What needs to be changed to save the new climate bill in Congress

Welcome to Callaway Climate Insights. As oil prices fall, another commodity is reaching new highs, especially in California. Water, anyone?

Today’s edition is free. To read our insights and support our great climate finance journalism four days a week, subscribe now for full access.

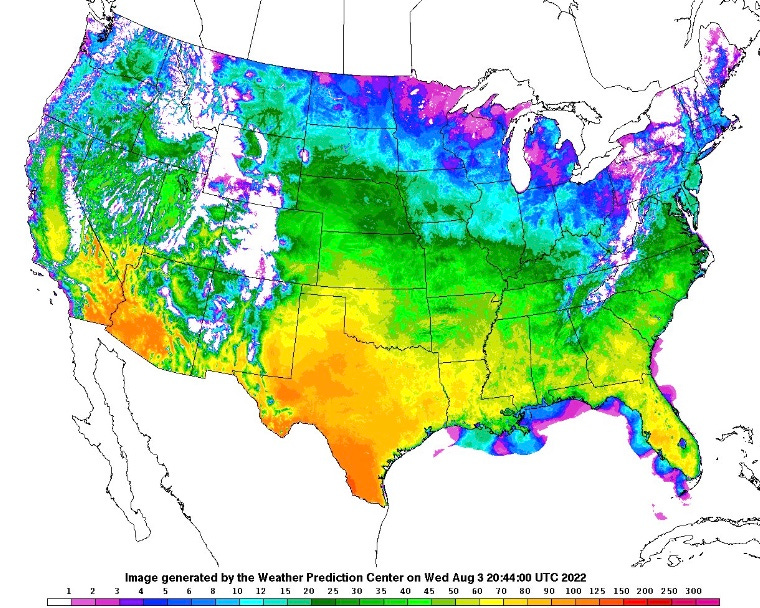

Here’s an estimate of the number of 90°F. (or higher) days this year through July 31 from the National Weather Service. Of concern: Arizona, where Phoenix hit 114°F. even before the start of summer. As of last week, Maricopa County logged 38 heat-related deaths so far this year, more than the 26 recorded over the same period in 2021. In 2021, the county recorded 339 heat-associated deaths — the highest on record. NWS via Twitter.

As the new Schumer-Manchin climate bill, um, the Inflation Reduction Act, enters the sausage-making phase in the Senate, it’s becoming clearer what needs to be tossed, and added, to cement passage of this vital legislation.

Now that Sen. Joe Manchin (D-W. Va.) has made sure it includes new oil and gas leases and pipeline approvals for his fossil-fuel buddies, Sen. Kyrsten Sinema (D-Ariz.) becomes the final obstacle, as the House will speedily approve the bill once passed in the Senate.

Expect the carried interest clause to get tossed. The favorite tax villain of the Democrats was always just a stalking horse, representing just $14 billion of the $740 billion expected to be raised in taxes to pay for the new legislation. More importantly, more money is going to have to be found to protect Sinema’s Arizona from the lethal heatwaves and droughts that are battering its economy (see map above).

While disaster funding is not the best way to mitigate climate change, it is — at least in conspiracy-loving Arizona — certainly the most obvious way to win approval.

President Joe Biden, often criticized for relying on the legislative process in the face of two parties being ripped apart by extremists, is nearing the finish line on what could prove to be the most important clean energy legislation of the decade. While not perfect, it is poised to create a huge push for renewable energy while balancing other energy interests at a time when all energy is becoming more crucial.

This one is truly too big to fail. Let the dealmaking begin.

More insights below . . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

A climate investors’ guide to the Inflation Reduction Act

. . . . As the Senate prepares to take up what could be the most important climate legislation ever passed in Washington, Bill Sternberg picks out the potential winners in the stock market for investors, from electric vehicle companies to solar and heat pump companies. And yes, even fossil fuel firms. Also, a few of the stocks who will get left behind, such as e-bike companies. It’s little wonder some of these shares were among the biggest gainers in July. . . .

Letter from Italy: Water shortages a new threat to European food prices

. . . . Europe’s grain problem with Ukraine is just the beginning. A megadrought in Italy combined with years of underinvestment in water infrastructure is starting to cause food shortages at Europe’s largest provider of tomatoes and rice, writes investment adviser Andrea Zanon from Venice. Climate inflation, another form of the wave of inflation crushing global economies, is a danger not just to poor countries but to international trade in gourmet foodstuffs as well. . . .

