Musk's Bitcoin broadside, plus the trouble with high-carbon ESG funds

Welcome to Callaway Climate Insights, and especially to our new subscribers this week. Please enjoy, and share with your colleagues.

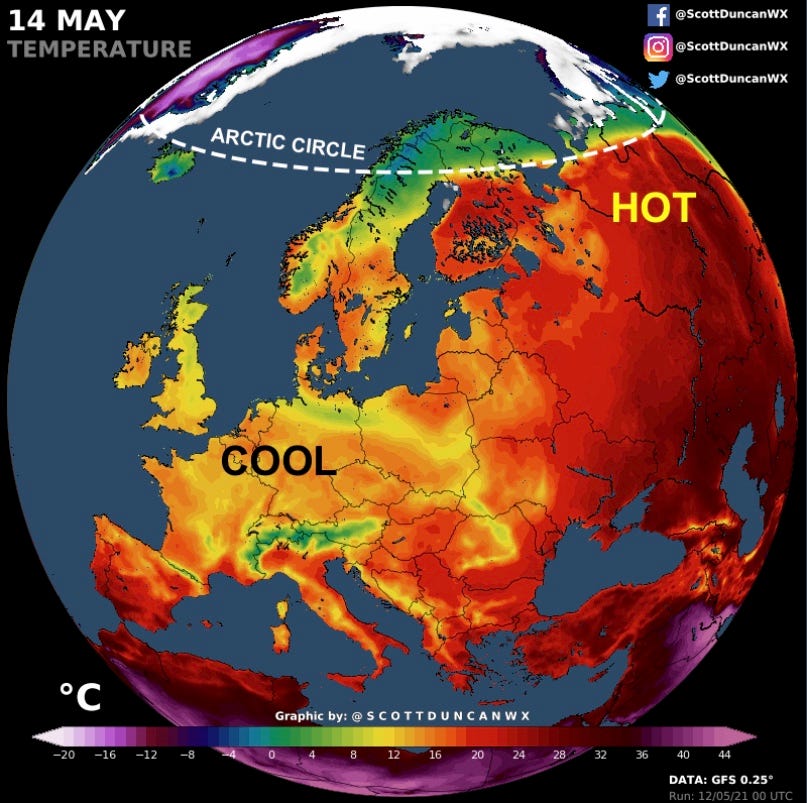

Scottish meteorologist Scott Duncan: We just [Wednesday] observed a staggering 28.1°C. (82.6°F.) south of the Arctic circle in Oulu, Finland. This is the earliest 28°C. on record for Finland, and Finland and Northwest Russia are among the hottest places in Europe right now. Above, the forecast for more heat in Europe tomorrow.

Nobody knows for sure why Elon Musk ended his two-month flirtation with Bitcoin this week, but we do know that Tesla made about $100 million in profit in the first quarter from the cryptocurrency — about a quarter of its total profit.

His claim that he suddenly got religion about the environment seems about as sketchy as his recent Saturday Night Live appearance, and is more likely just another of his periodic market-timing attempts. The episode is a stark example of Bitcoin’s instability, which should worry all investors, as it has continued to creep into the financial mainstream.

As an environmental play, however, it couldn’t come at a more important time. After four years of muzzling by the Trump Administration, the Environmental Protection Agency stood up and screamed on Thursday that extreme climate change is hitting the U.S. hard this spring. It issued a massive report with indicator after indicator to show how heat waves, rising seas and melting ice are hurting just about every community.

As a market event, climate change still can’t compete with the inflation storyline, or even the Bitcoin storyline. Tesla (TSLA) and the other electric vehicle stocks, along with the renewable plays, continue to get pounded this week after a big year in 2020. But like Bitcoin, they will bounce back, and it won’t be because of Elon Musk.

Climate risk is yet to be priced into most markets, even though it is literally staring us in the face.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

How ESG fund holdings could be WORSE for the environment

. . . . A new study has found environmental, social and governance funds have holdings that are actually worse for the environment than holdings of non-ESG funds, writes Mark Hulbert. Covering a period of eight years, the study found companies in ESG funds have a higher carbon intensity than their peers, and what’s worse, they did not improve over time.

But what possibly could cause ESG managers to go out of their way to invest in companies that are downright worse in their ESG performance? Could the managers actually be that nefarious?. . . .

ZEUS: Climate emergency in the old betting shop

. . . . When I moved to London 25 years ago, one of the most striking differences I noticed in the urban neighborhoods was the presence of the old betting shops.

Either William Hill or Ladbrokes brands, the shops had no windows to the outside, and once you walked in you were enveloped in the smoky, solitary study of the day’s racing form. Though you could bet on anything, including U.S. politics, the old betting shops were a testament to the bygone era — before mobile Internet — of cheap cigars, horses, betting slips, and delayed feeds from the track.

