Most banks miss climate market risk; plus the dangerous dilution of ESG

Welcome to Callaway Climate Insights. Don't miss the latest from Europe and California, and please share.

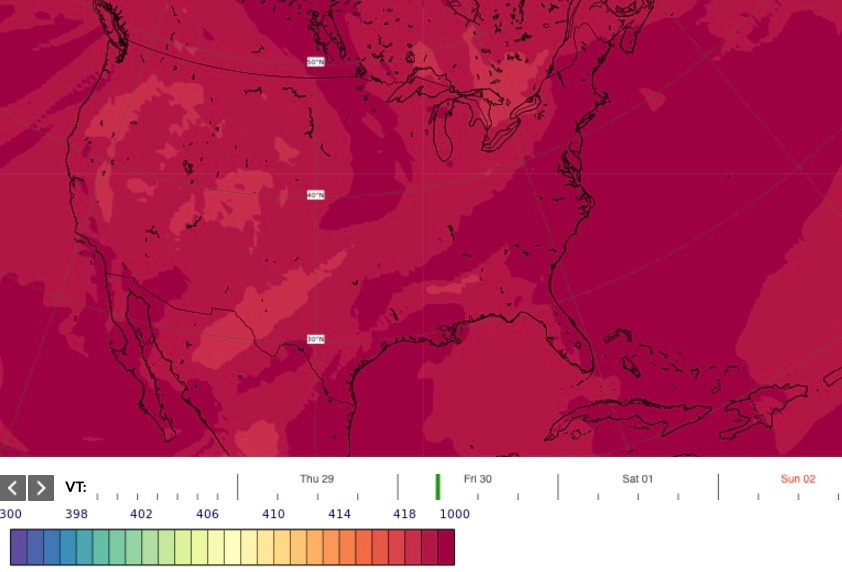

Today in CO₂: Total column of CO₂ (parts per million volume) forecast for Friday morning. Provided by the Copernicus Atmosphere Monitoring Service.

When it comes to climate change risk, the majority of banks and asset managers are still flying blind, despite the rash of global warming pledges in the past year, according to a shocking new report.

Almost three out of four financial institutions don’t report the market risk to their portfolios of climate change and two-thirds of them don’t identify the credit risk, according to a new report by CDP (Carbon Disclosure Project).

While 41% of banks do report the operational risks of climate damage to their buildings and other hard assets, the risks coming from their portfolios is on average 700 times greater, the CDP report out of London said.

Only half of the 322 banks surveyed even conduct an analysis of how their portfolios affect the climate and only half of those report their financed emissions. Financial giants such as BlackRock (BLK), Citi (C), JPMorgan Chase (JPM) and Fidelity Investments all say they intend to play major roles in transitioning their portfolios away from fossil fuel and other harmful investments.

But this report indicates the massive challenge still ahead for the financial industry as climate risks become more and more aggressive.

I wonder if Lehman Brothers and Bear Stearns were ever warned about the risks of the collateralized debt obligations markets in this way?

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

ZEUS: Surrounded by rising waters in drought-stricken California

. . . . The drive to Stinson Beach from San Francisco takes you across the Golden Gate Bridge, through a fire-prone valley and over a dry mountain, and finally down to a picturesque, sandy crescent with a couple of stores and seaside homes just yards from the beach, writes David Callaway. The simple drive provides the best Northern California has to offer, but also the worst. An ever-shifting spectrum of threats from climate change, ranging from wildfires, droughts, and car exhaust pollution to the rising sea levels, have led authorities to tell some coastal residents they will soon have to abandon their homes to nature. . . .

Hulbert: Does ESG even mean anything anymore?

. . . . The growing popularity of ESG investing has led to a surge in classifications of dubious securities wrapped in the environmental, social and governance flag, writes Mark Hulbert. From cybersecurity stocks to founder-led companies to partisan political mutual funds, Hulbert argues the branding of everything as ESG will ultimately dilute the category to the point where eager environmental investors won’t be able to recognize it. . . .

EU notebook: Gas and nuclear left out of new climate taxonomy, for now

. . . . The European Union’s new “climate taxonomy” for labeling companies in 13 industries with a green seal of approval was introduced with great fanfare last week, but with two groups conspicuous in their absence from the list, writes Vish Gain from Dublin. Both the nuclear industry and the gas industry were missing, and the EU said it would consider each as possible “transition fuels.” The taxonomy is designed to provide clear directions for investors looking to invest in sustainable companies. A movement which has been on fire in the past year as assets in environmental, social and governance funds (ESG) in Europe have almost tripled. . . .

