Amazon's bid to save the world looks a better bet than Wall Street -- for now

Welcome to Callaway Climate Insights. We're publishing twice a week now, and collecting feedback. Please share this; we look forward to hearing from you.

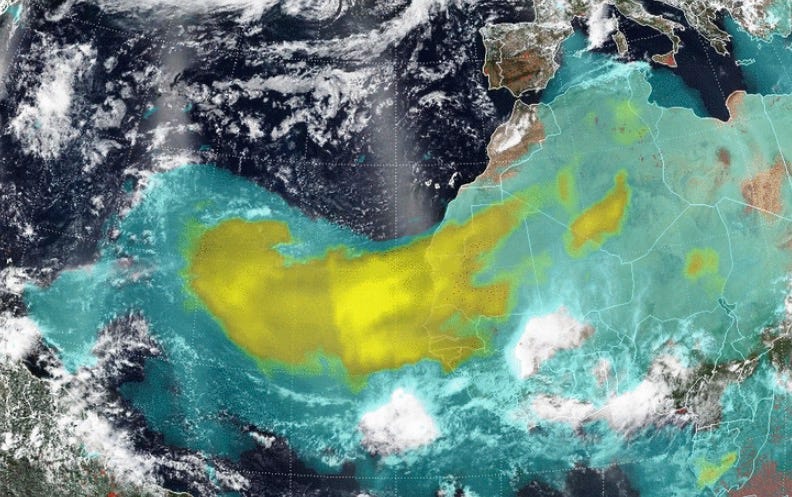

It’s coming: This image shows the aerosols in the giant plume of Saharan dust blowing off the western coast of Africa, expected to reach the U.S. this week. Image: NASA/NOAA, Colin Seftor.

LATEST NEWS AND INSIGHTS

Amazon’s $2 billion climate tech fund steals a step on Wall Street

BlackRock shows the money with six new climate ETFs

Two-thirds of Americans believe government should do more on climate

The bill for the U.S. shale boom is about to come due — for taxpayers

How do you like Callaway Climate Insights so far? As we approach our 20th edition, we’d love to hear your thoughts. Here’s a question: How can we expand our coverage of ESG investing? Please email me directly at dcallaway@callawayclimateinsights.com. Look forward to hearing from you.

SAN FRANCISCO (Callaway Climate Insights) — A big impetus for companies to become more climate friendly in coming years will come from their boardrooms, where the more climate-focused directors are involved the better. Activists are already pushing for such change, and in particular pushing for more women on boards to help them find new direction.

Against this backdrop, one of my old companies, BoardEx, a leading relationship mapping and intelligence service based in London, is out with its annual Global Gender Diversity Report.

It's a fascinating breakdown of boardroom progress, albeit more at the speed of a moving glacier than a melting one so far. The U.S. has six companies in the top 25, including ViacomCBS (VIACA), Omnicom (OMC) and General Motors (GM). But it is still ranked 18th, based on the volume of companies with poor board diversity. I'm linking to it here for any investors or directors who want a free download.

But I call your attention to the section on sectoral analysis, which shows that the media and retail sectors are the most successful in diversifying their boards whereas industrials and real estate are the least prone. BoardEx doesn't take a stab at explaining why, though it suggests there might be reasons outside the data. Indeed.

Climate change, as you see from the satellite image above of the Saharan dust cloud bearing down on Florida this week, is a moving target. The battle to address it at the boardroom level is getting outpaced.

