The risk behind the ESG rally as Covid and climate change run the table

Welcome to Callaway Climate Insights, and especially to all our new subscribers since the U.S. election. Enjoy, and please share.

Covid vs. climate change. It’s really no contest. As the U.S. sheltered from the raging pandemic this year, along with everyone else, greenhouse gas emissions fell more than 9%, to their lowest level since 1983, according to a report by Bloomberg New Energy Finance Thursday.

The extraordinary declines came mostly from the transport sector, as people flew and drove less, and from the power sector, as gas and renewable energy overtook coal and other fossil fuels. The declines were enough to actually put the U.S. within the range of meeting its Paris Agreement commitments, if it were still in the pact.

But … there’s a but. The wildfires we saw in California and other Western states this past summer created enough new emissions to wipe out all the gains by the power sector, which represent almost a third of the decline. A reminder that climate change will keep re-setting the bar no matter what we achieve.

Also a reminder that the combination of the pandemic and climate risk present incredible risk to the financial markets, as described in our feature podcast this week by Bob Powell, with Elias Ghanem, global head of Capgemini’s financial services market intelligence group.

The investment firm published its Wealth Management Top Trends 2021 report this week, and Ghanem tells Powell that sustainable investing will develop from a “nice-to-have into a must-have” in the coming year, as investors adjust their portfolios to both the risk and opportunity of environmental, social and governance strategies.

To me, the most notable facts that emerged were that while 27% of high net worth individuals are interested in ESG, more than 49% of ultra-high net worth investors (more than $30 million) are interested. And that both groups plan to invest almost half their portfolios in sustainable investments by the end of 2021.

Good to know if you’re selling sustainable investment products, especially if those investments can fund solutions in what’s poised to be a historic 2021 in battling both climate change and Covid.

More insights below. . . .

And don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

How ESG’s vague meaning is hurting its investment potential

. . . . Do ESG funds outperform because they are environmental, social and governance focused? Or does the vague meaning of ESG create an impossible storyline for investors and fund managers? Mark Hulbert looks at how meaning something different to everyone is hurting the potential for investors to make money and do good.

As a practical matter, it strains credulity to think Wall Street wouldn’t have long ago embraced ESG strategies if they regularly outperformed the market. Wall Street managers are intensely competitive, devoting countless hours and resources to discovering what would give them even a tiny advantage over their competitors. The money managers I speak to assure me that if there were a way of using ESG criteria to reliably and consistently beat the market, everyone on Wall Street would have long since made it a core part of their investment strategies — regardless of whether they believed in mitigating climate change or not. . . .

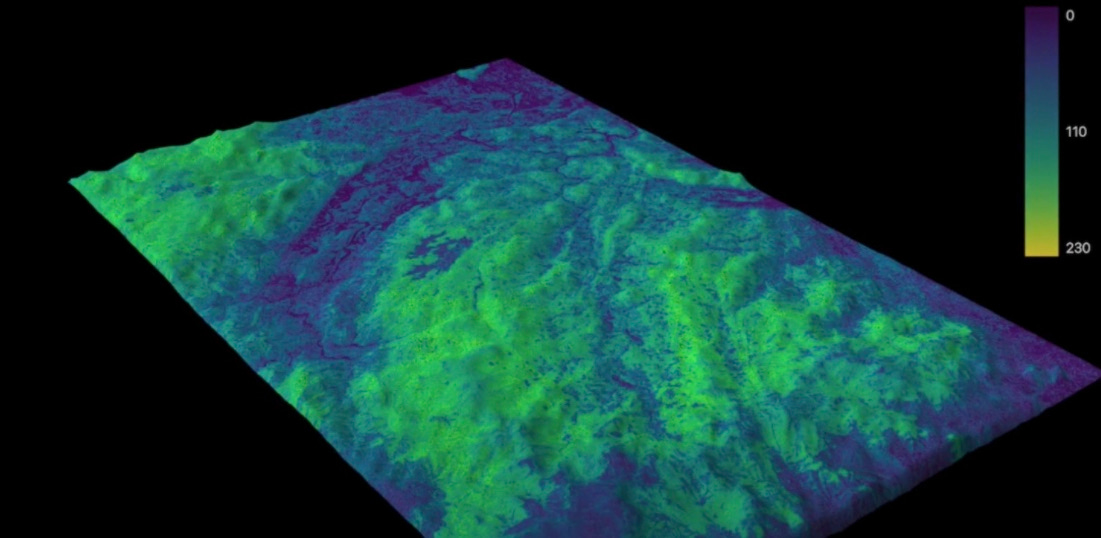

Scotland’s Space Intelligence measures and maps natural capital to fight climate change

. . . . Talk about seeing the forests for the trees. Two leading Scottish academics tell Darrell Delamaide how they are using artificial intelligence and satellite imagery to map the growth and reduction of forests to create carbon offset opportunities for clients in a new company called Space Intelligence. The company is providing badly-needed metrics to the nascent carbon reduction industry.