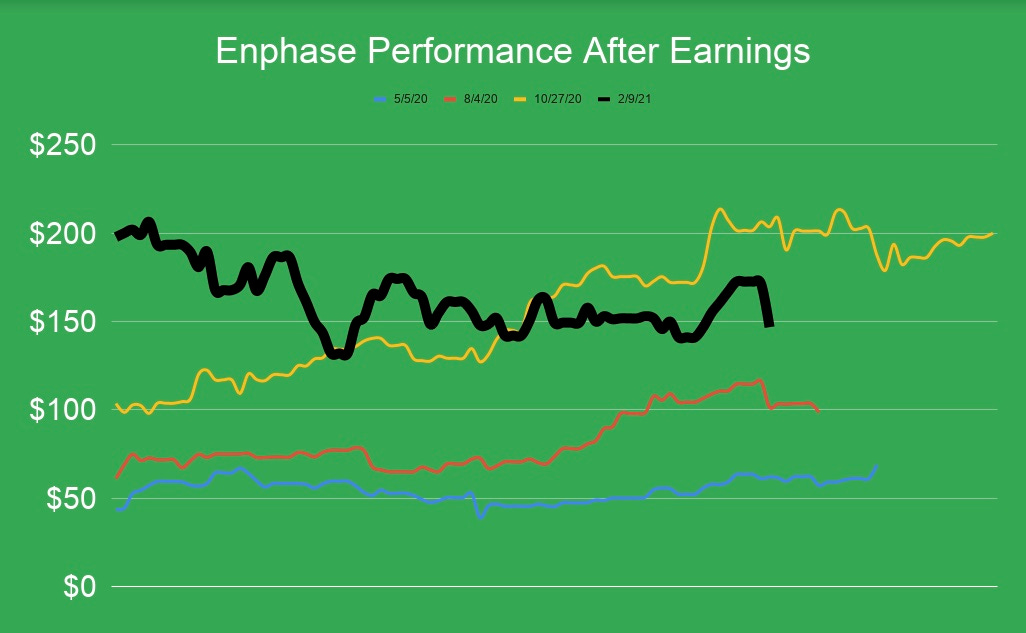

Markets report: Supply constraints hit Enphase shares

. . . . Solar power components maker Enphase (ENPH) shares took it on the chin Wednesday after the company posted strong results but said supply constraints will affect production through the end of the year. The stock saw its sharpest percentage loss since June of 2020, when it lost 26% on a short seller report. Enphase has enjoyed a stellar run over the past 16 months, boosted by surging interest in solar energy companies and the Biden administration’s emphasis on curbing greenhouse gas emissions. Even with Wednesday’s selloff, the stock is up more than 4 times higher than it was at the beginning of 2020. However, Wednesday’s slide is the first sharply lower move following an earnings report over the past year. The chart above compares price movements of Enphase following each of its past four earnings reports — May 5, 2020, Aug. 4, 2020, Oct. 27, 2020 and Feb. 9, 2021. . . .

Thursday’s insight: Daimler, Volvo commit to hydrogen fuel in Europe

. . . . Volvo Group and Daimler Trucks announced a commitment Thursday to accelerate adoption of hydrogen fuel cells for long-haul trucking in Europe. Hydrogen is seen as an alternative to diesel fuel and is lighter than batteries, but without enough attention to infrastructure, the road to economic viability for hydrogen trucking will be rocky. Read more here. . . .

Editor's picks: 100+ Accelerator taking applications

AB Inbev’s 100+ sustainability accelerator open to new applications

Duke Energy aims to triple renewable capacity

Is lithium California’s new ‘white gold’ rush?

Data driven: 132 million tons of coal

. . . . Coal stockpiles have never been larger in India, with coal stocks reaching 132 million tons at the end of March — well above the previous 5-year average stockpile of roughly 80 million tons, according to an analysis of Indian Coal Ministry data conducted by the Institute for Energy Economics and Financial Analysis (IEEFA). The oversupply, as IEEFA characterizes it, puts downward pressure on the growth of new coal production and calls into question India’s plans to expand its coal mining fleet. — George Barker

Latest findings: New research, studies and projects

Yellowstone: Climate change will be life-changing

Things are going to get hotter, drier and more risky for humans and animals alike in the Greater Yellowstone region, which reaches across 18 million acres in Wyoming, Montana and Idaho. The Greater Yellowstone Climate Assessment: Past, Present, and Future Climate Change in Greater Yellowstone Watersheds is open for public comment until April 30. The final report is scheduled for release in late June. WyoFile.com reports this is “the first major climate assessment to focus on the Greater Yellowstone Region, which the National Park Service describes as one of the largest nearly intact temperate-zone ecosystems on Earth. The region is the ancestral home to more than a dozen Native American tribes, a diversity of wildlife, hydrothermal features and, of course, the nation’s first national park.” The report also details findings in the assessment, including average temperature increases, shrinking snowpack estimate, greater wildfire risk, invasive species outbreaks, habitat loss and migratory pattern changes.

More of the latest research:

Words to live by . . . .

“Carbon is the currency of how you measure climate change, but water will be the teeth.” — Former World Bank President Jim Yong Kim.