Wall Street's 11th-hour push to dilute SEC climate rules is embarrassing

Welcome to Callaway Climate Insights. Still awaiting the Supreme Court's climate ruling, which could come tomorrow or next week at the latest.

To read all our insights, news and in-depth interviews, please subscribe and support our great climate finance journalism. Callaway Climate Insights publishes Tuesdays and Thursdays for everybody.

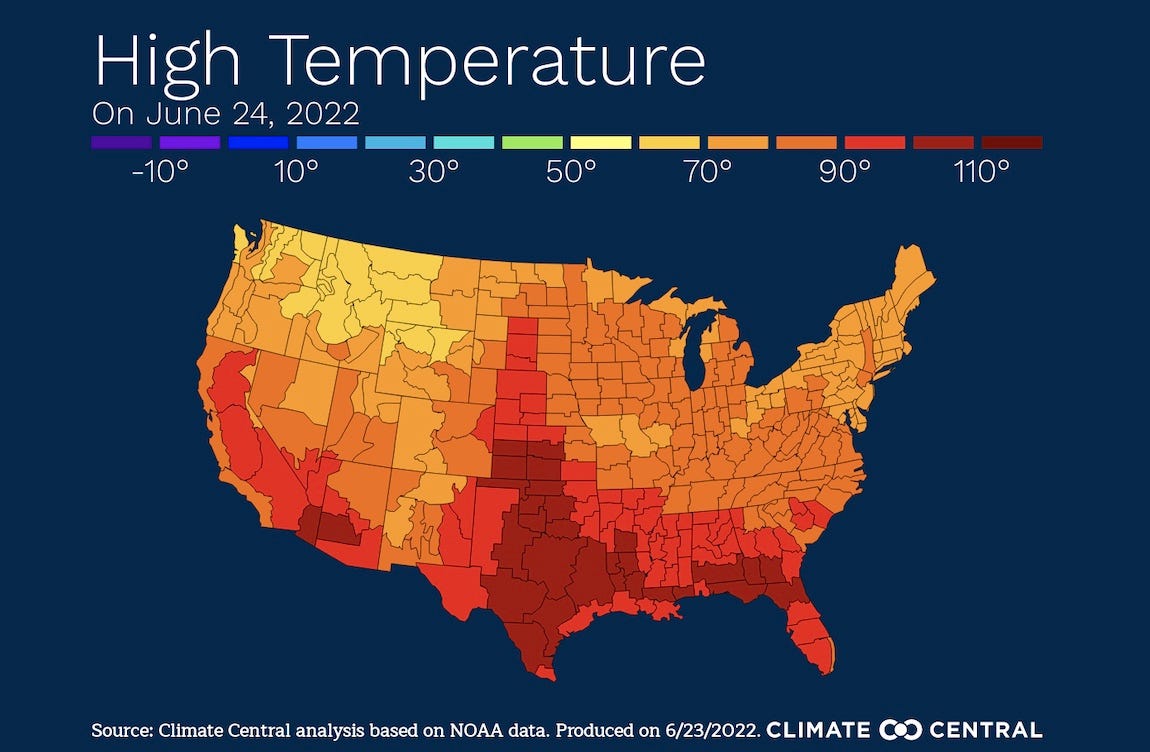

Friday, June 24: On the day that the U.S. Supreme Court could rule against the EPA’s ability to drive down carbon emissions at power plants … this country’s on fire. We’re looking at you, Texas, with an expected high of 105°F. Climate Central has launched the Climate Shift Index, a tool that shows the local influence of climate change, every day. CSI levels indicate how much climate change has altered the frequency of daily temperatures at a particular location. This image shows the high temps expected for the U.S. tomorrow based on NOAA data.

As European regulators this week unveiled plans to require independent auditing of corporate climate disclosures, Wall Street is in an 11th-hour press on the U.S. Securities and Exchange Commission to water down its own emissions disclosure proposal. Frankly, it’s embarrassing.

Some of the biggest names in finance — including BlackRock and the Nasdaq Stock Exchange — weighed in as the SEC deadline for comment passed last Friday, arguing that the new rules will add costs and more confusion to the hodgepodge of current voluntary rules, and instead pushing a practice dubbed “comply or explain.” In essence, if you don’t want to report your emissions, just explain why not.