Space Intelligence has done some mapping of the U.S. West Coast to help find ways to reduce the risk of wildfires. Once again, the focus here is on analyzing the distribution of trees. Other projects of the firm around the world range from mapping agriculture to using astronomy to track space debris.

For the moment, one of the startup’s biggest projects is for the Scottish government, mapping the country’s forests as well as other surface resources such as water and meadows. The government must now report annually on these resources as Scotland moves toward net-zero emissions. The research also signals where intervention, such as forest restoration, is needed. . . .

ZEUS: The UK just made a major climate commitment

. . . . Boris Johnson’s conservative government has been rocked by scandal tied to its handling of both Covid-19 and Brexit, but an attempt to steer the conservation to climate this week carried one big commitment, writes David Callaway. Amid an otherwise vague list of climate pledges and financial promises, Johnson made a promise on auto emissions and electric vehicles that places the UK in the forefront of nations battling to get to net zero.

But the big part of the plan — the major commitment — was certainly the pledge to move Britain off fossil-fuel emissions for autos by 2030, some 10 years sooner than previously pledged. The government will provide grants for cars and for charging points throughout the union. Certain hybrid cars will be given until 2035. See here how it will affect electric vehicles.

This pledge alone would have been worthy of the news cycle, as it puts the UK in the forefront of plans to eliminate gasoline and diesel emissions. California recently put in place plans to ban sales of gasoline autos and trucks by 2035. Europe and China are moving fast in that direction as well. Having lived in the UK, and now living in California, I’d put the UK’s chances of pulling this off well ahead of the Golden State, even with its political troubles. . . .

Europe notebook: The growing arms race in offshore wind farms

. . . . Investments in offshore wind in China and India are starting to raise concerns in Europe, which has always thought of itself as the undisputed leader in wind opportunity, writes Stephen Rae from Dublin. The EU is redoubling its efforts, investing in several new technologies, such as floating wind turbines. As Chaucer wrote, time and tide wait for no man.

“Europe is the global renewable offshore technology and industrial leader and should fully exploit this first-mover advantage,” the European Commission argues.

The North Sea — currently the world’s most populated wind farm — the Baltic, the Atlantic, the Mediterranean and the Black Sea are all identified for greater deployment of wind turbines. . . .

Sustainable investing moves toward the mainstream: Capgemini

Elias Ghanem, Global Head of Capgemini's Financial Services Market Intelligence Group, talks with Robert Powell about Capgemini’s Wealth Management Top Trends 2021 report, which identifies how the pandemic has forced wealth management firms to build capabilities to cater to the rising demand for sustainable investing as it moves toward the mainstream. Listen to the podcast.

Data driven: 1% of people cause half of global aviation emissions

. . . . Just 1% of people cause half of global aviation emissions, according to new research out of Sweden. “If you want to resolve climate change and we need to redesign [aviation], then we should start at the top, where a few ‘super emitters’ contribute massively to global warming,” Stefan Gössling at Linnaeus University in Sweden, who led the new study, told The Guardian. The research, based partly on pre-pandemic data, was published in the journal Global Environmental Change. . . .

News briefs: Deutsche Börse deal for ISS; recycled paper wine bottles

Editor’s picks:

Deutsche Börse buys majority stake in ISS for ESG

Biden names climate, environment picks for transition teams

Wine bottles from recycled paperboard

Latest findings: New research, studies and projects

Managing nature-related financial risks

Managing Nature-Related Financial Risks: A Precautionary Policy Approach for Central Banks and Financial Supervisors considers how financial authorities should react to environmental threats beyond climate change. These include biodiversity loss, water scarcity, ocean acidification, chemical pollution and — as starkly illustrated by the COVID-19 pandemic — zoonotic disease transmission, among others. The authors first provide an overview of these nature-related financial risks (NRFR) and then show how the financial sector is both exposed to them and contributes to their development via its lending, and via the propagation and amplification of financial shocks. Authors: Katie Kedward, UCL Institute for Innovation and Public Purpose; Josh Ryan-Collins, Institute for Innovation and Public Purpose; Hugues Chenet, University College London - UCL Institute for Sustainable Resources; Chair Energy and Prosperity.

More of the latest research:

Study shows climate change can help crab escape its parasites

Wales elephant grass research could help unlock greener energy

Words to live by . . . .

“If you do it right, you can do it cheap,” said Jamie Dimon, CEO of JPMorgan Chase, suggesting that carbon emissions should be taxed on a progressive scale. That way, the levy would incentivize people to make persistent efforts to reduce their carbon footprint, he said during The New York Times Online DealBook Summit.