Why Senate EV vote will ultimately fail despite dangerous path

Welcome to Callaway Climate Insights, your daily guide to global climate finance. Please enjoy and share with your colleagues.

Today’s edition of Callaway Climate Insights is free for all our readers. We really want to bring you the best and latest in climate finance from around the world. Please subscribe now.

The U.S. Senate on Thursday followed through on its threat to revoke California’s rule mandating all cars sold in the state be electric by 2035, setting a dangerous federal legal precedent on state’s rights and impacting at least 11 other states representing 40% of the existing EV market.

But the sinister intent behind the passage — to keep fossil fumes pouring into the atmosphere for as long as possible — is doomed to fail. Ultimately, it will fall victim to market trends as EV prices come down and technology improves.

California currently has more than 1.2 million EVs on the road, representing about a third of the national market. The state has 13 million cars and light trucks and 30 million vehicle registrations, according to Statista. EV sales in California quadrupled in the five years between 2017 and 2022 and although they are now growing slower as federal subsidies are cut and the first adapters have all moved over, falling prices and improving battery ranges will keep them growing to the point that by 2035, they will almost certainly be more than half the market.

In China, EVs are already half the new sales market and in Europe, they are about 15%, with hybrids another 35%. Some countries in Europe, such as Norway, are almost 90% EVs, near-complete saturation.

The actions of Congress and the White House, in addition to creating precedent for further abuse of state laws, are a desperate and hopeless attempt to rollback technology against the will of the market and trends clearly established in many major countries. The battle will now go to the courts, and the increased timeframe will only make global warming’s impact worse.

But a decade from now, we’ll be wondering why anyone ever thought gasoline-powered cars were so great anyway.

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

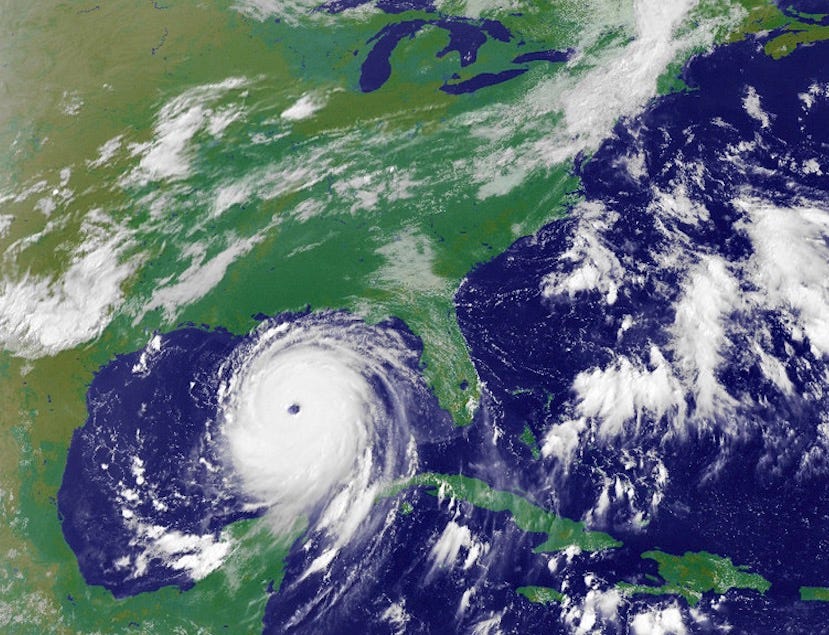

Red states in crosshairs as hurricane season starts amid FEMA rollbacks

. . . . Hurricane season in the U.S. is predicted to be worse than average when it starts in a few weeks, and that’s before the turmoil expected by the White House cuts to federal weather mapping and disaster relief efforts, writes Bill Sternberg. The lack of federal assistance is expected to hit hardest in the most hurricane-prone states, which coincidentally are the red states of Florida, Alabama, Louisiana, and Texas that all supported President Trump’s bid for re-election. Federal weather monitoring staff has been cut by about 12% in the past few months and several centers shuttered, while at the same time the government has authorized more development of fossil fuels that add greenhouse gases to the atmosphere and make global warming more dangerous in the future.

