ZEUS: Hong Kong's ESG plan, a talk with Elsa Pau

As the world waits for China's next climate move, one Hong Kong entrepreneur prepares for the ESG revolution

(David Callaway is founder and Editor-in-Chief of Callaway Climate Insights. He is the former president of the World Editors Forum, Editor-in-Chief of USA Today and MarketWatch, and CEO of TheStreet Inc.)

SAN FRANCISCO (Callaway Climate Investors) — It’s been years since I’ve been to Hong Kong, one of my favorite cities, but friends there paint a very different picture these days. Between aggressive lockdowns and a steady squeezing of freedoms from Beijing, the city’s reputation as an international business center has taken a huge hit.

But business goes on there, and like everywhere else, reading the tea leaves of how China will present its climate case to the world in coming weeks is a delicate art. At our Dublin Climate Summit yesterday, I was on a panel that discussed how fighting climate change could be one of the narrow windows of cooperation between the U.S. and China in coming years, but a lot depends on Beijing.

For Elsa Pau, a popular publisher and investment adviser leading a new charge into ESG metrics, the China spending potential outweighs the challenge of greening Hong Kong, where she says there is still little recycling infrastructure and the air conditioners are still running in empty office towers.

“China has put the most investment into emissions control,” she said in a Zoom interview from her home office there. “I’m pretty confident China will be a leader in ESG in the next 10 years.”

Pau is CEO of publisher WealthAsia Group, which oversees one of the region’s most popular annual fund awards, the Benchmark Fund of the Year Awards. She was once voted one of Asia’s most influential women. Now, Pau is sufficiently excited about environmental, social, and governance investing trends to try to enter the business with a new fintech portal she claims will be the industry leader in ESG metrics.

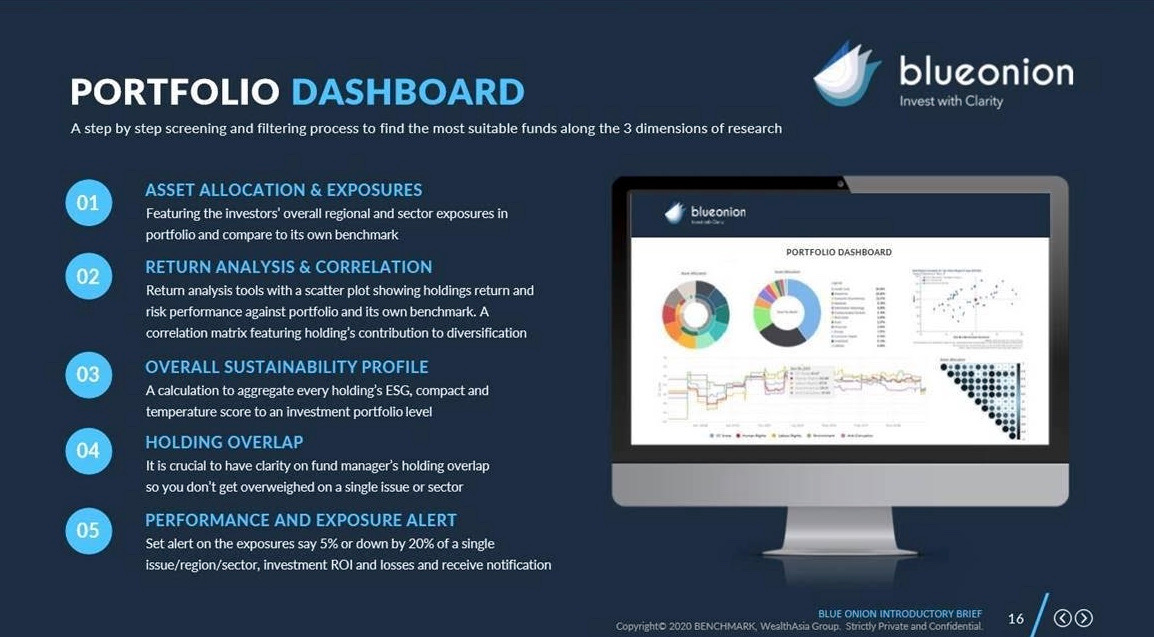

BlueOnion was unveiled late last year and a second iteration is set to launch next month. It sprang out of a project to digitize years of fund awards data at Benchmark magazine. Like many fund screeners, it contains performance data, holdings, profiles of portfolio managers, etc. But Pau has combined AI with a host of ‘qualitative’ metrics to dive deep into the personalities of the funds and allow more advanced screening for her subscribers.

For example, there is is a temperature scale, which measures how the assets of the funds are complying with the limits of the Paris Agreement, and whether operating together the fund would make or miss the accord’s threshold of holding the rise in the average global temperature to 1.5°C. above pre-industrial levels.

There is a screen for what the underlying holdings of the fund do, to weed out companies that invest in alcohol or guns, for example, or pork, which would disqualify many Middle Eastern investors. And there is a screen for the profiles of the fund managers, helped by a due diligence questionnaire of some 500 questions, to raise flags on things like past scandals or arrests.

“It’s very much an enhanced version of a search engine,” she said. “The idea for innovation came from necessity. We couldn’t find it in the marketplace. It’s very important we have what the manager is putting in the fund and its alignment with the Paris Agreement.”

Pau singles out BlackRock (BLK), the world’s largest asset manager, for its oil holdings while its CEO Larry Fink talks about holding the market’s feet to the fire on climate change. “Every time Larry Fink comes out with something, I have a headache. Because of how much oil they own.”

BlueOnion, whose name Pau came up with while dining with a friend and looking at her plate, is meant to signify peeling back the details of a fund as one would an onion. Designed for the institutional buy side, it currently tracks 47,000 funds across 125 sectors in 14 countries, she said.

BlueOnion is another example of how fast ESG metrics are moving, with S&P Global and Morningstar both making significant gains in recent weeks as well in terms of providing data for ESG investors. The Sustainability Accounting Standards Board, founded a decade ago in San Francisco, is still the backbone of most quality ESG metrics. But 2021 is set to be the year a next generation innovates off of it as climate investing becomes more mainstream.

As for Hong Kong itself, Pau says it has a lot of catching up to do, and hopefully China’s spending will include it at some point.

“Quite sadly, I don’t think Hong Kong is going to do well. We haven’t started anywhere,” she said. “If you look at Taiwan, Japan, they are way ahead of the game.”

A lot will depend on China’s five-year plan, due to be announced next month. Pau for one, is expecting ESG investors, even in Hong Kong, will be surprised.