The warnings, which were in contrast to many comments supporting the rules and urging the focus on better tools and more rigid definitions (more on these next week), particularly singled out the SEC requirement for so-called Scope 3 emissions, which is the pollution caused by a company’s supply chains or vendors. The finance giants argued they should be shelved or at least reduced to comply or explain.

Investors have had months to send in their comments and/or lobby the SEC on its new rules, which were put forward this past spring. That some big investors, who otherwise identify themselves as supportive of environmental, social and governance objectives, would wait until the last minute to propose these major changes, is akin to the time-honored practices of diplomatic intrigue used by big countries such as China and India to sabotage global climate agreements at the last minute.

With President Joe Biden’s climate agenda under attack on Capitol Hill and from the U.S. Supreme Court, the SEC rules are one of the only remaining ways the country can make any sort of progress on reducing greenhouse gas emissions in the next two years. Let’s hope SEC Chairman Gary Gensler and his team are prepared to stick to their guns on this one.

More insights below . . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Why the crypto winter is a good antidote to global warming

. . . . The collapse in cryptocurrencies this month could lead to an unexpected boost for renewable energy companies, writes Mark Hulbert. While crypto mining to make currencies has long been criticized as an energy-suck, Hulbert argues many of the crypto mining companies might now need to turn to cheaper sources of energy — such as wind and solar — to stay in business as their customers dry up. In fact, some of the larger crypto mining companies could potentially even morph into renewable energy companies themselves as they search for new lines of revenue. . . .

EU notebook: Hydrogen plans approved across 15 countries; and whatever happened to those three billion new trees?

. . . . An ambitious European Union strategy to invest in dozens of hydrogen projects across 15 countries was green-lighted in Brussels this week, writes Alisha Houlihan from Dublin. At a time when oil and coal prices are spiking and Europe is worried about a potential cutoff in Russian gas this coming winter, the transition to hydrogen is becoming a more important policy point than ever. Plus, a look at the plan two-years ago to plant three billion trees by 2030. So far we’ve planted … well. . . .

