The other colored U.S. map; the future of cooling, and who are the top climate game changers

Welcome to Callaway Climate Insights, where climate change and Covid won't wait for election results. Enjoy and please share.

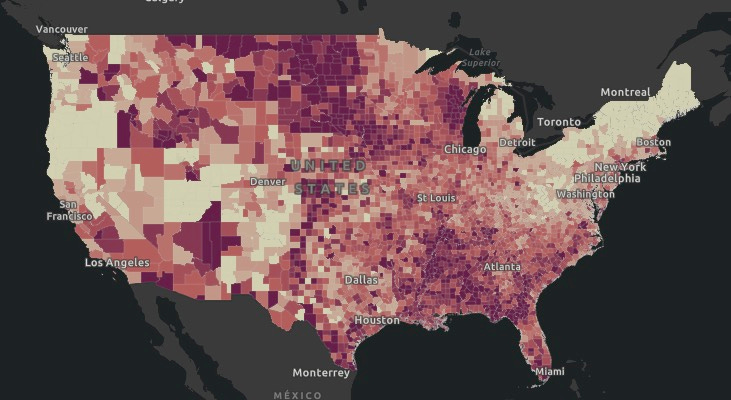

Since we’re all looking at maps this week... Here’s one that combines blue and red into a deadly purple, representing the U.S. Covid-19 situation as new daily infections passed 100,000 on Wednesday for the first time.

It’s hard to comprehend how much the country has changed since the third week of March, when 10,000 total cases sent it into a national lockdown. This weekend we will pass the 10 million level of total infections, and before Thanksgiving we’ll hit a quarter of a million people dead. Worldwide, almost 10,000 people died just yesterday. Yet for the most part, in the U.S. we’re back to business.

Count me among those who expected more on Election Day from an electorate so thoroughly ravaged by the pandemic. And yet, we fell into our familiar voting patterns, with only small anomalies in states such as Wisconsin and Arizona now dictating the final vote count. Both candidates received millions more votes than in 2016.

In the coming hours or days, a winner will be declared. Half the country will celebrate. The other half will be very, very angry. The red and blue maps will fade but the purple map will grow darker, a reminder that Covid-19 and climate change didn’t take a break for the election, nor do they care how close the vote is.

Our ways haven’t really changed this political season, but the world has. Whoever is president in January faces the fight of their lives.

More insights below. . . .

And don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Who are the top climate game changers? You’d be surprised

. . . . A senior investment banker told me once that his bank prefers to work with the big fossil fuel companies, rather than shun them, as they tend to have most of the creative ideas about the future of energy. I filed it under things a banker might say until this study crossed my desk this week in a column by Mark Hulbert. The study found that the vast number of “green” patents taken out in the past 40 years were taken by large energy companies. Harvard Business School professor Lauren Cohen, Umit Gurun of the University of Texas at Dallas, and Quoc Nguyen, a professor at DePaul University, spoke with Hulbert about their report, titled The ESG-Innovation Disconnect: Evidence From Green Patenting. The study found that among the top patent filers were ExxonMobil (XOM), Chevron (CVX) and ConocoPhillips (COP.)

Relative to comparable companies at the top of ESG rankings, energy companies “have produced over two times as many green patents.”

Nearly a quarter of all the patents produced by energy companies over the past 40 years fall in the “green” category. The comparable “green patent ratio” for non-energy companies that also engage in “green” patenting is just 8.3%.

Furthermore, energy companies’ green patent ratio has grown faster than for non-energy companies. For the latest year analyzed, Cohen told me, the ratio was 30% for energy companies, double what it was in the 1980s. The ratio for non-energy firms has grown over the same period from just 6.4% to 6.7%. . . .

ZEUS: 5 climate things we know now as election nears end

. . . . The U.S. officially dropped out of the 2015 Paris Agreement to fight climate change Wednesday, and that’s one of the only things we know for certain after the wildest election night in 20 years, David Callaway writes in a special column this week. From the prospects for a federal carbon tax to reduced expectations for the renewable energy industry, here are five things we now know about the climate change transition no matter who is declared president. . . .

Europe notebook: circular economy harks back to ‘original greens’

. . . . EU Climate Commissioner Frans Timmermans is at the forefront of a movement to create a circular economy in Europe, where reusable and recyclable goods become the basis for most products, homes and offices. Stephen Rae in Dublin looks at how this might make Europe a leader in the recyclable universe, and wonders if it would bring us all back to the simpler days of yore.

I guess in many ways our parents and grandparents — particularly where I come from in the rural southwestern Atlantic coast of Ireland — were the original greens. They lived the circular economy, passing down clothes from child to child, repairing white goods and televisions and knocking a lifetime out of automobiles. The 1970s changed all that and in the interim greenhouse gas emissions have exploded and 90% of biodiversity loss has been linked to the extraction of natural resources to build disposable products.

Now consumers are demanding products and services that do no harm to our natural environment and, as Climate Commissioner Frans Timmermans indicated this week, “we need to protect them against greenwashing.”

Plus, the EU is banning the use of lead ammunition by hunters, as part of a plan to ultimately get rid of lead cartridges in firearms. . . .

Air conditioners and the ‘counter-Covid cyclical’ clean energy play

. . . . Jonathan Maxwell and his partners run the UK’s only listed investment trust focused on energy efficiency. Here in a guest column for Callaway Climate Insights, the writers from Sustainable Development Capital LLP write about the booming opportunity in the cooling business over the next several years as the world heats up, particularly in Asia. Bringing sustainable energy to cooling could be a major driver of the global economic recovery from the pandemic, the authors write.

In the next five years, we will see a billion new air conditioners come online, with global demand for cooling set to triple by 2050. If we do nothing, this will result in an increase in energy demand equivalent to all the energy used by China and India today. The demand for cooling increases as incomes rise and populations grow. This is especially prevalent in Asia where increased use of air conditioners will soon represent one of the top drivers of global electricity demand.

SDCL views cooling and energy efficiency projects as “counter Covid-19 cyclical” and as having the potential to play a fundamental role in jumpstarting economic recovery. . . .

Data driven: Powerful cities

News briefs: Can electric Ferraris growl?

Editor’s picks:

Can electric Ferraris growl?

Trump names Weatherhead to direct National Climate Assessment

WHO publishes profiles on climate change and health in island states

10 new wind farms come online in Q3

Latest findings: New research, studies and projects

Hunting for cooler waters, marine species are on the move

The so-called “blue economy” of America — the resources and services provided by the oceans, contributed about $373 billion to the economy in 2018, and fisheries play a large role in that, John Dos Passos Coggin writes for NOAA. Climate change, however, threatens commercial and recreational fisheries; changes in water temperature can affect the environments where fish, shellfish, and other marine species live, and cause them to seek new waters, according to new research reported in NOAA’s Climate.gov. A new indicator, jointly developed by the EPA and NOAA, shows that along the coasts, marine species are shifting northward or to deeper waters, and as smaller prey species relocate, predator species may follow. In waters off the Northeast, fish and shellfish, including the American lobster (above), are moving northward at a significant rate; in the eastern Bering Sea, they are still shifting northward but at a lesser rate. Likewise, marine species in both regions are moving to deeper waters, but the rate of change in depth is especially high along the northeastern coast.

More research:

Words to live by . . . .

“We do not face a choice between protecting our environment or protecting our economy. We face a choice between protecting our economy by protecting our environment — or allowing environmental havoc to create economic havoc.” — Robert E. Rubin, chairman emeritus of the Council on Foreign Relations and former U.S. Secretary of the Treasury.