A selection of this week’s subscriber-only insights

. . . . The water shortages we’re seeing in California, Germany, Italy, the southwestern UK, and elsewhere are starting to take their predictable effect on water prices, with spot prices in California soaring to record levels this summer, according to Bloomberg. The Nasdaq Veles California Water Index is up 56% and has never sustained such high levels for so long, as rivers, lakes and reservoirs dry up and water rights become rarer.

With some hedge funds buying rights now in anticipation, the threat to farmers and even to some cities is becoming more acute, and with that threat, economic disaster as crops in America’s vegetable heartland begin to suffer. Expect this issue to be among the next big economic climate crisis heading toward the state capital in Sacramento, and indeed Washington itself, as Europe is already grappling with the possibility of hosepipe bans. . . .

. . . . It’s the largest tire company in the world, and even though hundreds of millions of tires made by Lego are actually toy tires, it has the same sustainable problems from the rubber treads that Michelin and Goodyear have. How the Danish toy company is handling its pollution problem could be a guideline for how its larger, less fun competitors build their climate strategies. Read more here. . . .

. . . . Speaking of water, great feature this week by Louise Boyle at The Independent on the water issues facing the southwest’s Navajo nation, despite decades of treaties guaranteeing water rights, and the entrepreneurs and non-profit groups that are helping them turn on the taps. . . .

. . . . Could a rising tide sink the economy? As NOAA warns that sea-level rise is causing greater flood risks to life and property, how can homeowners and investors find safe harbor? One answer could be innovative infrastructure investment. Read more here. . . .

. . . . BlueOnion, the Hong Kong-based fund metrics startup launched by financial publisher Elsa Pau, said this week it hired Jeanne Ng, one of Hong Kong’s most well-known environmental leaders, as its new chief sustainability officer. Ng’s record of expertise in handling greenhouse gas emissions will combine with Pau’s knowledge of the asset management industry as BlueOnion launches a service designed to analyze portfolio assets for their sustainable and social components. . . .

Editor’s picks: Alpine glaciers, jet fuel from solar power, and Pacific offshore wind potential

Solar reactor for sustainable jet fuel

A pilot-scale solar fuel reactor outside Madrid is producing jet fuel from CO₂ and water using a new process developed by a team of researchers at the Swiss Federal Institute of Technology in Zurich. According to a report in Chemical and Engineering News, the kerosene made with this process could be used as a partial replacement for fossil fuels. The reactor is about 12 times larger than the one the team had previously tested in the lab and is more efficient than earlier versions, the report says, noting that aviation is responsible for an estimated 3% of global greenhouse gas emissions. A major challenge has been scaling up sustainable processes.

Wind in western states’ renewable energy sails

The long coastline from California to Washington offers a major resource that could help western states meet their climate goals, Michelle Solomon writes in Energy Monitor. With the right support from state and federal governments, floating offshore wind development could create jobs and revitalize coastal communities. That support should include tax credits, labor standards, permitting and leasing, and grid support, Solomon says. According to the report, proposed legislation is encouraging, including California’s AB 525 bill on offshore wind generation, which directs the California Energy Commission to set a planning goal (possibly 20,000MW) for 2045, and Oregon’s HB 3375 bill requiring its department of energy to identify the benefits and challenges of 3,000MW of offshore wind by 2030. And the U.S. Bureau of Ocean Energy Management has begun a leasing process for two wind energy areas in California with an estimated potential of 4,500MW.

Latest findings: New research, studies and projects

Climate financing and compensation issues

Climate financing and compensation have emerged as key themes in the international climate mitigation debate, writes the IMF’s Johannes Wiegand in a paper titled Global Climate Change Mitigation, Fossil-Fuel Driven Development, and the Role of Financial and Technology Transfers: A Simple Framework From the abstract: According to one argument in support of compensation, advanced economies (AEs) have used up much of the atmosphere’s absorptive capacity, thus causing global warming and blocking a similar, fossil-fuel driven development path for emerging markets and developing economies (EMDEs). This paper develops a simple model of a sequential, fossil-fuel driven development process to discuss these issues systematically. … Ultimately, a superior option — for both the world’s climate and growth prospects — is the development of clean energy technologies by AEs and their transfer to EMDEs.

More of the latest research:

Words to live by . . . .

“This grand show is eternal. It is always sunrise somewhere; the dew is never all dried at once; a shower is forever falling; vapor ever rising.” — John Muir.