What can stop carbon prices from rising, plus fallout from the EU nuclear decision

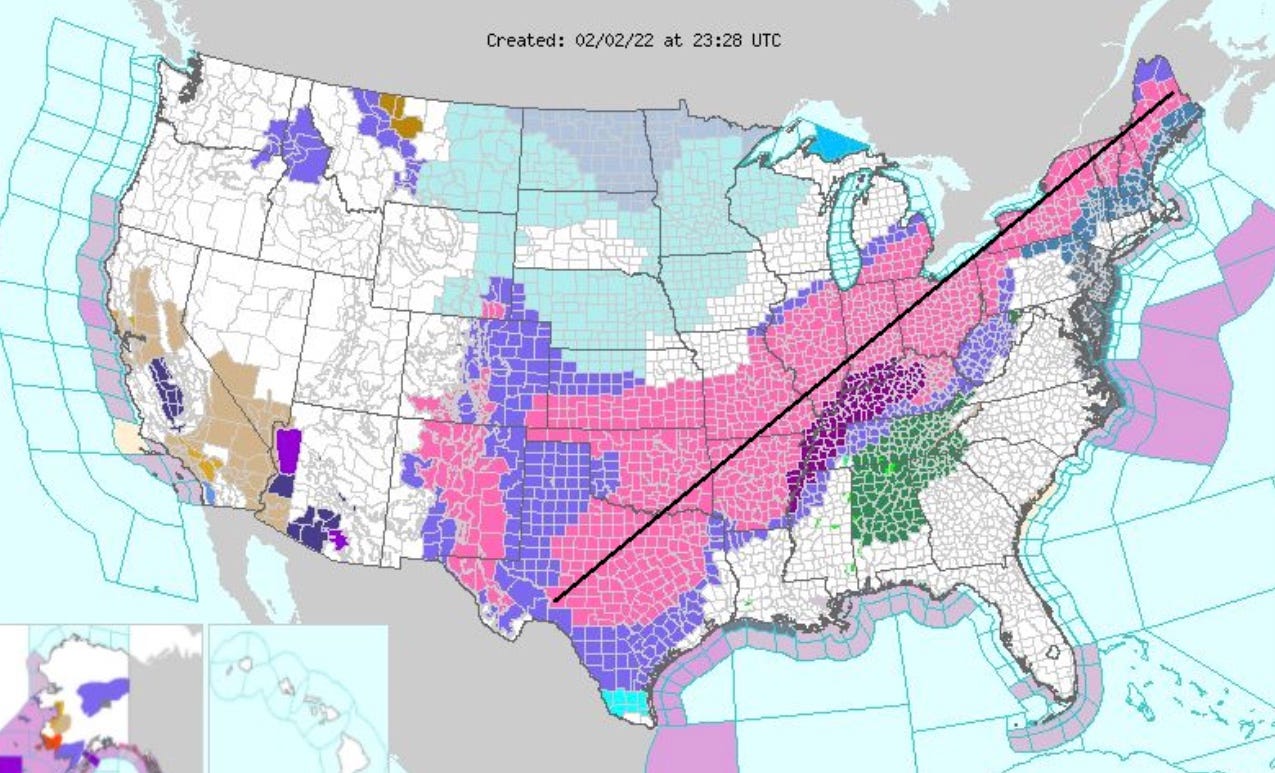

Welcome to Callaway Climate Insights. All eyes on the Texas grid this weekend as massive storm approaches.

To read all our insights, news and in-depth interviews, please subscribe and support our great climate finance journalism. Callaway Climate Insights publishes Tuesdays and Thursdays for everybody.

As carbon trading prices in Europe approach €100 a ton, I’ve been asking Callaway Climate Insights subscribers I’ve met with this past week whether they think carbon correlates with anything. Higher oil prices maybe?

