, but a series of price cuts and now lower rates has revived interest in the high-torque vehicles.

One quarter does not a rebound make. But going into the fourth quarter, traditionally one of the best of the year for automakers, auto executives could be forgiven for thinking they’ve seen the worst of it. Maybe those plans to cut back were a bit premature after all.

Editor’s picks: The science behind Milton; plus, states most vulnerable to climate disasters

Watch the video: As Hurricane Milton barreled toward Florida, residents — some still reeling from the impacts of Hurricane Helene — were preparing for a direct hit. Science educator Bill Nye joins José Díaz-Balart on MSNBC to explain how climate change is behind the storm’s explosive intensification.

States most vulnerable to climate change

Mississippi, Louisiana and Alabama are the states most vulnerable to the impacts of climate change. The rankings are from Statista, which reviewed the U.S. Climate Vulnerability Index, an analysis and ranking by the Environmental Defense Fund and Texas A&M University. According to the report, the states to the south are at greatest overall risk from climate change, while those further north are in a comparatively better position, with Alaska, New Hampshire and Vermont among those with lowest vulnerability. Statista says Mississippi has the worst ranking nationwide on a number of metrics, including child and maternal health, transportation sources and food insecurity. Meanwhile, Florida, reeling from Hurricane Helene and under a direct assault from Hurricane Milton, falls under the penultimate “higher vulnerability” category. Among its top drivers of overall climate vulnerability are temperature-related deaths, how climate change could increase the costs of disaster preparation and recovery, as well as infectious diseases, particularly in regard to HIV, Hepatitis A and B. Read more and see the chart at Statista.

Latest findings: New research, studies and projects

Electrification: the intersection of economics and engineering

Electricity production is the sector with the largest share of global emissions and there are many options for decarbonizing it, according to this IMF working paper titled The Economics of Decarbonizing Electricity Production. In the abstract, the author says that identifying the lowest cost option for achieving decarbonization (and full reliability) is a complex optimization problem at the intersection of economics and engineering. “Key determinants are the cost of individual technologies, the geographical potential, the complementarities between energy sources and supporting infrastructure like electricity grids and energy storage.” … “An electricity system based on solar and wind power can use flexibility options as a complement instead of baseload energy. Models vary by the degree to which renewable energy is supported by carbon capture and storage, bioenergy, and nuclear energy.” Author: Gregor Schwerhoff, International Monetary Fund.

More of the latest research:

Words to live by . . . .

“Nature is so powerful, so strong. Capturing its essence is not easy — your work becomes a dance with light and the weather. It takes you to a place within yourself.” — Annie Leibovitz.