Your money or your climate

If the younger generation is our hope for a better climate, change may have to come through a channel other than investing

(Mark Hulbert, an author and longtime investment columnist, is the founder of the Hulbert Financial Digest; his Hulbert Ratings audits investment newsletter returns.)

CHAPEL HILL, N.C. (Callaway Climate Insights) — Does your commitment to a cleaner climate have a price tag?

There’s a one-in-three chance that you do.

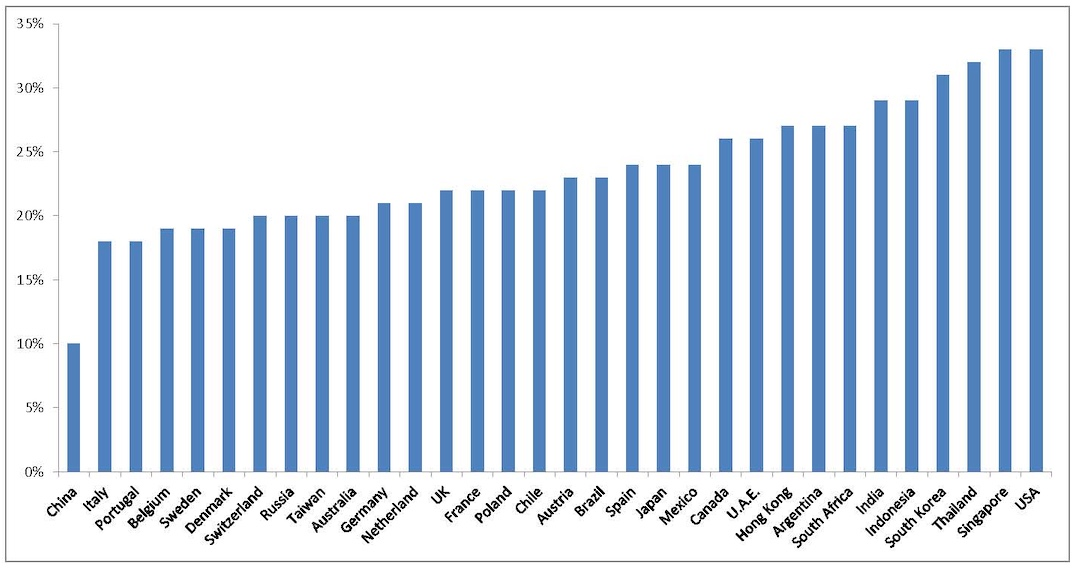

That disheartening statistic comes from a survey of more than 23,000 investors in 32 countries that Schroders Investment Management conducted last year. Some 33% of U.S. investors responded that they would be willing to “compromise their personal beliefs in favor of higher returns.” Investors in no other country in the survey had a higher percentage.

Another disturbing result of the survey was how many Millennials (those aged 18-37) are willing to sacrifice their principles for a higher return. Twenty-five percent said they were willing to do so, compared to just 20% of boomers and 16% of those aged 71 or older. If the younger generation is our hope for a better climate, change may have to come through another channel besides investing.

Not only did the survey determine how many investors have a price tag on their principles, it also determined what their price tag actually is. On average, it’s 21%. That’s the return respondents said would be enough to get them to sacrifice their principles.

Principles for sale

Proportion of investors willing to compromise their personal beliefs for higher returns

It’s hard to know which of these results is more depressing: That so many investors are willing to compromise their principles, or how low their price is. Regardless, this survey shows us the challenges that ESG investment managers face in making climate-friendly investments attractive to clients.

That’s because one of the hallmarks of knowing that our climate-friendly investing is actually changing corporate behavior is that our investment return, over time, will be lower than it would be otherwise. That’s because our goal ultimately has to be increasing the cost of capital for companies with climate-unfriendly practices, and as we remember from Finance 101, a stock’s expected future return is equal to its cost of capital.

Exhibit A in this regard is the performance of tobacco companies. They were some of the earliest targets of socially responsible investing, as long ago as the beginning of the last century. According to the Credit Suisse Global Investment Returns Yearbook 2020, one dollar invested in the U.S. market in 1900 would have grown to $58,191 by the end of 2019, compared with more than $8 million for stocks in the tobacco industry.

To be sure, it would be going too far to say that climate-friendly investors should jump up and down for joy when their investments have below-market returns. It’s not easy to differentiate between an ESG manager who is truly making a difference in the world and an unscrupulous manager who tries to hide his inferior abilities by wrapping himself in an ESG flag. Nevertheless, you can be assured that, if an ESG manager were ever to figure out how to consistently beat the S&P 500 by investing in climate-friendly companies, all other Wall Street managers would quickly follow in his footsteps — regardless of their commitments to a cleaner climate.

Another way of putting this: To the extent you have climate-related goals that go above and beyond what publicly-traded corporations are already doing, then you need to be prepared to earn below-market returns. This need will disappear only if and when all publicly-traded corporations are already pursuing the policies you want.

What about last year?

These comments apply to the long term, of course, and the results in individual years can and often will vary significantly from the historical averages. Last year was very much a case in point.

Consider the returns last year of the 17 ESG funds that S&P Global Market Intelligence identified as having more than $250 million in assets under management. Assuming dividends were reinvested, those 17 produced an average calendar-2020 return of 24.5%, comfortably more than the S&P 500’s 18.4% — and far more than the fossil fuel industry’s return of minus 32.5%, as judged by the Energy Select Sector SPDR ETF (XLE).

If it were always this way, of course, then the climate would have nothing to worry about from investors’ willingness to sacrifice principles for profits. But it isn’t always this way.

The rubber will hit the road when ESG funds significantly lag the overall market, which is inevitable sooner or later. Will you be willing to give them some slack, in the name of cleaning up the climate? Or will your actions betray you as no more than a fair-weather friend of the climate, promoting it only so long as you were beating the market?

Mark Hulbert, thanks for this article, in spite of its rather sobering discussion of the place we Americans find ourselves in the climate change struggle. I do find encouragement in the fact that the market seems to be taking care of this problem all by itself. The rather rapid decline in the coal and oil businesses, the very rapid shifts in the auto industry toward electric vehicles, and the explosion of research and development in the green hydrogen business all point to changes in the thinking in corporate boardrooms that will eventually drag the rest of us along. I would bet that investing with the above mentioned changes in mind will result in above-market returns in the decades to come, making the climate vs. higher returns compromise a non-issue.