So I was struck by news last week that some of the old William Hill shops might be remodeled, along with other boarded-up stores in downtowns in the UK, as climate emergency centers. The idea that such monuments to pollution and poor health (as well as fun) could be reborn to help the environment seems a very English act of practicality.

The pandemic and the climate emergency have redrawn the lines of how society moves about, from wearing masks to social distancing, to stadium vaccine centers, and the proliferation of electric vehicle charging stations, the look of where and how we live is changing rapidly. . . .

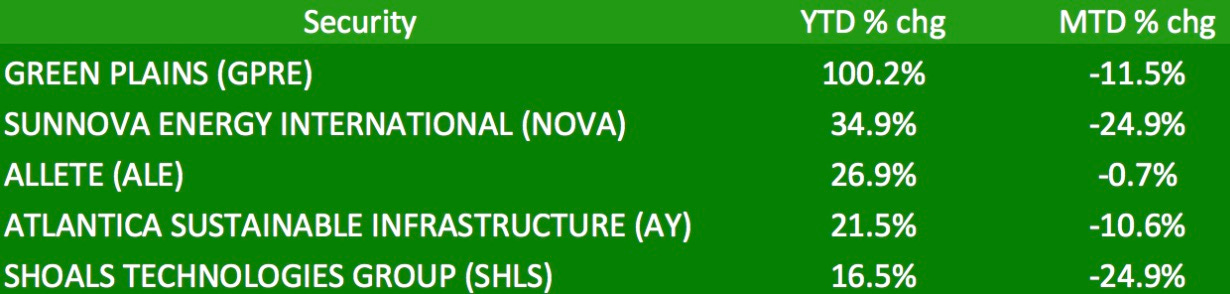

What correction? Five sustainable stocks still holding their own

. . . . With the post-Biden election bloom definitively off the alternative energy rose, the IShares Global Clean Energy ETF finds itself down more than 25% so far this year.

But it’s an ill wind that doesn’t blow any good, and among the nearly 100 securities held in the fund are some notable winners for 2021. Here’s a look at the top five. . . .

EU notebook: U.S. wary of carbon border tax, while UK's Boris Johnson ‘levels up’ on environment - and puppy smuggling

. . . . The U.S. is increasingly wary of the European Union’s plan to impose a carbon border tax this summer to protect its industries, writes Vish Gain from Dublin. While details of the carbon levy remain sketchy, many see complications in metrics driving an unfair trade situation.

Also, Boris Johnson’s new legislative plan in Britain, under the broad theme of “leveling up” in terms of the environmental protection and animal welfare, is failing to inspire activists ahead of COP26 in Glasgow at the end of the year.

And a look at the woman leading the surprising surge in the polls of Germany’s Green Party ahead of September’s election. . . .

Thursday’s subscribers insights: Utilities seek cut of the solar pie

. . . . A legal battle is brewing between utilities and municipalities over electric companies’ attempts to charge fees to customers who installed solar panels on their homes. Renewable energy, they argue, is hitting their bottom line. Read more here. . . .

. . . . A scarcity of minerals for renewable energy projects is causing a gold rush in Canada for banks seeking to fund new mining efforts as part of a grand U.S.-Canadian supply chain. Read more here. . . .

Editor’s picks: Salmon hitch a ride to the Pacific, Colonial Pipeline reopens

Editor’s picks:

Drought means salmon hatchlings get a truck ride to the ocean

After ransomware attack, Colonial Pipeline restarts but gas woes linger

St. Croix refinery ‘rains’ oil again, EPA investigates

Read all of Thursday’s news roundup.

Latest findings: New research, studies and projects

How climate change is impacting the ocean and what we can do about it

The ocean is a massive carbon sink, protecting us from the worst of climate change. But rising air temperatures are melting glaciers, while warming seas are bleaching coral. Action like coral reef restoration is already underway — and research has found some corals to be more resistant to higher temperatures, Douglas Bloom writes for the World Economic Forum. And there are now calls to designate Marine Protected Areas for 30% of the ocean by 2030. The ocean is inextricably linked to our climate, and Bloom that scientists say the seas have absorbed 90% of all the warming that has taken place in the past 50 years. Read more from the WEF’s Virtual Oceans Dialogue.

More of the latest research:

How Effective is Carbon Pricing? — a Machine Learning Approach to Policy Evaluation

It takes two to dance: Institutional dynamics and climate-related financial policies

Words to live by . . . .

“Without action to decarbonize our economies, unchecked climate change threatens to batter lives and economies around the world, hitting the poorest people hardest.” — Arancha González Laya, Minister of Foreign Affairs, European Union and Cooperation of Spain.