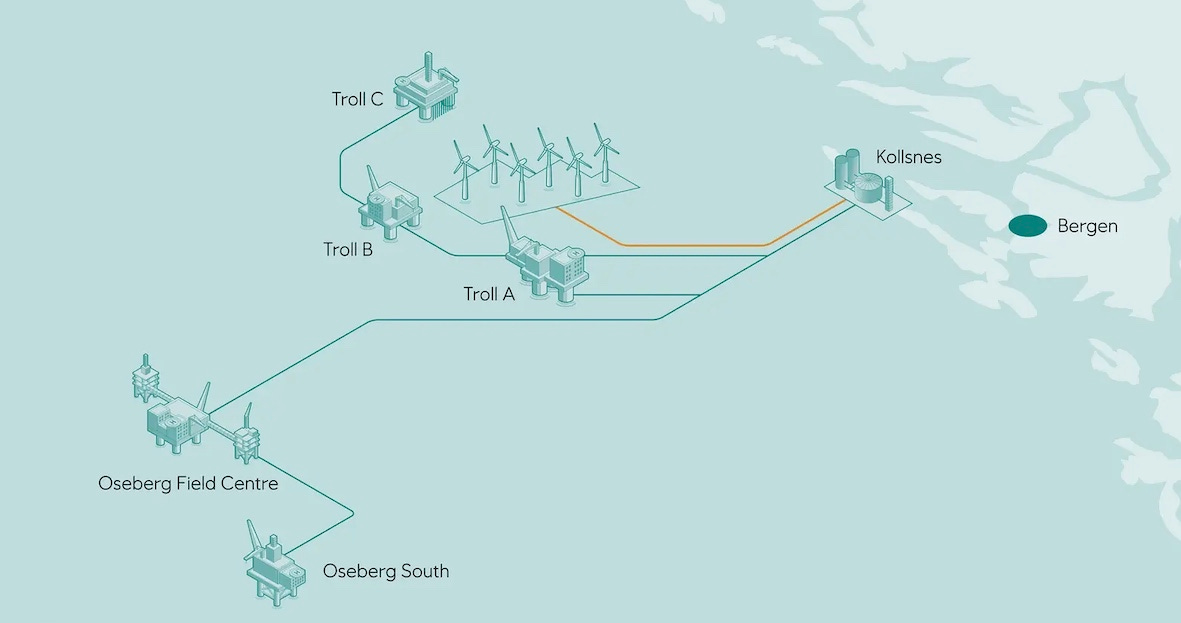

Thursday’s subscriber insights: Big oil’s plans to become Big Wind

. . . . There’s a big reason offshore wind power is key: It tends to be more windy at sea than on land. And its importance is growing in leaps and bounds, with massive investments, including from Big Oil, which is getting in on the next iteration, floating wind farms. Read more here. . . .

. . . . Green hydrogen has been in the news a lot lately. Now it is being explored as a possible solution to one of the biggest net zero stumbling blocks — air travel. Read more here. . . .

. . . . At last, some honesty from big business about reaching net-zero goals. It comes from Unilever CEO Alan Jope, who says he has “no idea” how his company will deal with Scope 3 emissions, and the use of his company’s products are beyond his control. Read more here. . . .

. . . . Want to differentiate yourself in the crowded beer market? Maybe by packaging your brewski in a recyclable wood-fiber bottle. That’s what Carlsberg, which has tried many slogans to push its products, is planning to do. Read more here. . . .

Editor’s picks: Medical journal takes on climate and health issues

New England Journal of Medicine takes aim at climate change

Beginning today, The New England Journal of Medicine is expanding coverage of climate issues and public health, saying it will devote regular coverage to the topic. In a recent editorial, the publication says “Why are fossil fuels an issue for medicine and, specifically, for medical journals? Their extraction and use are the root cause of air pollution and climate change. … Climate change is also increasingly disrupting health sector infrastructure, power, and supply chains, especially during climate-intensified events such as wildfires, floods, and hurricanes.” The editorial also says the publication is redoubling its commitment in response to the urgent need to reduce the devastating consequences of climate change and air pollution by instituting practices and advocating for policies that foster health and equity.

Big payback for Europe through clean energy shift

A clean power system is possible in Europe by 2035, at no additional cost beyond existing commitments, including halving fossil fuel consumption by the end of this decade and quadrupling wind and solar capacity, according to a research report from Ember titled New Generation: Building a clean European electricity system by 2035. Alex Blackburne writes in an assessment of the report for S&P Global Market Intelligence that “while accelerated decarbonization would require higher up-front investments of up to €750 billion, these would be offset by as much as €1 trillion in savings by 2035 from avoided fossil fuel consumption, energy and climate change.”

Latest findings: New research, studies and projects

Central banks and climate policy: unpleasant trade-offs

This paper focuses on the trade-offs that central banks would face if they were to start tackling climate change. The authors of Central Banks and Climate Policy: Unpleasant Trade–Offs? A Principal-Agent Approach say disruptive natural events can hamper growth and capital accumulation, thereby affecting price and financial stability — elements for which central banks are responsible. Yet, the array of instruments they could use to mitigate climate-related risks overlap with those already used in relation to their monetary and macroprudential mandates. By leveraging a principal-agent setting, the authors consider the conditions under which the central bank architecture would be fit to take on this objective without jeopardizing the attainment of central banks’ core mandates. They also examine the corresponding effects in terms of climate risks. Results show that central banks’ effectiveness in this regard depends on the degree of their independence from governments’ climate preferences and on their ability to calibrate their green easing, either monetary and/or regulatory, on the realized level of abatement and emissions. Authors: Donato Masciandaro, Bocconi University Department of Economics; Riccardo Russo, King’s Business School, King’s College London.

More of the latest research:

Finance for Fossils – the Role of Public Financing in Expanding Petrochemicals

Too Green to Be True? Forging a Climate Consensus at the European Central Bank

Words to live by . . .

“The climate crisis is the No. 1 emergency. Renewables not only fight the climate crisis, they support energy security. Renewables are the peace plan of the 21st century.” — António Guterres, Secretary-General of the UN.