Why companies have difficulty investing for the very long term

Mark Hulbert explains why the greater profitability produced by better climate policies may be realized only over a long period.

CHAPEL HILL, N.C. (Callaway Climate Insights) — The stock market is an imperfect vehicle for bringing about climate change.

At some level we knew this already, of course. If the markets on their own could have brought about better corporate climate policies, it would have already happened. But it’s still worth exploring why the markets have these shortcomings, since only by doing that can we recognize what must be done to nudge the markets in a better long-term direction.

The markets’ problem, in a nutshell, is that they deeply discount the distant future and therefore invest little to nothing in projects the potential payoff of which won’t be realized until decades from now. This problem is hardly unique to the markets, of course, since it is a general trait of human nature. The dismally poor retirement planning of most Americans is a symptom of this same trait, for example.

Regardless, the inadequacy of the market to value distant outcomes creates problems. Consider the impact of a 14% discount rate, which is close to what corporate CFOs say they use when evaluating projects. In fact, John Graham (a finance professor at Duke University) told me in an email that this rate has stayed quite steady over the many years in which he has conducted the CFO Survey. (Technically, this 14% that the CFOs report is the hurdle rate over which potential projects must jump in order to be pursued. But, Graham added, “in principle the hurdle rate and the discount rate should be the same number.”)

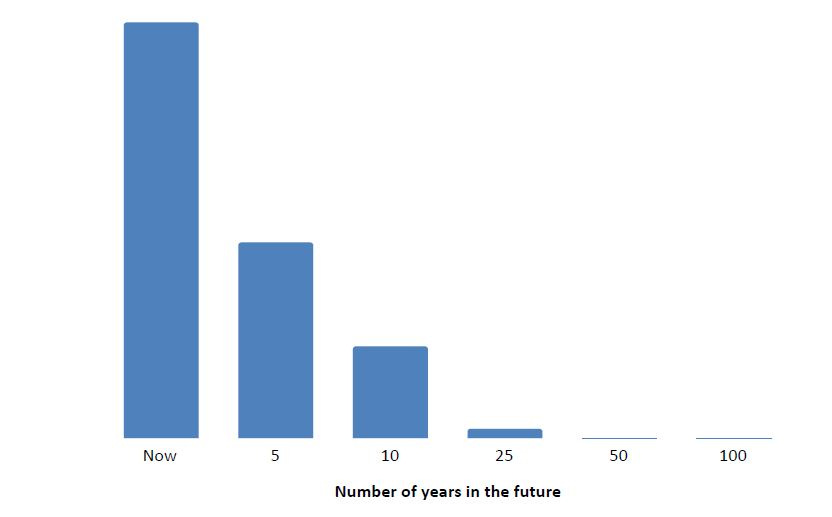

The accompanying chart illustrates how quickly values deteriorate at this 14% annualized clip: $100 in five years’ time is worth just $47.04 today. $100 in 10 years’ time is worth just $22.13 in today’s dollars. By the time our time horizon expands to 50 years or a century, this 14% discount rate has essentially eliminated all value. That in effect means that a company would be willing to spend nothing on a project whose payoff won’t be realized until 50 or 100 years from now.

The descent into nothing

Net present value of $100 at different points in the future, assuming a 14% discount rate.

Source: Hulbert Ratings

You can readily appreciate what this means for climate change. There is little real-world climate difference over the next five years between doing nothing and adopting the most dramatic of measures to change behavior. It’s only when we expand our focus to the next 50 or 100 years that the potential benefits of a good climate policy become starkly evident.

An analogy is how the markets respond to demographic shifts that are highly predictable decades in advance. Consider a 2007 study published in the prestigious American Economic Review by Joshua Pollet of the University of Illinois at Urbana-Champaign and Stefano DellaVigna of the University of California, Berkeley. They focused on companies and industries whose profitability will eventually be greatly impacted by those shifts. They found that those companies’ stock prices didn’t start reflecting those shifts until they were just four to eight years out, even though they had been evident for many years prior.

The professors concluded that investors are “short-sighted and neglect information beyond a horizon of four to eight years.”

In a recent email, DellaVigna acknowledged that the prediction of his and his co-author’s model is that, as in the case of demographic shifts, catastrophic climate changes coming down the pike wouldn’t impact stock prices until they are just four to eight years in the future. He added, though, that in the case of such an “epochal challenge” as saving the climate, investors may “be more tuned in” than in the case of demographic shifts.

We can only hope.

In the meantime, the ESG movement has its work cut out for it in arguing that better corporate climate policies lead to greater profitability. Even with a more tuned-in investment public, the greater profitability produced by better climate policies may be realized only over such a long period that its net present value is essentially zero.

In other words, doing good may not lead to doing well in the stock market. Consider two otherwise identical companies: One that makes no changes to its policies because of climate change, and another that pursues costly climate-friendly projects the payoff for which will come in 50 to 100 years. Chances are good that the stock price of the first will perform better than the second.

That’s a reason to despair only if you thought that you’d be rewarded for doing the right thing. But sometimes virtue has to be its own reward.

Cliff Asness, founder of AQR Capital Management, and someone who is sympathetic to ESG investing, put it this way: “Frankly, it sucks that the virtuous have to accept a lower… return to do good, and perhaps sucks even more that they have to accept the sinful getting a higher one. Well, embrace the suck, as without it there is no effect on the world, no good deed done at all. Perhaps this necessary sacrifice is why it’s called ‘virtue’.”

ESG investing during a pandemic

During the coronavirus-induced bear market over the past six weeks, I should acknowledge, there’s been less interest in ESG investing. Average trading volumes in many ESG-related ETFs have been lower recently than in January, for example, and aren’t likely to rise back to those levels until it looks like the bear market has run its course. That’s understandable, as it’s hard to focus on the long term when short-term survival is called into question.

There’s no sure-fire way of knowing when the bear has breathed his last, of course. One approach that I reviewed recently is based on when the CBOE’s Volatility Index (VIX) hits its peak. On average historically, bear markets bottom two and one-half months after that peak.

The VIX’s peak so far in this bear market occurred on Mar. 18 at 85.47, and it was recently trading 30% lower. Assuming that high holds, then history suggests the bottom will come by late spring/early summer.

(About the author: Mark Hulbert is an author and financial markets columnist. He is the founder of the Hulbert Financial Digest and his Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.)