Biden's EV order first of the grand targets of the countdown to COP26

Welcome to Callaway Climate Insights. We've begun the mad rush to this Fall's global climate summit. Please enjoy our analysis and share with your colleagues.

Callaway Climate Insights publishes Tuesdays and Thursdays for everybody. To get our insights and analysis every day, please subscribe.

In the pantheon of dramatic climate pledges, President Joe Biden’s Thursday on electrifying the U.S. car industry in the next decade was about as telegraphed as they come, back to his pre-election campaigning, in fact.

But whether America achieves 50% EV sales by 2030, and manages to keep its labor unions happy in the process, and doesn’t snub foreign car makers or even Tesla for that matter in its rush to message made-in-America, doesn’t really matter. It’s the sheer ambition of the plan that will make headlines this week. The first of a series of grand climate announcements we can expect in the next three months leading up to the COP26 global climate summit.

As I forecast in my ZEUS column below, we can expect to be deluged with these momentous targets in the coming weeks, despite the fact that most of them will be hopelessly unachievable. Still, in a summer that has demonstrated for the first time the true horrors of what is to come from global warming, a surge in optimism and ambition is exactly what investors need to see to maintain the pace of funding for the great transition from the fossil-fuel era.

In our subscriber insights section below, we break down the winners and losers expected from the Biden plan. Correspondent Mark Hulbert also takes a crack at calling the forces behind what could be a global reset as markets take on the true underlying risk of climate change in the next few years.

With great change comes great opportunity. The next 12 weeks will start to lift the veil on where, and with whom, investors should place their bets.

Callaway Climate Insights will be on holiday next week and will return on Tuesday, Aug. 17. More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Callaway Climate Insights indexes: Solar stocks pop on earnings

. . . . Shares of at least some solar energy stocks have seen sharp gains in recent days following strong financial reports for the second quarter. Names like First Solar (FSLR), SolarEdge Technologies (SEDG) and Enphase Energy (ENPH) have all seen shares pop after their latest results. Strong comps against pandemic-suppressed results from a year ago have helped. In addition, new demand from construction and infrastructure initiatives in the U.S. are seen driving growth in the sector.

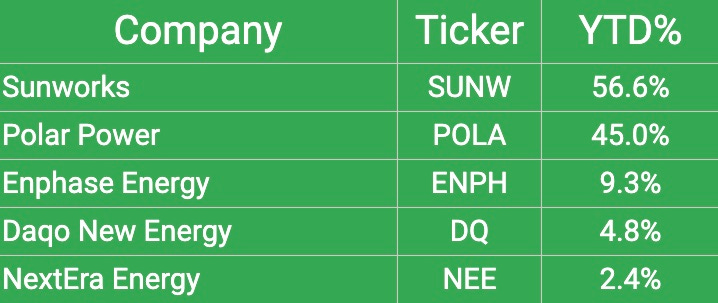

But with all that, it’s worth bearing in mind that relatively few names in the sector are actually up for the year. Of 17 companies followed in the Callaway Climate Insights Solar Index, only five are up year-to-date. The CCI Solar Index itself is off about 7% for the year. Similarly, the Invesco Solar ETF (TAN) is down about 16% through the end of July. . . .

ZEUS: How the next 12 weeks before COP26 could set the stage for a global carbon market

. . . . Expect a rising sea of new net-zero pledges from large global companies and many countries in the next 12 weeks leading up to COP26, but don’t expect them to make a big difference, writes David Callaway. Available land used to offset greenhouse gas emissions is already dwarfed by the size of the polluting world’s commitments to account for it against its fossil fuel burning, according to a new report. Instead, expect the supply-demand equation to unleash new momentum for a global carbon market, with prices rising sharply to curtail pollution spending. Market forces may be the only hope to break geo-political gridlock. . . .

Markets are missing climate risk; that's an opportunity

. . . . Global financial markets are vastly underestimating the risks of climate change, according to a massive new survey of investors, regulators, and international lenders. Mark Hulbert asks how if everybody believes the market is not prepared, why doesn’t it correct, as efficient markets normally do. The answer may be in the speed with which it will correct, and the triggers behind it, in short, the actions of large institutional investors. If true, it presents investors with a big new opportunity. . . .

EU notebook: Europe must rethink debt obsession to adapt to growing climate emergency, top central banker warns

. . . . European capitals will need to get past their obsession with meeting EU debt requirements and more closely align their fiscal policies to keep the economy competitive as they go to war against global warming, a top banking official said this week. Stephen Rae in Dublin looks at Irish central bank chief Gabriel Makhlouf’s argument that growing while remaining carbon neutral will require coordination akin to what the EU pulled off during the Great Financial Crisis a decade ago. Tighter fiscal control in the EU has always been one of the elusive goals of the single European market after the euro was introduced, but never quite achieved. . . .

