Ken LaRoe: An open letter to anti-ESG politicians about sustainable investing

Commentary: Trying to protect failing industries such as coal is a losing game.

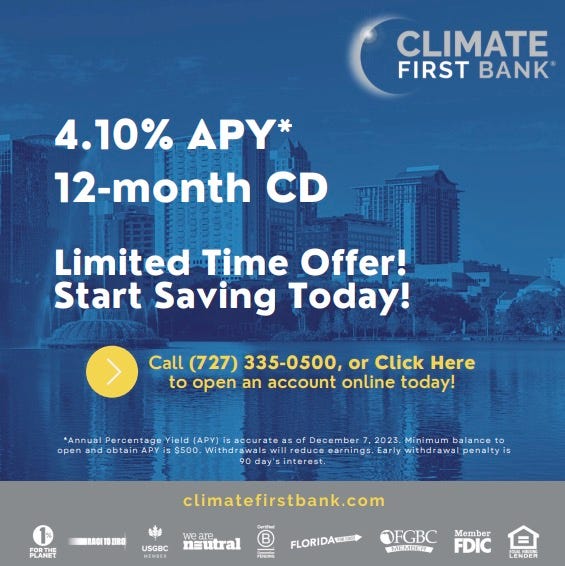

SPONSORED STORY

By Ken LaRoe

(Ken LaRoe is CEO & Founder of Climate First Bank, America’s first FDIC-insured bank founded to combat the climate crisis. Ken is a serial values-based entrepreneur and a leader in ethical banking. In 2021, Ken started Climate First Bank, who’s mission it is to meaningfully contribute to the drawdown of atmospheric CO₂.)

ST. PETERSBURG, Fla. (Callaway Climate Insights) — Across the United States, Republican-leaning states, including Texas, Florida, West Virginia, and most recently, Kentucky, are taking aim at businesses investing in Environmental, Social, and Governance (ESG). This partisan crusade is taking different forms and arguments. Some argue that ESG investing sacrifices returns, while others claim that firms that do not invest in the fossil fuel industry threaten the economy. As a result of these claims, some states have begun proposing and adopting new legislation to limit or prohibit state governments from ESG investment.

Earlier this month, our bank, Climate First Bank, was cited as one of 11 banks that Kentucky State Treasurer Allison Ball threatened to divest from, due to our stance on the fossil fuels industry. Initially, when we heard that Climate First Bank had been targeted, we needed clarification as we currently do not do any business in Kentucky, and we were disappointed to have been included in such a nonsensical partisan dispute.

Today, as we reflect, we are saddened that Kentucky’s State Treasurer is pushing a flawed narrative, claiming that divesting from institutions like Climate First Bank could help the fossil fuel industry in Kentucky. As voters and climate advocates, we must take notice and respond to false claims by participating in elections, voting with our wallets, and standing up against this false propaganda.

I felt compelled to respond to Ball personally, and I urge readers to write to their own local officials to express their concern. Below I have included an excerpt from Climate First Bank’s letter to Kentucky’s State Treasurer:

“It is disappointing to hear Republicans, like yourself, choose to weaponize Environmental, Social, and Governance (ESG) and politicize Corporate Social Responsibility (CSR). Governments and corporations nationwide (and worldwide) have reaped the benefits of incorporating ESG, contrary to comments like ‘ESG-focused investing sacrifices returns.’ For instance, BlackRock has had the five highest-ranked returns for the state of Florida amongst its 12 external managers, yet they have been blocked both by you and the Comptroller in the State of Florida for boycotting the fossil fuel industry.

Climate First Bank has recognized from day one that a forward-looking approach and rapid action are necessary to halt the climate crisis whilst generating sustainable, profitable financial outcomes in the long-term. This premise has not only led us to become the fastest-growing new bank in the country since 2017 but also enabled the bank to have a higher profile compared to similar banks our size (for instance, because of your dictum last week, Climate First Bank garnered attention worth an estimated $2 million in ad value).

Your short-sighted and partisan decree is harmful to your constituents and provides false hope that your state’s downtrodden fossil fuel industry will rebound. According to the Kentucky Energy and Environment Cabinet, since 2012, coal production in Kentucky has decreased by over 92%, and it’s not coming back. It is time that your state focuses on the future: clean energy and a green economy. Ultimately, ESG is not a partisan issue; If it’s not incorporated into your economic decisions, your state will get left behind.

Climate First Bank currently does not do business in Kentucky, but we will, and many of the like-minded financial institutions you have placed on your ‘blacklist’ already do.

To be clear, this blacklisting will not harm the financial institutions you have listed nor undermine the interweaving of ESG factors into investment decision-making. However, this blacklisting will have real consequences for your state and taxpayers.”

I urge readers to write their own letters to their local officials. Climate First Bank has produced a downloadable letter for you to fill out and mail. Please stay vigilant in how your states address ESG investing and use your vote, wallet, and platform to condemn partisan falsehoods by your state officials.

For more information, visit Climate First Bank.

More from Ken LaRoe:

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views or positions of David Callaway or Callaway Climate Insights.