Wind stocks caught in market melee as Vineyard Wind project approved

Welcome to Callaway Climate Insights. Only one day until the Gitterman ESG Playbook summit for financial advisers. Details below.

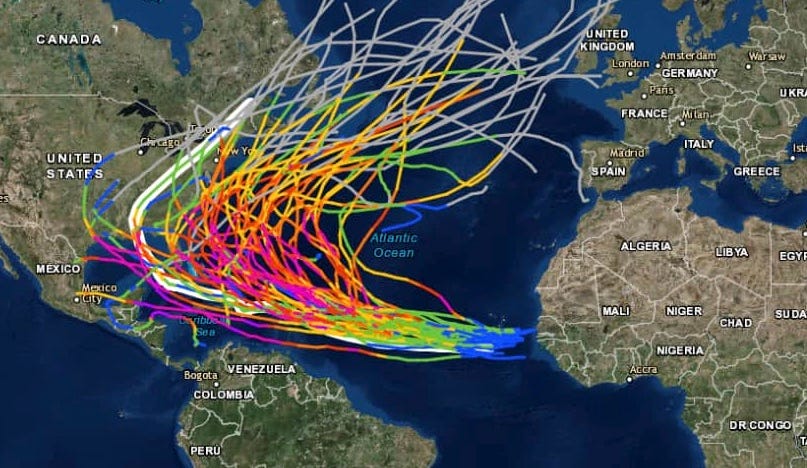

It’s Hurricane Preparedness Week (May 9-15, 2021). NOAA’s Historical Hurricane Tracks is a free online tool that allows users to track the paths of historic hurricanes. View more than 150 years of hurricane tracking data in your region. Above, category 4 and 5 hurricane tracks from 1851-2016 in the East Atlantic ocean basin.

As the chart above shows, most hurricanes in the past century tracked past or close to Martha’s Vineyard, so one thing the new Vineyard Wind project announced by the Biden Administration today won’t have to worry about is wind power.

The announcement marks the U.S. debut in the offshore wind market, with 84 turbines projected to create enough electricity to power 400,000 homes, and create 3,600 jobs. Coming only days after hackers shut down the largest U.S. oil pipeline, the investment in renewable energy is a welcome, er, shift. More than a dozen other new offshore projects are expected to be approved in coming months.

Of course, hackers can threaten wind projects as much as hurricanes. And even though Vineyard Wind is estimated to be up and running in two years, the U.S. is still far behind Europe in its wind aspirations (See Tuesday’s insights). The Biden national infrastructure plan calls for 40 times the power from offshore wind by 2030 that the Martha’s Vineyard project projects it can create when it launches in 2023.

But short term, the ill winds are in the markets, where the world’s biggest wind stocks have been buffeted by the renewable energy selloff this year, itself part of a wider market correction. Big players such as Vestas Wind Systems (VWDRY), Orsted (DK:Orsted), and Siemens Gamesa (GCTAY) are all down 20% to 30% from their January peaks after a monster 2020.

The same selloff that has hit ESG exchange-traded funds, as well as electric vehicle stocks, is hurting the wind play just as the U.S. is adopting it. Of course, these are long-term projects, and cheap money markets will ensure they get completed. But investors in the great renewables shift could be forgiven for noting that the price of oil is currently moving in the opposite direction.

Don’t miss . . .

. . . . Speaking of energy challenges, don’t miss fund manager Jeff Gitterman’s interview with me for his ESG Playbook Summit on Wednesday, May 12, for registered investment advisers. Click here to register.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Tuesday’s subscriber insights: A sample of our best offerings

. . . . The great American shift to renewable energy and electric cars comes with a hefty — and dirty — price tag. Prices of minerals needed for the technology are hitting record highs, and the cost of extracting them could be more pollution. Read more here. . . .

. . . . The Vineyard Wind project off of Martha’s Vineyard was formally announced Tuesday, kicking off America’s entry into the offshore wind market. It’s even better for the European investors behind it. Read more here. . . .

Read all of our subscriber insights by signing up with a 30-day free trial.

Editor’s picks: Mattel wants you to pick up all your old toys

Editor’s picks:

Mattel wants your old toys back. If you’ve outgrown them.

Drought emergency declared in California’s hard-hit Central Valley

U.S. Steel cancels plans for emissions upgrade to Pittsburgh plants

Data driven: Drive on!

