Investing in nuclear fusion is only slightly less difficult than nuclear fusion itself

Plus, EU kicks off era of carbon tax trade wars with controversial new plan

In today’s issue:

— There are no publicly traded fusion companies — yet. But there are ways to invest in the coming technology

— As exciting as fusion energy sounds, solar and wind companies aren’t sweating the competition in the near term

— Carbon price era moves closer as EU finally approves controversial border tariffs

— Portugal, Spain and France announce massive undersea hydrogen pipeline in Mediterranean

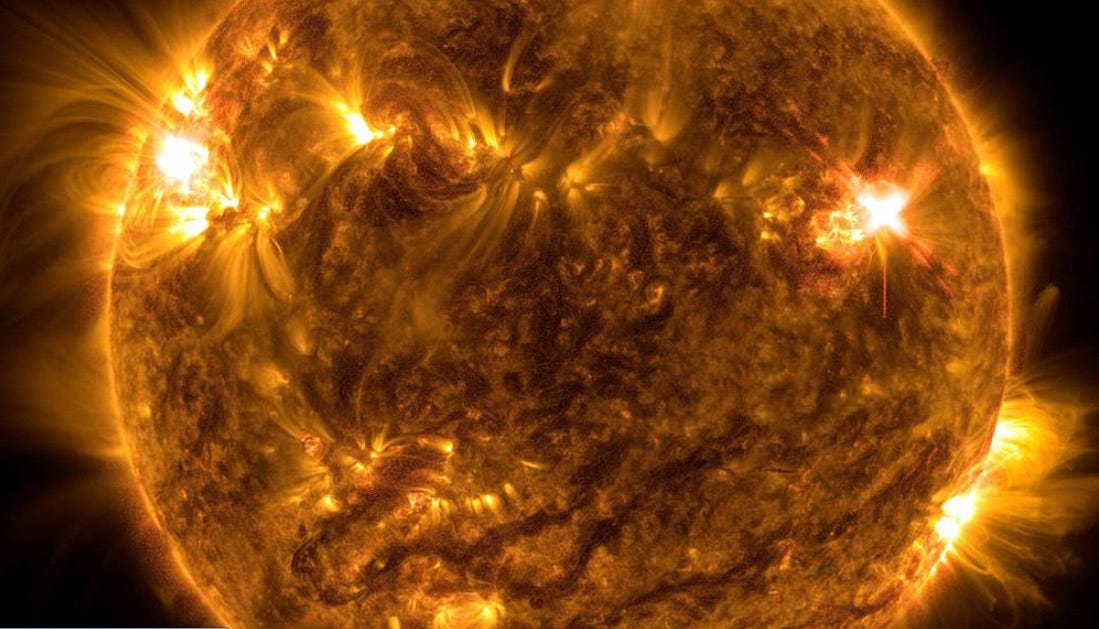

Nuclear fusion: The Sun releases an X1 solar flare, a powerful burst of energy, captured in this image by NASA’s Solar Dynamics Observatory in early October. Scientists at a national lab reported a major breakthrough today in fusion energy, which powers the Sun and other stars, opening a path to a potentially unlimited source of clean electricity.

The chorus of enthusiasm around today’s announcement of a successful test of nuclear fusion in a U.S. government lab is sure to send investors running to their online brokers to speculate on fusion plays. Turns out, investing in fusion is only slightly less difficult than creating energy from fusion itself.

There are about three dozen companies out there working on some form of nuclear fusion, which is the fusing of two atoms to create energy, which is what the sun does. Traditional nuclear energy, which is easy to invest in, is created by splitting atoms, or fission. Because new energy through fusion was, at least until today, unable to be created by technology, there is no startup mature enough to have a business plan around it. All we know is that it has unlimited potential. Wait, like crypto?

Some well-known companies in the nascent market are Helion Energy, Commonwealth Fusion Systems, and Marvel Fusion in Germany. Most have raised funds for their research from venture capital firms and even from big tech names such as Bill Gates or Jeff Bezos. So going through a private equity fund or venture fund, if you are an accredited investor, is one way to do it.

Other ways open to investors are the materials plays, such as makers of lithium or deuterium, which are used in the fusion process. Those include Albemarle Corp. ALB 0.00%↑ and Piedmont Lithium PLL 0.00%↑ . Or the usage plays, which banks on the theory that the big data center companies such as Google GOOGL 0.00%↑ and Amazon AMZN 0.00%↑ will be the primary customers for renewable fusion energy once it is commercially available, saving billions in energy costs.

Like carbon storage and removal companies, which were some of the hottest investments on Wall Street last year, nuclear fusion is still an unproven technology without a business model. And if anything ever fell into the controversial scientific sphere of geoengineering, it’s fusion. But for investors who are convinced new technologies will help us fight global warming, these are exciting times.

Get ahead of the holiday shopping rush and support our great climate finance journalism by subscribing with our holiday deal. For a limited time, get 15% off any subscription.

More insights below . . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

. . . . From our sponsor: Ken LaRoe, CEO and founder of values-focused bank Climate First Bank, gives his opinion and insight into COP27, greenwashing, and the value of voting with your wallet. Read more here. . . .

Keep reading with a 7-day free trial

Subscribe to Callaway Climate Insights to keep reading this post and get 7 days of free access to the full post archives.