The energy play when the AI dust clears

Plus, Orsted's existential moment

In today’s edition:

— Fossil fuels v renewables when the AI shakeout begins

— Orsted investors and the battle for wind power in Trump’s America

— The bulky bears of Alaska’s Brooks Falls are back

— Managed EV charging could cut electric bills by billions

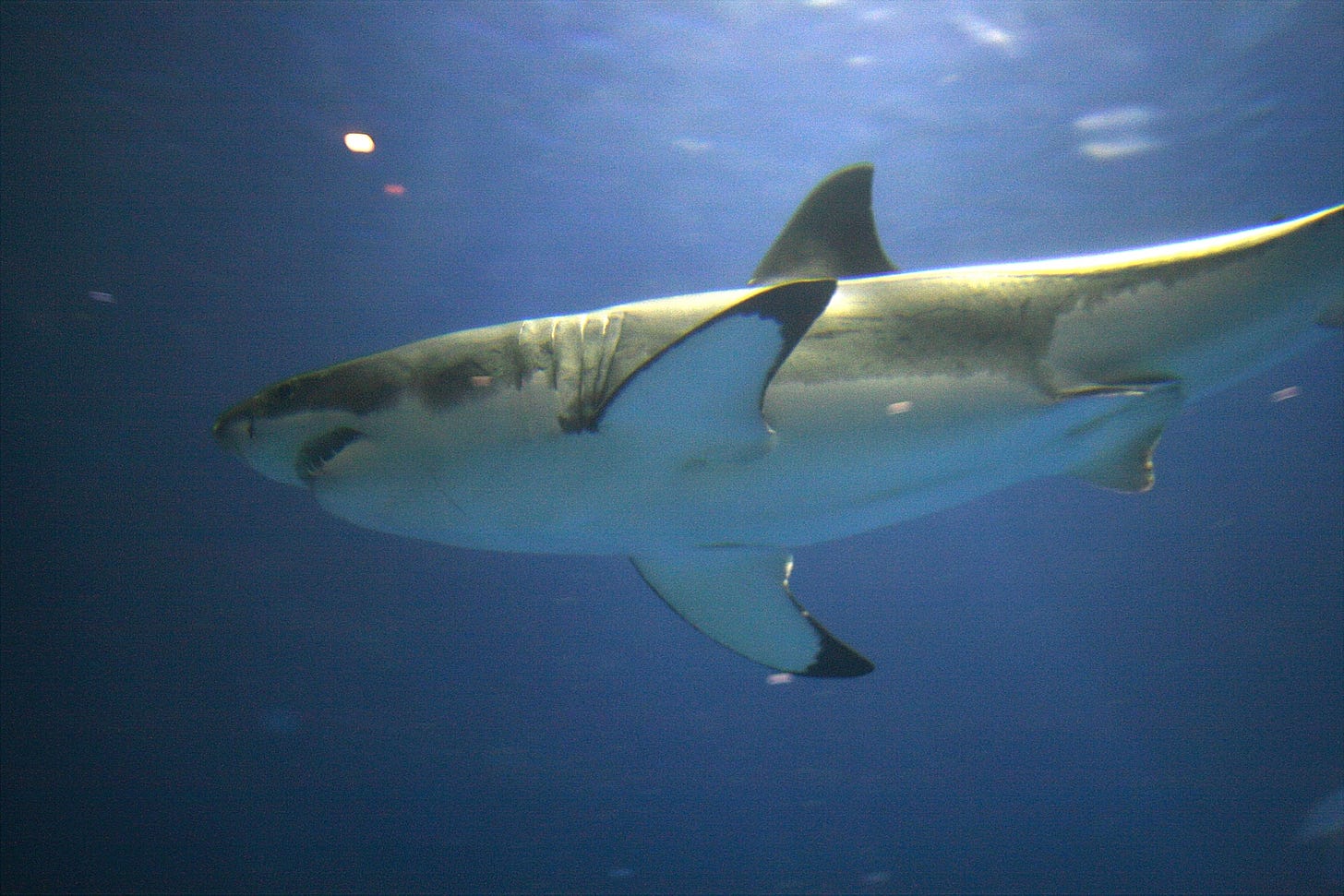

— More great white sharks are summering off Cape Cod.

Summer sale alert!

For the rest of this month, leading up to Labor Day in the U.S., Callaway Climate Insights will be available to new subscribers for less than $5 a month for the first year. Take advantage now to get the best of our daily global climate analysis. Please subscribe with our special Labor Day sale offer.

Last week’s tech stock climbdown on AI concerns, while brief, gave us enough pause to consider what will happen when the real AI shakeout finally happens. When it becomes clear that not every company is going to win the AI race, and that not every energy company roped in to power data centers is going to reap riches.

As we move into September and October, the most volatile times of the year in markets, and ahead of Nvidia’s NVDA 0.00%↑ earnings Wednesday, it is worth reflection, especially after three years of sweeping gains for any company with an AI story to tell.

The situation is different from the internet bubble 25 years ago, when hundreds of companies claiming to be changing the future were simply buying each other’s advertising and self-perpetuating the frenzy. AI and its profits are real, and the data centers sprouting around the world are indeed sucking up unprecedented amounts of energy, both fossil fuel and renewables.

