The ESG mouse that roared

Last year was a tipping point for the ESG money management industry, as $21 billion flowed into ESG strategies.

By Robert Powell

(About the author: Robert Powell, CFP, is a longtime financial journalist whose work appears regularly in TheStreet.com, USA Today and AARP. He is the editor of TheStreet’s Retirement Daily. He can be reached at rpowell@allthingsretirement.com.)

BOSTON (Callaway Climate Insights) — In a sign that ESG investing has moved beyond the niche approach, Calvert Research and Management has won the 2020 overall fund family award from Refinitiv Lipper.

The firm, a wholly-owned subsidiary of Eaton Vance, has been at the forefront of ESG investing since 1976. And according to a recent InvestmentNews report, the awards “stand out as the latest evidence that investors aren’t giving up performance when supporting investments based on environmental, social and governance criteria.”

The award is especially noteworthy because it’s based on risk-adjusted performance, not just total return. In other words, it’s based on how well the fund family, which had $21.5 billion in assets under management at the end of 2019 spread across 28 actively-managed and passive mutual funds, did given the level of risk involved in producing that return.

“I'm really thrilled to have won the award,” said Anthony Eames, a vice president and director of responsible investment strategy at Calvert Research & Management, in a podcast with Callaway Climate Insights. “I think it's definitely a confirmation of ESG investing really now firmly being in the mainstream.”

The year 2019 was indeed a tipping point for Calvert and the ESG money management industry in general as an all-time high $21 billion flowed into ESG strategies — four times what they were in 2018.

According to Eames, Calvert benefited from investors looking for an investment manager who can deliver investment strategies that integrate traditional analysis with an evaluation of how companies are managing their nontraditional assets in ESG areas. (Eames noted that it’s helpful to start with the definition of responsible investing from the United Nations and the Principles for Responsible Investing or PRI)

As part of their process, the company — which offered in 1982 the first mutual fund (the Calvert Social Investment Fund) to oppose Apartheid in South Africa — focuses on factors most relevant to specific companies or what they describe as “financial materiality.” They’ll focus more on how well a utility company manages its natural resources (E), for instance than say its human capital (S).

The firm then identifies the companies with the most attractive financial materiality factors and combines that work with the traditional analysis being done by Eaton Vance analysts.

“This process allows us to evaluate how companies are managing these different forms of capital,” said Eames. “Our goal is to really find companies that are balancing the needs of capitalism. So when people invest, they are hoping to get a return on that investment through dividends and appreciation growth, but also the impact on society and the environment… we don't want the financial return to be at the expense of society or the environment. So it's really about finding those companies that are balancing the needs of capitalism and the social and governance, considering environmental considerations as well. It's about identifying companies that are offering a net benefit to society.”

And this screening has helped performance. In fact, Eames noted in the interview that Calvert’s suite of nine indexes, on which the fund family’s passive funds are based, generally beats traditional indexes. See Calvert Indexes. Also read Are Sustainable Equity Funds Doing What They Claim to Be Doing?.

What sort of companies might you find Calvert investing in its passive funds?

Here’s a look at the top 10 holdings in the following funds:

Calvert US Large-Cap Core Responsible Index Fund Class A (CSXAX)

Top 10 Holdings: 23.40% of total assets

Apple (AAPL) 0.0493% of assets

Microsoft (MSFT) 0.046%

Amazon.com (AMZN) 0.0321%

Alphabet (GOOGL) 0.0313%

JPMorgan Chase (JPM) 0.0157

Visa (V) 0.0134%

Procter & Gamble (PG) 0.0120%

Bank of America (BAC) 0.0117%

Intel (INTC) 0.0112%

Mastercard (MA) 0.0112%

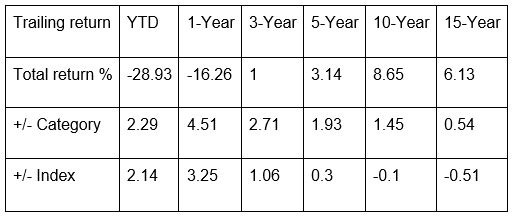

Performance: Morningstar notes that the fund has outperformed its category over the past 15 years and outperformed Morningstar’s index in all but the 10- and 15-year trailing period.

Calvert US Mid Cap Core Responsible Index Fund Class A (CMJAX)

Top 10 Holdings, 5.30% of total assets:

Lam Research (LRCX) 0.70% of assets

Centene (CNC) 0.62%

IHS Markit (INFO) 0.52%

Eversource Energy (ES) 0.51%

Hilton Worldwide (HLT) 0.51%

Motorola Solutions (MSI) 0.50%

T. Rowe Price (TROW) 0.50%

Amphenol Class A (APH) 0.49%

IQVIA Holdings (IQV) 0.48%

PPG Industries (PPG) 0.47%

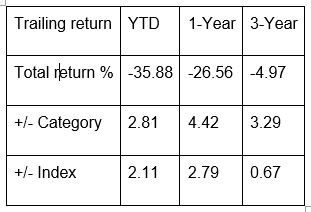

Performance: Morningstar reports that this fund has outperformed both the category and the index for all trailing periods.

Of note, Calvert’s Green Bond fund (CGAFX) has performed well during this time of extreme volatility. That fund is down only 2.95% year-to-date through March 27, while the S&P 500 is down 21.34% for the same time period.

In the podcast, Eames also noted that Larry Fink’s 2020 letter to CEOs will encourage investors to think about the investment risks presented by climate change and the significant reallocation of capital that’s occurring.

Eames also said that there’s “opportunity for engagement” for large investors. That would include, for instance, voting proxies in alignment with ESG principles. “Increasingly there are shareholder proposals that come out each year that are directly related to ESG issues,” said Eames. “Executive compensation, diversity issues, gender pay equity, carbon emissions, the very issues that we've been talking about. And those are opportunities for managers to vote in support of those resolutions.”

At the moment, Eames said large investors aren’t necessarily taking advantage of this opportunity for engagement. But he’s hopeful. “We would love to see more investors, particularly some of the largest, most influential investors to use their power to encourage companies to move in the right direction,” he said. “And so I think it's sort of walking the talk in this case. And I think we would expect to see more progress… in that direction over time.”

Eames also noted that ESG is at least benefiting from a bottom-up interest on the part of millennials. And that’s part of the reason for firms jumping on the ESG bandwagon. “I think that's a lot of the reason why you see so many traditional asset managers now trying to get involved in this space as well,” Eames said. “They don't want to be left behind as investor sentiment increasingly turns towards ESG investing.”

Eames also addressed the issue of greenwashing — disinformation disseminated by an organization so as to present an environmentally responsible public image — during the podcast. Though it exists, he’s confident that his firm’s investment research screens out those firms involved in the practice.