Thursday’s subscriber insights: Winners and losers in Biden’s new EV pledge

. . . . President Biden’s new pledge Thursday to toughen U.S. fuel-standards and boost EV sales to 50% of all vehicles by 2030 will require an overhaul of the entire American auto industry. We look at the winners and losers to come. Read more here. . . .

. . . . From risk metrics companies to insurers to makers of air purifiers, the world’s long, hot climate summer this year is suddenly creating huge opportunities for those focused on mitigating global warming. Check them out here. . . .

. . . . A Democratic proposal for a retroactive tax on fossil fuel giants for two decades of polluting stands little chance of passing, but for climate advocates, even success would leave the majority of polluters out of the line of fire. Read more here. . . .

. . . . Electric vehicle sales grew at a faster pace than hybrids and plug-in hybrids for the first time in the second quarter, but supply chain shortages of key minerals for electric batteries are forcing automakers to return to an old gas-engine favorite to keep up with demand. Read more here. . . .

Editor’s picks: Moody’s buying risk assessment provider RMS for $2 billion; Norway tops in renewable energy

Watch the video: The global economy now faces a rubber shortage because of multiple supply chain disruptions. “We could be on the cusp of a rubber apocalypse,” Ohio State University professor Katrina Cornish tells CNBC. Rubber producers are working against all odds: climate change, disease and the fight for shipping containers. The global rubber market was valued at nearly $40 billion in 2020, but one analysis predicts the natural rubber market could be worth nearly $68.5 billion by 2026.

Moody’s to acquires risk assessment provider RMS for $2 billion

Moody’s says it will acquire RMS, a leading provider of climate and natural disaster risk modeling and analytics, for $2 billion from Daily Mail and General Trust plc, ESGToday reports. RMS is a leading provider of climate and natural disaster risk modeling serving the global property and casualty (P&C) insurance and reinsurance industries. The company’s solutions enable organizations to evaluate and manage risks from events such as hurricanes, earthquakes, floods, climate change, cyber, and pandemics. According to Moody’s the deal will significantly accelerate the company’s integrated risk assessment strategy for customers in and beyond the insurance industry. With estimated RMS revenues of approximately $320 million, the acquisition immediately boosts Moody’s insurance data and analytics business to nearly $500 million in revenue.

Norway tops in renewable energy

Norway is the country with the highest share of renewable energy in the world, according to new data. A study by energy tariff comparison platform Utility Bidder reveals the top 20 countries in the clean energy field, as well as those which rely most on fossil fuels, according to a report this week in EuroNews.com. The fossil fuels measured were coal, oil and natural gas, while renewable sources were biofuels and waste, wind, solar and hydro using data from the International Energy Agency.

Redfin adds climate change risk data to real estate site

Online real estate brokerage Redfin says it will now publish climate risk information for every location page on its website. Visitors to Redfin.com who want to understand the climate risks for fire, heat, drought and storm over a 30-year period to any area in which they’re searching for a home can now see a ClimateCheck rating from 0-100 associated with the county, city, neighborhood and ZIP code of the property they’re checking. Redfin said in a news release that ClimateCheck, a company that measures an area's risk for climate-related disaster, provides the data and, currently, it is available throughout the contiguous U.S.

Latest findings: New research, studies and projects

Climate change and western wildfires

A team of scientists from leading research universities, conservation organizations and government laboratories across the West has produced a synthesis of the scientific literature that clearly lays out the established science and strength of evidence on climate change, wildfire and forest management for seasonally dry forests, Michelle Ma reports for the University of Washington. The goal is to give land managers and others across the West access to a unified resource that summarizes the best-available science so they can make decisions about how to manage their landscapes. According to a report published in the Ecological Society of America journals, these three articles in the collection evaluate the strength of scientific evidence regarding changing forest conditions, fire regimes, and science-based strategies for adapting western forests to climate change and future wildfires.

More of the latest research:

“The past year has cruelly and emphatically underscored the global challenges before us. The truth is that climate change, poverty, and social justice are inextricably linked, as are their solutions. In this make-or-break decade, we must all work together to implement solutions in a meaningful and comprehensive manner — one that can deliver more durable, more sustainable, and more just outcomes for billions around the world.” — M. Sanjayan, CEO of Conservation International.