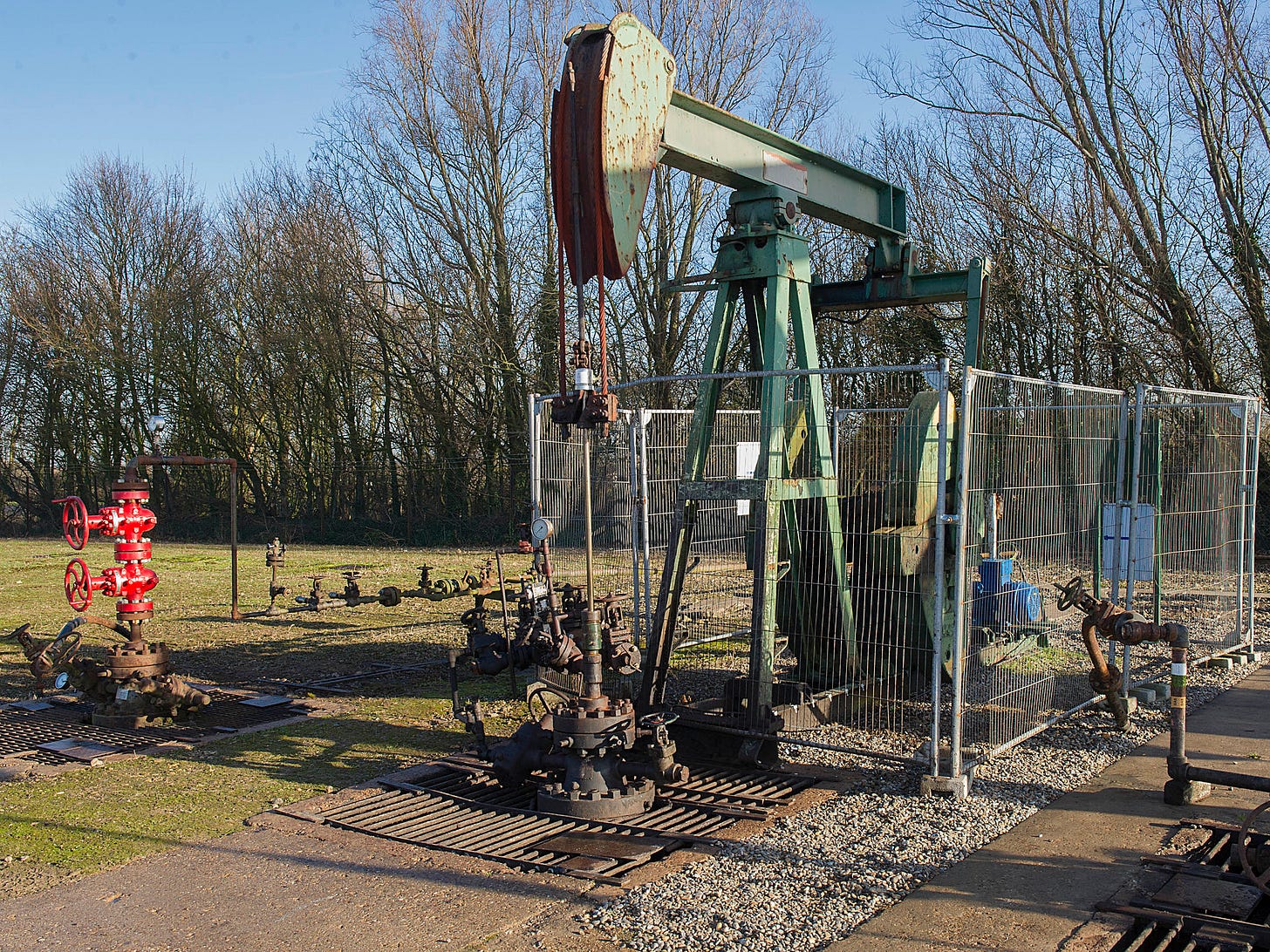

. . . . Check please. The shale boom in the U.S., now past its peak and fading fast with oil at $40 a barrel, is about to ignite a new controversy. A report out from Carbon Tracker this week raises the possibility that taxpayers might have to foot the bill for plugging the more than one million shale digs the oil and gas industry have ripped up in the past 14 years since shale drilling (fracking) became popular.

The biggest shale basins, in places like Texas and Louisiana, Pennsylvania and North Dakota, have always been controversial. Activists accused them of everything from polluting local water to causing minor earthquakes. But at their height 10 years ago, shale oil helped make the U.S. energy independent of the Middle East for the first time, and made several companies and individuals rich beyond measure.

Now we’re seeing the other side of the peak. A recent study by Deloitte LLP, reported by Bloomberg News, estimates that a third of the industry is technically insolvent, after burning through $342 billion in cash in the past decade. With money running out, taxpayers might be the only choice. A microcosm of our climate problems if there ever was one. . . .

. . . . Battle of the Titans: The race to fund climate solutions is beginning to look a lot like the age-old battle between Silicon Valley and Wall Street. Amazon (AMZN) announced a $2 billion climate tech fund this morning to invest in climate entrepreneurs and startups, stealing a march on BlackRock, which announced six new ETFs Monday to invest in environmental, social and governance (ESG).