Thursday’s subscriber insights

Jean Rogers speaks out on her move to Pegasus Capital from Blackstone

. . . . We caught up with Jean Rogers this week following the bombshell announcement of her move to Pegasus Capital from Blackstone BX 0.00%↑, and while she’ll be staying in the New York area, her remit will now be more foreign focused.

Rogers will help Pegasus Capital’s David Cogut and team expand their focus on blended finance deals in emerging markets, particularly Brazil, Chile and Mexico. She said she’s looking forward to taking the due diligence practices and research she learned at Blackstone and “taking that into emerging markets where funding is needed and the deals are impactful.”

“These are markets that are really underfunded,” she added, in part because the success of former President Joe Biden’s Inflation Reduction Act in attracting foreign capital into the U.S. in the past few years caused funds to veer away from emerging markets, where they are even more needed.

Cogut said climate solutions in emerging markets are underfunded by between $2 trillion and $4 trillion a year.

“That to us screams opportunity,” he said.

Among the companies Pegasus is currently working with in emerging markets is Mexican solar company Luxon and Brazilian sustainable fertilizer company Agrion.

We expect to hear more from both Rogers and Cogut as Brazil’s COP30 United Nations climate summit approaches this autumn.

Editor’s picks: Will oil boom bust Guyana’s net-zero status?; plus, TVA seeks permit for small nuclear reactor

Watch this video: With its lush rainforests, Guyana is considered a net-zero country by UN climate rules, but a massive oil boom has sparked foreign investment in what some now call “the Dubai of the Caribbean.” CBC’s Kyle Bakx examines what oil production means for Guyana and its unique net-zero status.

First US utility requests permit for small nuclear reactor

The first U.S. utility has submitted a request to build a small nuclear reactor, the Associated Press reports. The Tennessee Valley Authority said this week it has submitted a construction permit application to the U.S. Nuclear Regulatory Commission for a small, modular nuclear reactor. According to the report, the TVA wants to develop next-generation nuclear power at its Clinch River site in Oak Ridge, Tenn. In an exclusive interview Monday, TVA President and CEO Don Moul told the AP, “Nuclear is very reliable, very resilient. It is carbon free. It is what I would consider one of the highest quality generating sources we have.” There are no next-generation reactors currently operating commercially in the U.S. The AP says the NRC is currently reviewing applications from companies that want to build these reactors to begin providing power in the early 2030s.

Latest findings: New research, studies and projects

How can trade help climate agendas?

Trade policies can support or undermine countries' climate agendas, write the authors of a paper titled Making Trade Work for Climate. The work explores whether there is correlation between trade policies and climate clubs, and how trade policies can contribute to climate goals without disproportionately affecting developing countries. Economic integration through international trade can reduce emissions by accelerating the diffusion of clean technologies and low-carbon goods and services, the authors say. Yet trade can also increase emissions, either via increased economic activity or because a global economy integrated through international trade may lead to relocation of emissions to regions with low climate standards, reducing the effectiveness of policies in place. Barriers to the diffusion of clean technologies outside climate clubs limit the effectiveness of climate policy. Authors: Alaz Munzur, University of Saskatchewan - Johnson-Shoyama Graduate School of Public Policy; Katharina Koch, University of Calgary - The School of Public Policy; Jennifer Winter, University of Calgary - The School of Public Policy; University of Calgary - Deptartment of Economics; Environment and Climate Change Canada

More of the latest research:

Words to live by . . . .

“We must dare to be great; and we must realize that greatness is the fruit of toil and sacrifice and high courage.” — Theodore Roosevelt.

I agree and I think more and more of us in California will switch to EVs in coming years, mandate or not.

It's okay. We have two EVs, solar on the roof, and as I write this, we are have a storage battery installed on the side of our house. Gas is $5 a gallon in the Bay Area, and this stands to be a lot cheaper in the long run, not to mention the air quality issue.