Searching for climate's Enron; plus China's Glasgow surprise

Welcome to Callaway Climate Insights. Serving ESG investors since 2020. Please enjoy, and share with your colleagues.

As the Securities and Exchange Commission prepares for its introduction of new climate and human capital disclosure laws this summer, it’s useful to consider the impact of its existing rules on preventing corporate fraud and warning investors.

In a new column, sent first to Callaway Climate Insights subscribers, Bill Sternberg points to a history of how companies have missed key disclosures that later tanked their stocks, even though they filed reports. From Wedtech, Enron and Theranos, to Carnival Corp. (CCL) last year just before Covid, history shows that it’s a rare report that sets off alarm bells in time for investors to react.

With climate metrics still somewhat vague and companies just now starting to think about how and what to report, it will be fascinating to see how regulators try to fasten disclosure rules to all sorts of public companies in a way that will generate meaningful disclosures. Somewhere out there, maybe in electric vehicles or solar energy or transitioning oil and gas companies, lurks the next Enron.

Pile in at your own risk.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Tuesday’s insights: China’s Glasgow surprise, plus Supreme Court punts on Baltimore case against Big Oil

. . . . Speaking of the SEC, electric vehicle startup Canoo’s CEO said the agency contacted the company (GOEV) recently on a fact-finding inquiry, perhaps tied to other investigations it has on Lordstown Motors (RIDE) or Nikola Corp (NKLA). Canoo’s shares took a hit late Monday on the news but bounced back by midday on Tuesday. . . .

. . . . Asked what China might do to surprise the world ahead of COP26 in Glasgow in November, former Australian Prime Minister Kevin Rudd told a Citi sustainability conference Tuesday that it’s possible Xi Jinping could move the company’s goals for peak fossil fuel usage from 2030 to 2025. Such a move coming right before the global climate summit would help improve China’s credibility on reaching its carbon neutral targets by 2060, Rudd said, as most analysts don’t think it possible without moving up the peak usage date. China has already said it intends to reach peak coal by 2025, but oil and gas are another matter. . . .

. . . . Separately, Rudd said he doesn’t expect China to attack Taiwan in the next five years, as it is not quite prepared to deal with the military logistics or the fallout with the U.S. and other nations. He said he expects “a lot of sound and noise” to continue, but that under current preparation scenarios, it would be at least the second half of this decade, if at all. . . .

. . . . The U.S. Supreme Court punted this week on Baltimore’s case against Big Oil, kicking it back to lower courts on a technicality, in what was the most-closely watched of some 20 cases nationwide seeking damages from fossil fuel companies over climate change. While Big Oil “dodged a bullet,” the plaintiffs live to fight another day. Read more here. . . .

. . . . From the annual Fortune 500 CEO survey, out this morning, only a third of CEOs have published a climate plan to hit net zero, while some 44% are still thinking about it. The SEC’s disclosure rules can’t come soon enough. . . .

. . . . The International Energy Agency said in a major report Tuesday that to meet the world’s climate goals by 2050, all new fossil fuel projects need to stop this year. The report was well leaked ahead of time, but apparently not to Africa, where several major fossil fuel projects, including coal, move ahead, as countries such as South Africa fight just to keep the power on. Economic hardship remains the principal challenge to the world’s transition to renewable energy. Read more here. . . .

Data driven: Pedal vs. metal

. . . . As recently as 1965, bicycle and car production volumes were essentially the same, at nearly 20 million each per year, but as of 2003 bike production had climbed to over 100 million per year compared with around 50 million cars produced that year, according to Worldometer. So far this year, approximately 29.9 million cars have been produced, and about 56.5 million bicycles. . . .

Editor’s picks: IEA report; plus, Washington wants to clear the way for salmon

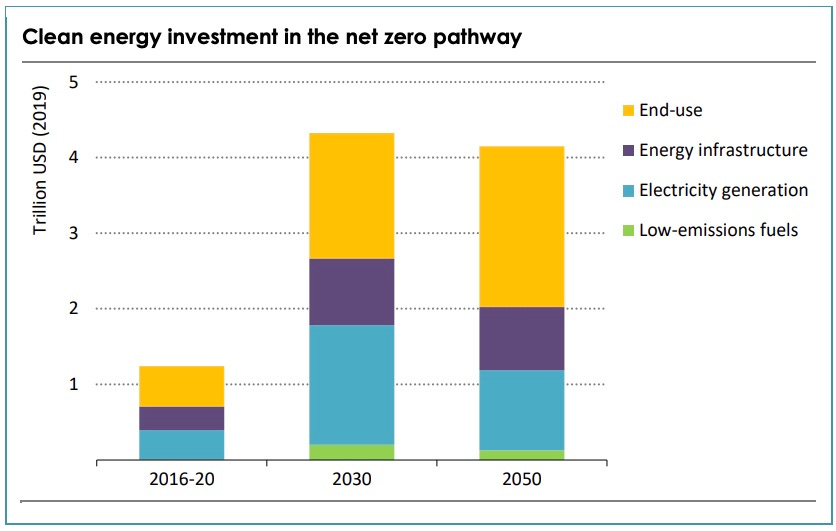

From the International Energy Agency: Total annual energy investment surges to $5 trillion by 2030, adding an extra 0.4 percentage point a year to annual global GDP growth, based on our joint analysis with the International Monetary Fund. This unparalleled increase — with investment in clean energy and energy infrastructure more than tripling already by 2030 — brings significant economic benefits as the world emerges from the Covid‐19 crisis.

Editor’s picks:

IEA report: No room for gas and diesel cars, fossil fuel boilers

Washington’s King County to spend $9 billion on clean water and habitat

EPA sets new Energy Star standards for the U.S.

This week in wildfires

. . . . As of May 18, the Fire Information for Resource Management System reported five new large incidents in the U.S. and Canada, one large fire contained, and seven large fires uncontained. The report shows 210 new fires categorized as “light.” Hot spots included the southwest region and Southern California, where there are two large uncontained fires. That includes the Palisades Fire in Los Angeles, with numerous structures threatened and evacuations, area, road and trail closures in effect. Los Angeles Mayor Eric Garcetti said an arson suspect in custody is believed to be responsible for starting the uncontrolled Palisades Fire. . . .