Hard not to bet on Amazon in this case, in terms of speed to market. The Climate Pledge Fund will allow Amazon to cherry-pick startups and ideas that can directly contribute to its business, among other things. And the company, which already has a $100 million climate fund, said as part of its annual sustainability report that it is now on track to run its global operations on 100% renewable energy by 2025 — five years ahead of schedule.

BlackRock’s new products underscore leader Larry Fink’s pledge back in January to expand the company’s offerings of ESG investments and to rid its active balance sheet of fossil fuel investments. In putting the company’s money where Fink’s mouth is, the company is also climbing on board a surge in ESG investing in the first half of this year that has seen about $13 billion come into the sector, according to Bloomberg. The funds will come with BlackRock’s popular iShares tags. . . .

. . . . Meanwhile, in Washington: More than two-thirds of Americans think the government is not doing enough to invest in solutions to climate change, according to a Pew Research Center survey released this morning. Among the ideas supported strongly by both sides of the political aisle are tax credits for carbon capture and storage projects. As I’ve said before, you can’t tax your way to a greener world. But you can certainly avoid taxes along the way. . . .

Startup upstarts: Benji Backer, 22, American Conservation Coalition

. . . . Benji Backer is happy to discuss politics with you. Just not when it comes to climate change.

“This is a generational issue — we don't see this through a political lens,” said the 22-year-old founder and president of the American Conservation Coalition, a non-profit group dedicated to encouraging conservatives to engage in climate change discussions. . . .

News briefs: NWF urges climate action; plus infrastructure investments

Watch this: The carbon cycle is key to understanding climate change | The Economist

Editor’s picks:

National Wildlife Federation urges Congress on climate change

Green infrastructure can fuel the post-coronavirus economy

Climate change, Covid-19 boost air-conditioner sales

Data driven: Where the sun shines

. . . . Everybody seems to be talking about renewable costs going down, so we turned to the International Renewable Energy Agency to find out how much. The cost for utility-scale solar photovoltaic power has declined 82% since 2010 and the costs for onshore and offshore wind have declined 39% and 29%, respectively, IRENA said in a report this month.

Replacing the costliest 500GW of coal with solar PV and onshore wind next year would cut annual power system costs by up to $23 billion and reduce yearly CO2 emissions by around 1.8 Gt- (gigatons) equivalent to 5% of total global CO2 emissions in 2019. . . .

Above, solar panels at Arizona State University in Phoenix. Photo: edwardhblake/flickr.

Latest findings: New research, studies and papers

Above, a NOAA satellite image from March 2020 shows almost no snow cover in the Sierra Nevada, due to the exceptionally dry 2019-2020 winter.

How California drought led to higher power costs and emissions

In a recent study, a team led by a researcher from North Carolina State University analyzed the downstream effects of a drought in California that took place in 2012-2016, and was considered one of the worst in the state's history. They found that drought led to significant increases in power costs for three major investor-owned utilities in the state, but other weather-related events were also likely the main culprit behind those increases. They also found that increased harmful emissions of greenhouse gases could be linked to hydropower losses during drought in the future, even as more sources of renewable energy are added to the grid.

Asset diversification vs. climate action

Asset pricing and climate policy are analyzed in a global economy where consumption goods are produced by both a green and a carbon-intensive sector. We allow for endogenous growth and three types of damages from global warming. It is shown that, initially, the desire to diversify assets complements the attempt to mitigate economic damages from climate change. In the longer run, however, a trade-off between diversification and climate action emerges. We derive the optimal carbon price, the equilibrium risk-free rate, and risk premia. Climate disasters, which are more likely to occur sooner as temperature rises, significantly affect asset prices.

Authors: Christoph Hambel, Goethe University Frankfurt; Holger Kraft, Goethe University Frankfurt; Rick van der Ploeg, University of Oxford

CEPR discussion paper via SSRN

Domestic support under the WTO Agreement on Agriculture

This paper evaluates the space the domestic support rules of the WTO Agreement on Agriculture (AoA) generate for different members to provide support subject to limits and exempt from limits. It reviews economic analysis of direct payments and market price support (MPS) and summarizes discussions over the information members notify to the WTO. The paper highlights the domestic support issues in the ongoing negotiations and recognizes that new policy priorities have gained prominence, notably climate change but related also to productivity growth, biosecurity, water management and biodiversity.

Authors: Lars Brink; David Orden

International Agricultural Trade Research Consortium via SSRN

That’s it for today. Remember to send me your thoughts on how we can expand our coverage of ESG investing; email me directly at dcallaway@callawayclimateinsights.com.