Climate change with Chinese characteristics; and EV stocks look for a bounce

Welcome to Callaway Climate Insights. It's been a rough week in the global warming battle. Please enjoy, and share.

Months-long expectations for a bold climate plan from China were dashed over the weekend after the world’s largest polluter laid out only moderate ambitions for any action over the next five years. But perhaps people looking to the centralized government’s five-year plan for action were looking in the wrong place. Analysts say much of the heavy lifting on China’s renewable energy and electric vehicle growth will be at the company level or provincial level — in other words, out of sight of international researchers. That takes Xi Jinping’s government off the hook on missing targets and gives Xi more leverage in coming negotiations with the Biden team on other geo-political issues, such as Taiwan or the South China Sea.

The government did outline plans to bump up nuclear energy generation in the next five years, a surprise which gives China more geo-political leverage and adds a big new player to the growing list of countries advancing nuclear as a renewable power source.

A third place to look might be to China’s fledgling carbon market, which it outlined plans for last month. Citi issued a note this morning saying it expects the carbon market to grow 30-fold over the coming decade as more Chinese companies are required to pay for their greenhouse gas emissions.

The carbon market joins markets in California and Europe, where the EU Emissions Trading System is the most advanced. Together, they will account for about one-fifth of global emissions, according to Citi, though China is starting somewhat small by only including its electricity companies in it.

While the U.S. has historically shied away from carbon pricing on a grand scale, the China market could, uh, light a fire under reluctant legislators as other competitive markets develop. Putting a price on emissions might be the only effective means of finally getting companies to pare pollution.

As China proved so deftly this weekend, international diplomacy only goes so far.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Monday’s insights: EV adoption threatens grid; Goldman's supply chain

. . . . The expected boom in electric vehicles in coming years will force a shaky U.S. grid system to more than double its capacity, requiring an estimated $200 billion in new investment. A tall order after witnessing what happened in Texas. Read more here. . . .

. . . . Goldman Sachs placed its latest climate pledge on its supply chain late last week, with CEO David Solomon claiming the bank spent $93 million in climate-focused investments last year. Solomon touted growing capacity in Goldman’s renewable investments in the U.S. and India and said the bank will this year focus more on helping clients better disclose their climate plans. Read more here. . . .

. . . . While shareholder cash payments may have continued to roll in 2020 from Big Oil, a new report says most of the largest companies are using new debt to finance them as free cash flow falls. The era of ringing dividends from some of the largest companies in the world may be coming to a close. Read more here . . . .

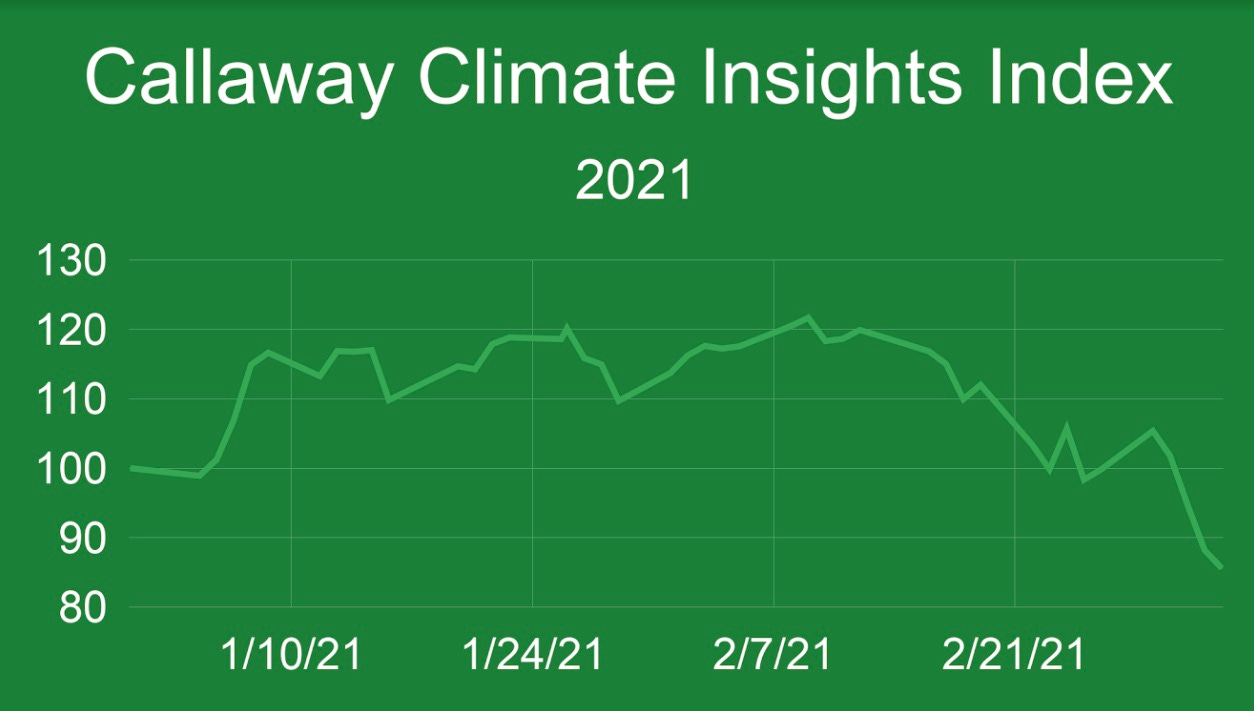

CCI Indexes: March comes in like that lion

. . . . Climate index stocks were hammered in the first week of March amid market volatility tied to rising interest rates. Read about the winners, the losers and earnings reports for the week ahead. . . .

Kerry, Timmermans to meet in Brussels Tuesday

In our inaugural #DublinClimateSummit recently, European Climate Commissioner Frans Timmermans offered an enthusiastic call for Europe to rebuild from the Covid crisis in a way that addresses its pressing global warming problems, ranging from energy efficiency in its centuries-old cities to carbon trading and smart agriculture.

He also discussed his friendship with John Kerry and said he’s already talked with key U.S. Senate committee members on climate cooperation with the new Biden Administration. Key to European goals are to take the €1.8 trillion ($2.2 trillion) allocated to economic recovery and to use it in green ways, unlike the money spent on recovery from the Great Financial Crisis a decade ago. “Too much money was spent on re-establishing parts of our economy then, that were not part of our economic future,” Timmermans said. Also during the event, Ireland’s Green Party leader Eamon Ryan said of Kerry, “he has taught us everything,” referring to Kerry’s role in establishing the Paris agreement. “We need to collaborate with the new Biden administration to achieve our zero-carbon goals,” Ryan said in his summit remarks.

We’re pleased to provide the full recording from our inaugural Dublin Climate Summit: Watch the full recording of the webinar here.

Data driven: Hydrogen could account for 25% of our energy supply

. . . . Hydrogen could account for a quarter of the planet’s energy supply by 2050, Natasha Luther-Jones, DLA Piper’s international co-head of sustainability and ESG, wrote in her firm’s Hydrogen Report recently. That relies on quite a few assumptions and tremendous buildout in the industry, given that hydrogen accounts for a negligible amount of the planet’s energy mix today, but isn’t baseless as Europe has 17GW worth of planned electrolysis operations to be constructed by 2030, compared to under 1GW today. . . .

News briefs: Energy department's loan program revs up again

Editor’s picks:

DOE’s clean-energy loans crank back to life

Tiny Singapore goes big with floating solar farms

Kerry twists arms during whirlwind world tour