ZEUS: Fossil fuels are the new newspapers

For vulture investors, stranded oil and coal assets may be the new big business as carbon nears tipping point

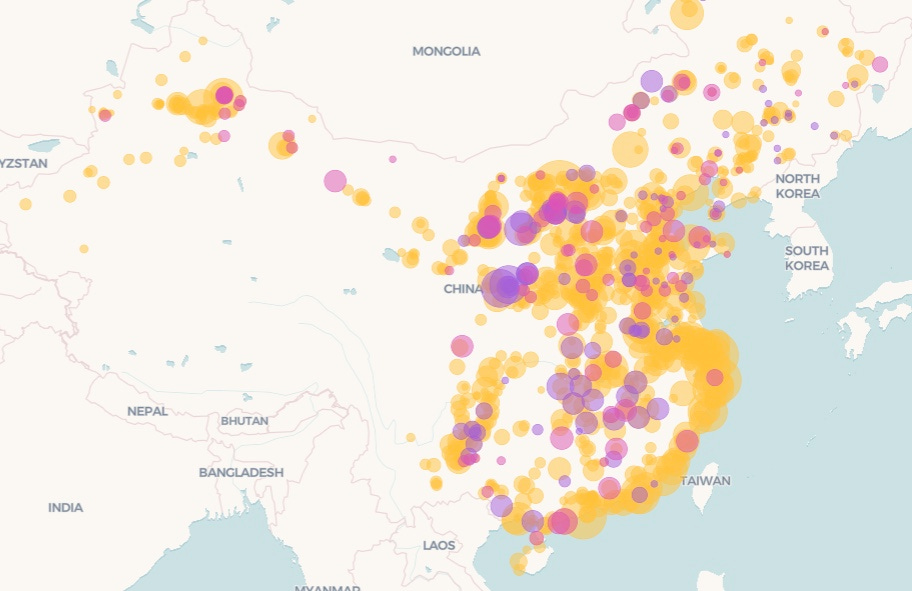

China currently has an estimated 1,037 active coal plants. In the first half of 2021, the country said it plans to build 43 new coal-fired power plants and 18 new blast furnaces — equivalent to adding about 1.5% to its current annual emissions. This image maps coal-fired power plants in China. Operating plants are yellow; new plants are orange; plants under construction are marked in pink and future plants are purple. Data courtesy of Global Energy Monitor. Interactive by Rosamund Pearce/Tom Prater with data wrangling by Simon Evans for Carbon Brief.

(David Callaway is founder and Editor-in-Chief of Callaway Climate Insights. He is the former president of the World Editors Forum, Editor-in-Chief of USA Today and MarketWatch, and CEO of TheStreet Inc.)

SAN FRANCISCO (Callaway Climate Insights) — One of the more depressing things to watch as a journalist is not just the collapse of newspapers in the past decade but the bloodlust of some hedge funds as they squeeze the last of the profits from them.

Once-proud papers in Denver, Chicago, Boston, San Jose, and Orange County, among hundreds of others, have fallen prey to corporate strip-miners with cheap capital, who have cut their hearts out by firing journalists while sucking up the last of the profit margins. One hedge fund, Manhattan-based Alden Global Capital, has made a particularly notorious name for itself in this ruthless, but legal practice.

Now we’re starting to see the same business tactics applied to another set of weak assets, coal mines, oil fields and some water deposits which are near depleted or in other ways almost abandoned. Bloomberg News had a great piece just this week on one such company, Diversified Energy Company, which has bought tens of thousands of used or abandoned oil wells in the Appalachian region in recent years.

As major oil companies such as Exxon Mobil (XOM) and Chevron Corp. (CVX) sell off assets in coming years to meet shareholder and government demands to transition to renewable energy, we can expect more buyers like this on the other side of the trade from the private equity and hedge fund world.

Like the collapse of newspapers, the transition from fossil fuels to renewable energy is going to be messy. In a big report this week, the International Energy Agency forecast that global fossil fuel usage will peak in 2025, just four years from now. And that renewable energy will start to take over.

Trouble is, even as that report hits the streets, coal and oil usage have surged to one of their biggest years in history, as global economies recover from Covid and as an energy shortage this Fall in places such as Europe, China, and India causes governments to fire up more pumps.

Many are looking to global leaders to announce a grand transition plan in Scotland in a few weeks at the UN’s climate summit, COP26, but any such pronouncements are constrained by two glaring realities. Fossil fuel use is rising as the world grapples with shortages in other fuels, and renewable energy is not growing fast enough to replace it in time to avoid the worst impacts of climate change.

Also read, from David Callaway, ZEUS: Here is where the COP26 climate conference will succeed — and fail. Pledging more money is the easy part. But expect international goalposts to be moved, and coal and carbon deals to remain elusive.

Plus, ‘Most businesses wouldn't know carbon if they fell over it’ — our COP26 preview event

The IEA said in its 368-page report that growth in renewable energy such as wind, solar, and hydro power in the next decade will only be enough to achieve about 20% of what scientists say is needed to maintain global temperatures from rising to catastrophic levels. Investment in those new energies needs to more than triple in the next few years, and oil and coal usage must shrink and then end.

In the gray area of this future transition, there is money to be made for risk takers willing to buy assets that might soon go out of favor. Not just for those who think the IEA is wrong, and that oil and coal use will be robust for at least a few more decades, but for those willing to bleed the assets for profit no matter which way they go.

Private equity in particular has invested more than $1 trillion in energy in the past decade, with only about 12% going into renewables, according to PitchBook data cited by The New York Times.

How this impacts the fight against global warming depends largely on the speed with which the opportunity for profit swings to renewable energy from oil, coal, and stranded assets such as old wells. Despite good intentions in Europe and the U.S., where President Biden’s infrastructure bill is currently a legislative stranded asset, this opportunity is not yet big enough, according to the IEA.

To make it happen will require a massive rise in government spending, particularly in emerging markets, which is why the international effort to raise $100 billion a year for small country transitions is a priority for Glasgow. I think it will be achieved.

Still, it’s clear that the actual turning point is still years away, and that most likely we will not notice until a few years after we get there. Each day oil prices hit new highs this month prolongs that turning point just a little longer. We will get there. The political will is there, if not the money. We just won’t notice right away.

In the meantime, like with newspapers and printers’ ink, and for all the wrong reasons, fossil fuels will not go quietly.