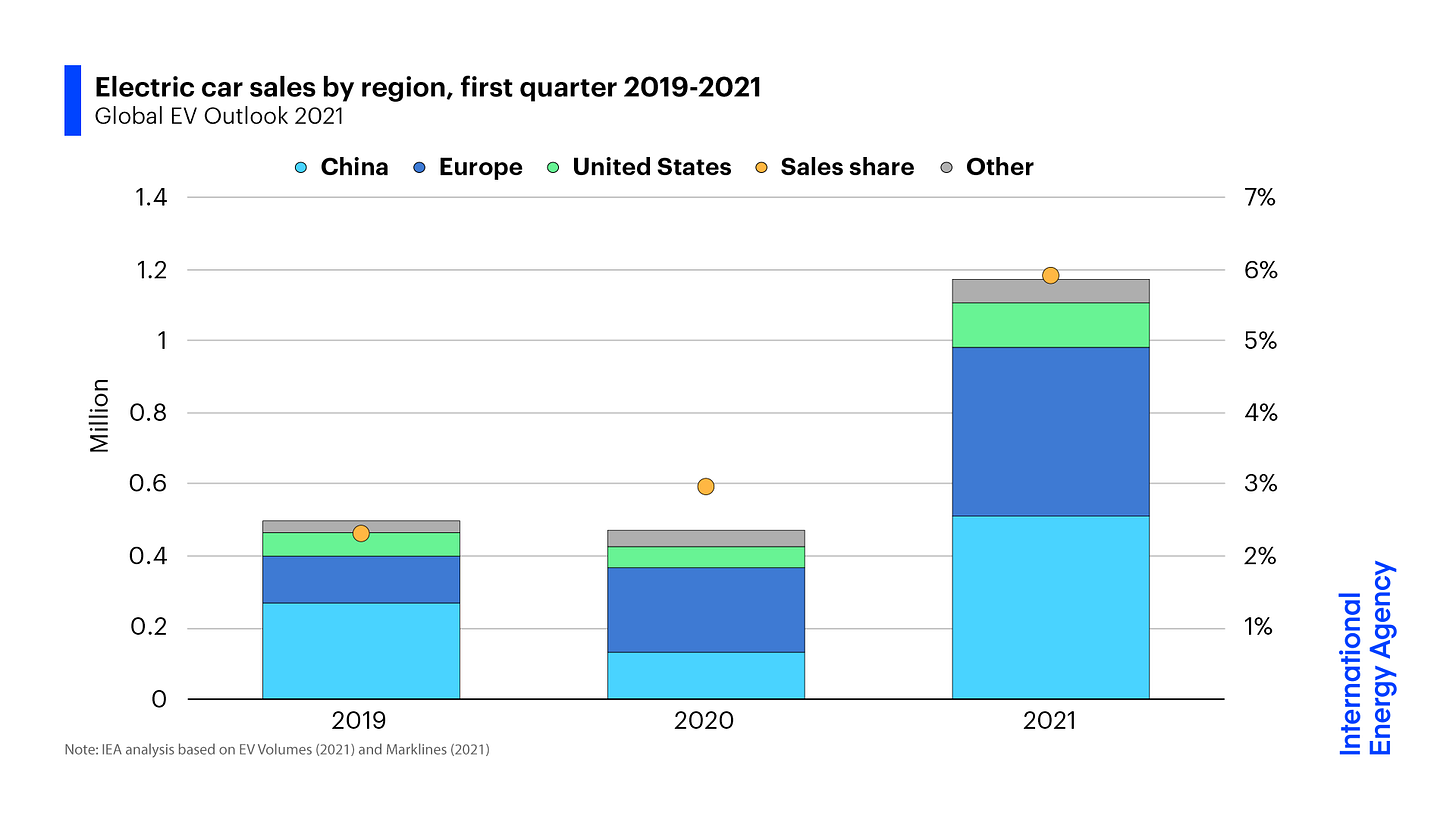

. . . . The International Energy Agency said its Global EV Outlook 2021 report shows accelerating momentum for electric vehicles, despite the pandemic. After a 40% rise over the whole of 2020, electric car sales more than doubled in the first quarter of 2021 from the same period a year earlier. . . .