But aside from a few large energy companies, such as GE Vernova GEV 0.00%↑ and Constellation Energy CEG 0.00%↑, most renewable energy companies, and certainly fossil fuel firms, haven’t felt the investor love. That’s despite the White House-led rush to fossil fuels and the sudden proclamations among tech leaders that oil and gas are needed now because data center needs are now and renewables might take too long.

Fossil fuels especially are at risk. Our friend and climate colleague, Peter McCillop at Climate and Capital Media, likened fossil fuels to the subprime mortgages of the Great Financial Crisis era almost 20 years ago, in an excellent column this past weekend. He argued that tech and financial companies are ignoring the market fundamentals that show renewable energy is cheaper than fossil fuels to blindly chase returns on fossil fuels because the prevailing political winds are telling them the AI race must be won now.

We might not go that far. But we do see an AI reset almost certainly coming, and with it a shakeout in the “all things energy” story that has accompanied it. At that point, it will become clear that despite the claims of the White House, the market will choose renewable energy not because it helps with climate change, but simply because it is cheaper. Winners and losers among the tech giants will fall along the lines of who stuck with renewables and who abandoned them in the past year.

That only leaves the questions of when the shakeout might come, and of course, how long it will last.

If you have ideas or suggestions for us, contact me directly at

dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

Tuesday’s subscriber insights

Orsted assures investors its wind plans can work with Trump

. . . . The White House’s sudden closing of the $1.5 billion Revolution Wind power project off the coast of Rhode Island late last week couldn’t have come at a worse time for Orsted (DK:ORSTED), one of one of Europe’s largest renewable energy companies.

The decision to close the almost-completed project, citing vague national security concerns, came only hours after Denmark’s prime minister reportedly signed a climate deal with California Gov. Gavin Newsom, a political move of spite that has become a hallmark of the second Trump administration.

It throws the future energy plans of New England states, which had been counting on the new renewable mix, into chaos and will certainly raise electricity bills. But for Orsted and its investors, it’s an existential moment. The company’s shares, down some 40% this year and most of the past three years on concerns about its U.S. wind power ambitions, plunged on Friday to a new low.

That’s because Orsted is readying a $9 billion-share sale, one of Europe’s largest in years, to raise money to complete a host of wind plans. Orsted is half-owned by the Danish government, so it has some sort of support. But the blow from the White House is a major knockdown in a year when it, and fellow Danish energy giant Vestas Wind Systems (DK:VWS) have suffered the impact of the new U.S. anti-climate policies, their shareholders paying for their hopes to rebuild their European wind empires in the U.S.

Orsted told its investors in a special meeting Tuesday morning that it will go ahead with the share sale and will publish a prospectus early next month, as its shares rebounded a little. But it’s going to take more than a shot of new funds to revive investor confidence in the business as long as it remains committed to building in a country with a government that clearly has Orsted in its sights.

Editor’s picks: Bears bulking up at the salmon buffet; plus, managing EV charging could pay off

Watch the video: Check out this year’s contenders for the title of the Fattest Bear at Brooks Falls in Katmai National Park & Preserve in Alaska. Each year, the National Park Service and Explore.org host Fat Bear Week, where the public can watch live bear cams and vote for the chunkiest bear. Fat Bear Week is expected to be in the first week of October this year. Check out the live bear cams now at Explore.org. Read about Fat Bear Week.

Managed EV charging could generate $30 bln in annual savings

The careful management of electric vehicle demand charging could cut all U.S. electric bills by 10% annually, regardless of whether a customer owns an EV, according to new research from Brattle and ev.energy. UtilityDive reports that by managing charging programs, flexible EV vehicle loads can become a grid resource capable of generating $30 billion in annual utility savings, The research shows that each actively managed vehicle can create up to $575 in avoided costs for utilities, leading to a 10% reduction in all customer electric bills by 2035 — whether they own an EV or not. Programs that include a vehicle-to-grid bidirectional charging component could more than double the benefits. “The biggest source of demand growth is going to be electric vehicles on the energy system in the 2030s, and that really means, from a utility perspective, that if they don’t control and manage that resource, they could end up building lots of expensive additional generation to meet the demand,” ev.energy CEO Nick Woolley told UtilityDive.

Data driven: More sharks summer off Cape Cod

Great white sharks are following the seals north

. . . . There have been more sightings of great white sharks off Cape Cod, Mass. in recent years. And now scientists say the sharks are moving even farther north, into New Hampshire and Maine. Greg Skomal, a senior fisheries biologist with the Massachusetts Department of Marine Fisheries and a veteran white shark researcher, tells Fortune that his research shows the number of white sharks detected off Halifax, Nova Scotia, increased about 2.5 times from 2018 to 2022. The paper, published by Skomal and others in the journal Marine Ecology Progress Series, shows that even farther north, the number detected in the Cabot Strait that separates Nova Scotia and Newfoundland increased nearly four times over. The reason for the shift? Skomal said that successful conservation efforts of seals has increased the food source for the sharks. The paper also says “broader environmental changes are likely the primary drivers of increased white shark presence in” Atlantic Canadian waters. “As global temperatures rise, the prevalence and duration of warmer water conditions in the Northwest Atlantic is expected to accelerate. This trend has already prompted various fish species, including white sharks in the eastern Pacific, to shift their distributions poleward.”

Yay! Fat Bear Week! I miss Otis. I wonder if he's still around.