Academic studies in the past show there is a loose correlation between oil and natural gas prices and carbon. And certainly, the more than tripling in some carbon prices on exchange in the past year has come as oil approaches $90 a barrel and natural gas soars on shortages in Europe.

The correlation is usually tied to the idea that the more oil and natural gas burned by big energy companies, the more offsets they’ll need to buy to improve their climate chops. That makes sense. Since there is a tight supply of quality offsets out there, demand goes up among the buyers of carbon contracts who need them to sustain their fossil fuel production, sales and usage.

Trouble is, in that scenario, carbon prices may seem a one-way street. Longtime investors know that doesn’t exist. So, what can stop them? A great expansion in offsets perhaps? That is unlikely without diluting their quality even more. Or prices could rise to the point where it’s more economical for energy companies to switch to renewable energy. That is sort of the holy grail of the whole carbon price idea, but prices would have to go far higher than they are now, at least double.

Or, maybe, a reduction in demand for offsets as mining for gas and oil and other minerals becomes technologically cleaner. This is where Big Oil is going, if only to reduce costs and keep Larry Fink and other climate shareholder advocates off its back. Sustainable production techniques are starting to catch attention. Among the scenarios for a turn in carbon prices, it might be better than waiting for a turn in oil and natural gas. More to come on this.

Question to subscribers: Do you think there is a correlation between carbon prices and other assets?

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Zeus: What's behind the sudden tightening in climate funding

. . . . Whispers about venture funds and asset managers tightening their covenants around lending to startup cleantech companies have grown louder in the past two weeks, reflecting concerns that the fund-raising party among young climate companies may be over. David Callaway sees a fundamental shift in the making, but not just because the public markets are looking vulnerable. Private investors have more data at their fingertips these days, and higher expectations because of it. The results may end up better for investors in the end. . . .

Hulbert: The climate gains a powerful new Wall Street ally

. . . . Value stocks have long enjoyed a statistical performance advantage to growth stocks, which doesn’t bode well for the new generation of clean tech companies, whose exciting prospects would put them in the volatile growth camp. But Mark Hulbert has unearthed a surprising new study that shows how traditional industrial stocks in the value category would benefit from a carbon tax as high as $100 a ton. In a political world where a carbon tax is seen as anti-business, though pro-climate, the new information adds a powerful incentive for investors looking to climate plays without the momentum premium. . . .

What’s next for EU after controversial nuclear and natural gas plan approved?

. . . . The European Commission’s decision to move ahead with plans to classify nuclear energy and natural gas as sustainable energies this week drew fire from all sides and set the stage for a major legal challenge, writes Elizabeth Hearst from Dublin, in our weekly EU notebook. While officials strained to defend the decision as a “transitional” one designed to first remove coal from the picture, opponents said it threatens the bloc’s entire climate-fighting reputation and vowed to fight it. Even as energy prices in Europe soared this winter because of shortages and concern about supply of natural gas from Russia. . . .

Thursday’s subscriber insights: Where the electric vehicle era will first arrive in the U.S.

. . . . While reports are saying EV auto sales are surging in the U.S. — and that people are generally pleased with their vehicles — it may be that fleet sales of electric vans will be the most notable first EV wave to arrive on U.S. shores. While the Biden Administration fights with the U.S. Post Office to go electric, companies such as Amazon, FedEx and others have already committed to EV vans, and manufacturers such as Ford, are scrambling to fulfill demand. Read more here. . . .

. . . . Engine No. 1, the shareholder advocacy firm that won a key climate proxy fight with ExxonMobil (XOM) last year, launched an actively-managed ETF Thursday to invest in companies focused on cutting greenhouse gas emissions. The ticker is NETZ, and the ETF follows an earlier one more focused on shareholder advocacy, VOTE, which is up about 7% since launching last summer. . . .

