The staggering losses behind Big Oil's clean energy plans; plus a talk with FirstLight Power CEO Alicia Barton

Plus, the billionaires behind the EV boom, and will carbon prices go to €100?

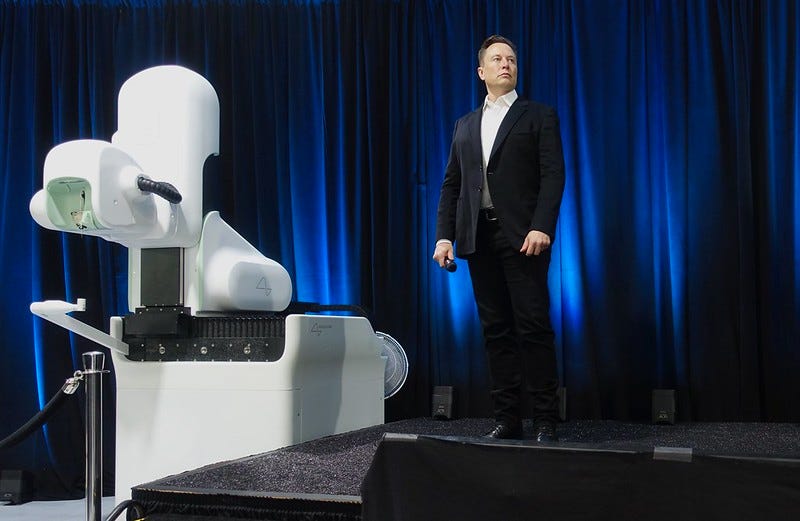

Above: It’s Groundhog Day, and Punxsutawney Phil — like folks in New York and New Jersey — thinks winter’s not over yet.

When you’ve just lost $20 billion in your fourth quarter, winning Elon Musk’s $100 million prize for best carbon capture technology might seem like small consolation. Yet ExxonMobil (XOM) didn’t let that stop it from unveiling a slew of carbon capture projects this week to redirect attention from its worst year ever, a shareholder activist on its tail, and news that it talked about a merger with Chevron Corp. (CVX).

The projects, which are at various stages of discussion but at none of the stages of capture, would complement Exxon’s current capture capacity of about 9 million tonnes, if affected, the company said in a press release.

The statement did nothing to stop Engine No. 1 from continuing its demand for four board seats, although it shed a huge light on the staggering climbdown Exxon and Big Oil have suffered as the world turns on fossil fuels. Royal Dutch Shell (RDS.A) is expected to unveil its own low-carbon plan, focused on energy trading next week, while BP (BP) and Total are leaping on the crowded renewables bandwagon.

The history of industrial and corporate evolution does not look favorably on incumbents. Think railroads, or super-computer makers. Big Oil is different though. Its collapse would mean economic collapse in many ways, including stranded assets around the world, held by the banking industry. Whatever they are doing in these boardrooms, they need to do it faster.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

The inevitable shakeout in batteries and electric vehicles is coming, but for now it’s making these people very rich

. . . . Going green by betting on batteries can bring in boatloads of greenbacks. That’s the big message from a new ranking showing that the world’s fastest-growing fortunes are being garnered by tycoons who have plugged into the electric car and solar power booms. The 15 billionaires on Bloomberg Green’s new list highlight the huge growth of the electric vehicle, battery and solar power industries. At the top of the pile is Tesla titan Elon Musk, whose green net worth, or the portion of his fortune tied to cars and solar, is $180.7 billion or 91% of his overall wealth (his other interests include space rockets). But you’ll look in vain for another American — 80% of the getting-rich-quick billionaires are from China, including Wang Chuanfu, Lv Xiangyang and Xia Zuoquan, the top shareholders of battery and electric automaker BYD Co., as well as Liu Jincheng, chairman of lithium battery company Eve Energy Co. Apart from Musk, the only non-Chinese on the list are Australian Anthony Pratt — at No. 7 — who runs the paper-recycling giant Pratt Industries. And Aloys Wobben of Germany, whose Enercon is a wind-power powerhouse, comes in at No. 9. The numbers portend a coming together of battery businesses, whose storage value is increasing, and electric vehicle businesses, whose costs are rising as manufacturing ramps up. An inevitable shakeout is coming after the hype period, which we are clearly in. . . .

. . . . With a growing governmental push, particularly in Europe, to eliminate airborne pollutants, some investors are betting that prices for carbon credits are going to soar this year. Brussels is enacting plans to eliminate carbon emissions by the middle of the century in a massive shift in how the European Union powers its economy, reports Bloomberg Green. Part of the process is likely to include forcing up the bloc’s carbon price, thus incentivizing companies to increase their sustainability efforts. Among the investment players are London-based Andurand Capital Management and Lansdowne Partners. “We’re very confident the price path forward is up,” said Casey Dwyer, an analyst at the Andurand Capital Management energy and oil-focused hedge fund. “We have an aggressive target for where we think prices need to go,” said Dwyer, adding that he expects it will hit €100 ($121) per metric ton of carbon emissions, possibly as soon as later this year, from about €33 now. That might not seem a lot to Robinhood investors, but most central bankers are convinced a fairer value for carbon right now is in the 40-euro range. Beware market predictions that only go up. . . .

A clean energy jobs boom is coming. FirstLight Power CEO Alicia Barton tells us why and where

. . . . Alicia Barton’s come a long way from her days as an environmental lawyer in New York, pushing clean energy theories with colleagues in a corporate echo chamber. Now, with climate finance booming and industries such as off-shore wind seeking to come online, the new CEO of FirstLight Power, New England’s largest renewable energy producer, thinks the timing could finally be in place for the transition to clean energy jobs the industry has been waiting for. And it doesn’t hurt that there’s a new administration in Washington either.

Both New York and Massachusetts, where Barton has had a hand in offshore wind, are considered leaders nationwide in their response to climate change, particularly with offshore wind. While Massachusetts is a bit behind New York, they’re still well ahead of many other states.

“A big factor for what [I think] is attractive to either Massachusetts or New York is not only getting clean energy, but capitalizing on the potential to create an entirely new industry, one that doesn't exist in the U.S. today, but that could supply many thousands of new clean energy jobs,” Barton said. “Looking at that economic opportunity I think has been a signature of the states’ recognition of why pursuing ambitious clean energy policies is really a smart strategy.”. . .

News briefs: Britain needs to speed up EV charger installation, more

Editor’s picks:

Brits way behind with electric-car charging stations

Southern France tourism set to fry if climate change continues

And in other green news, scientists have taught spinach to send emails

Data driven: Punxsutawney Phil says ‘chill’

. . . . In honor of Groundhog Day, we note this week’s winter storm has already dumped 30 inches of snow in New Jersey, and winter storm Orlena isn’t done yet. The Garden State’s current all-time snowfall record was set 122 years ago, when 34 inches of snow hit Cape May, N.J. Meanwhile, the National Weather Service credited Central Park, New York with 17 inches, making it likely to crack the Park’s top 10 historical snowfall totals. . . .