New attack on solar immediately undermines tax bill

Plus, Elon Musk's return to Tesla lasted just 38 days

In today’s edition:

— Only days after passing a tax bill that limits solar incentives, White House attacks again

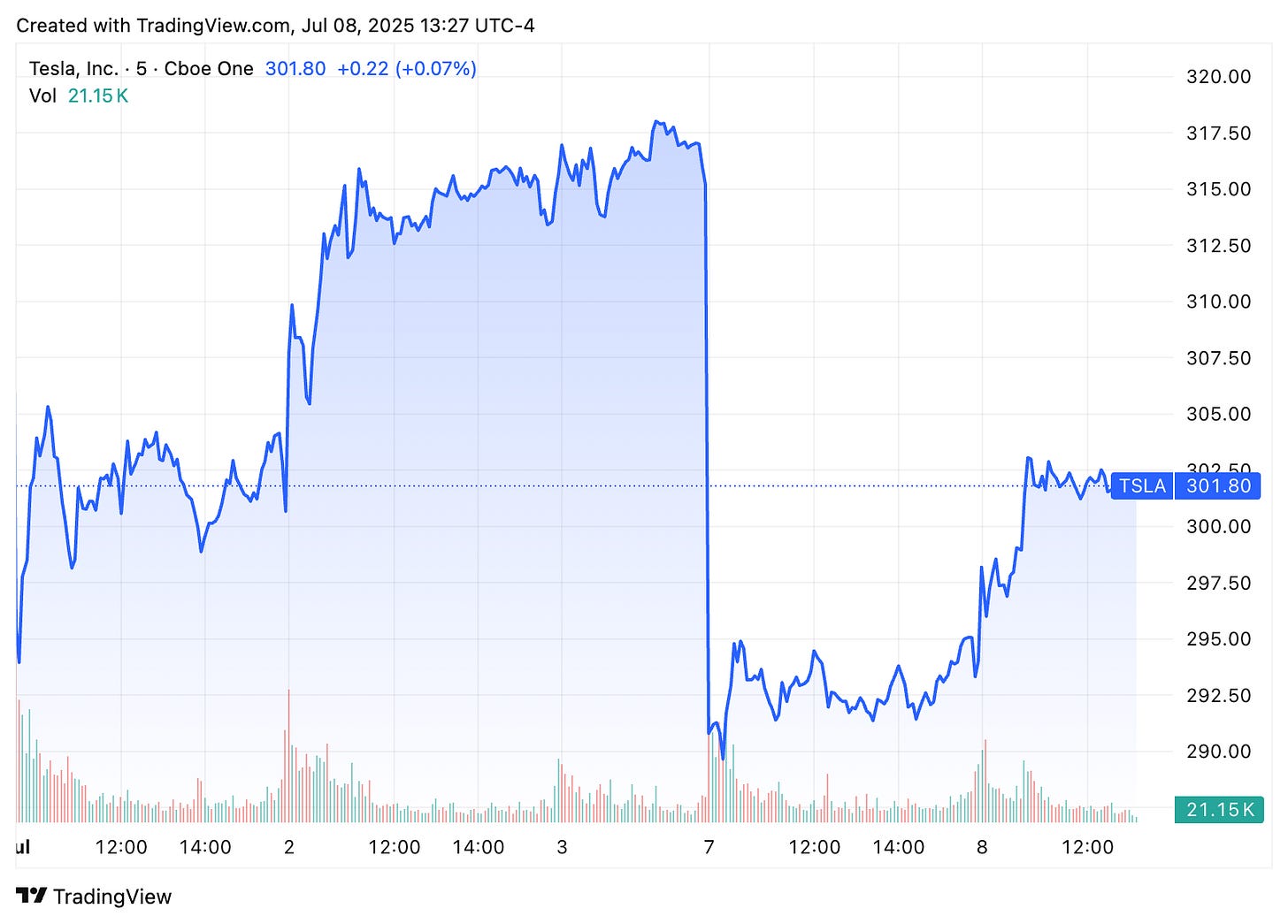

— Tesla stock gives up all its gains from Musk’s return as he plots new party

— Drones used to clean up trash on Mount Everest

— Fig trees found to be natural carbon sinks

— U.S. national climate assessments have disappeared from government websites

Investors in battered solar and other renewable energy companies who thought they might get a short summer break after the savaging of their stocks during the run-up to the new tax bill last week were disappointed again after the White House immediately said it would take a hard line on even the scant extensions to subsidies the bill allows.

Shares of Enphase Energy ENPH 0.00%↑, Sunrun RUN 0.00%↑, First Solar FSLR 0.00%↑ and NextEra Energy NEE 0.00%↑ led other renewable stocks lower for a third week after President Donald Trump signed an executive order requiring the Treasury department to take a hard line on any companies seeking to comply with the requirements of last week’s tax bill to gain limited subsidies.

The executive order effectively eliminates a concession in the Senate version of the bill that allows renewable projects that begin before 2027 to continue receiving some form of subsidies. It returns the spirit of the House version of the bill, which was much harsher, to the forefront — despite the bill becoming law.

For renewable energy stocks, it’s just another example of how headline risk is still the principal driver of equities, even as market indexes rise to record levels and investors begin to ignore broad pronouncements on tariffs. Listening to the CNBC feed of a Trump cabinet meeting today, in which the president said people who had wind turbines attached to their homes had to suffer from the noise of the turbines, it was clear that the mood of the cabinet was still in attack mode on anything green.

The stocks will recover. Our collective insatiable thirst for more power for AI in the next year or two will require all sources of available energy. But for now, what’s even more concerning is that only three days after the “big, beautiful bill” was signed to much fanfare, the government is already ignoring it.

Don’t forget to contact me directly if you have suggestions or ideas dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

Tuesday’ subscriber insights

And he’s gone. Musk abandons Tesla shareholders again to form new party

Keep reading with a 7-day free trial

Subscribe to Callaway Climate Insights to keep reading this post and get 7 days of free access to the full post archives.