. . . . Sarah Bloom Raskin defended herself Thursday at a Senate hearing on her nomination to become vice chair of supervision at the Federal Reserve, responsible for Wall Street. Republicans attacked her for her climate views and painted her as a threat to the economic viability of the oil and gas industry. She responded that credit allocations to certain industries were the responsibility of banks, not the Fed. Read background on this story here. . . .

. . . . Moo! One group already benefiting from the solar boom are farmers, who are renting out their fields at a time when it is becoming harder to make money from agriculture. Particularly lucky are livestock farmers, whose animals can continue to graze in fields full of panels. Read more here. . . .

. . . . The EU’s controversial decision to include nuclear energy and natural gas as sustainable energies is drawing fire from all sides (see EU notebook above), but at least it faces up to the fact that there will have to be an energy transition period to allow for coal to be kicked out. Matthew Diebel argues it’s a wise move. Read more here. . . .

. . . . The news that young consumers in China and India are more environment-minded than their peers in the west is a positive step given that these Asian countries are the world’s worst polluters. But will their youthful idealism endure the realities of having to power the two most populous countries as they lift their economies? Read more here. . . .

Editor’s picks: The Olympic torch, China’s 4G nuclear reactor, and the combo of offshore wind and carbon-capture technology

Offshore wind farms that also capture carbon

Offshore wind farms that double as carbon-capture devices? It’s possible, David Goldberg writes for Fast Company, that when built together, these two technologies could reduce the energy costs of carbon capture and minimize the need for onshore pipelines. Goldberg, a marine geophysicist, deputy director and Lamont research professor for the Lamont-Doherty Earth Observatory at The Earth Institute, says “Several research groups and tech startups are testing direct air capture devices that can pull carbon dioxide directly from the atmosphere. The technology works, but the early projects so far are expensive and energy intensive. … For the process to achieve net negative emissions, the energy source must be carbon-free. The world’s largest active direct air capture plant operating today does this by using waste heat and renewable energy. The plant, in Iceland, then pumps its captured carbon dioxide into the underlying basalt rock, where the CO₂ reacts with the basalt and calcifies, turning to solid mineral.” A similar process could be created with offshore wind turbines, he says.

China’s 4G nuclear reactor powering up

The first unit of China’s fourth-generation nuclear reactor has been connected to the national power grid, and another, still under construction, is expected to begin commercial operations in mid-2022, Echo Xie reports for the South China Morning Post. According to the report, the domestically developed high-temperature gas-cooled reactor (HTGR) at the Shidaowan nuclear power plant in China’s eastern Shandong province is currently the world’s only one in commercial operation. The reactor, made up of two small units with a total generation capacity of 200 megawatts, is being built by state-owned China Huaneng Group, China National Nuclear Corporation (CNNC) and Beijing’s Tsinghua University.

Latest findings: New research, studies and projects

Stiff winds: climate change and economic activity

The authors of Climate Change and Economic Activity: Evidence from U.S. States say, “We investigate the long-term macroeconomic effects of climate change across 48 U.S. states over the period 1963 to 2016 using a novel econometric strategy which links deviations of temperature and precipitation (weather) from their long-term moving-average historical norms (climate) to various state-specific economic performance indicators at the aggregate and sectoral levels. We show that climate change has a long-lasting adverse impact on real output in various states and economic sectors, and on labour productivity and employment in the United States. Moreover, in contrast to most cross-country results, our within U.S. estimates tend to be asymmetrical with respect to deviations of climate variables (including precipitation) from their historical norms.” Authors: Kamiar Mohaddes, University of Cambridge; Ryan N. C. Ng, University of Cambridge; M. Hashem Pesaran, University of Southern California; Mehdi Raissi, International Monetary Fund; Jui-Chung Yang, National Taiwan University, Taiwan.

More of the latest research:

Words to live by . . . .

“Climate risk is business risk. … This is a big deal because there is a real linkage between ESG criteria and a company’s financial performance.” — Chris James, founder and executive chair of Engine No. 1, speaking at a National Association of Corporate Directors event in 2021.