Climate's inequality equation threatens recovery; plus Citi's transition team

Welcome to Callaway Climate Insights. We've had a surge in subscribers this month thanks to sharing of this newsletter. Please enjoy, and share.

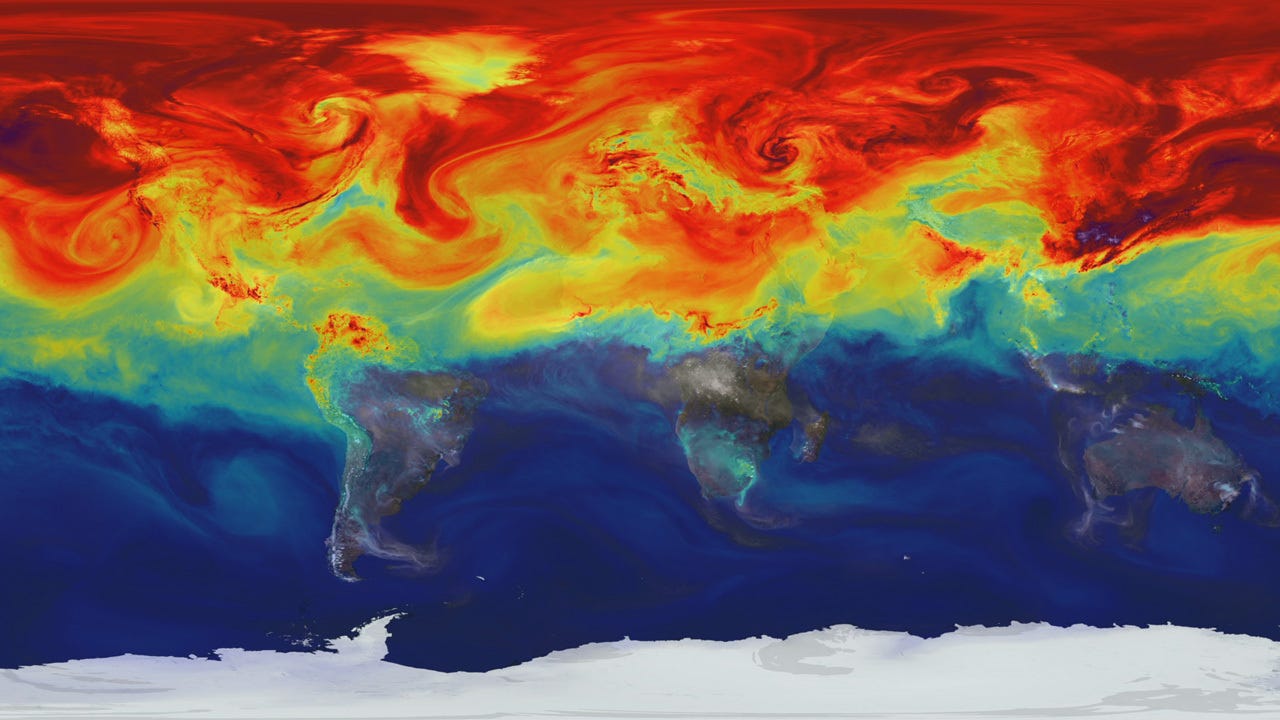

A NASA study has confirmed with direct evidence that human activities are changing Earth's energy budget, trapping much more energy from the Sun than is escaping back into space. This supercomputer model image shows how greenhouse gases like CO₂ fluctuate in Earth’s atmosphere throughout the year. Higher concentrations are shown in red.

Of the many concerning results of a landmark survey of economists out today about the costs of climate change, one leaped out. Inequality among rich and poor countries in handling global warming will be mirrored within those countries as well.

The survey by New York University School of Law’s Institute for Policy Integrity of 738 economists said the cost of fighting global warming in a few decades will far outweigh the cost of rapidly reducing greenhouse gases now, and it will result in a startling disparity between rich and poor countries.

But the findings that it will increase inequality within countries portends dramatic struggles ahead that will dwarf today’s scramble for Covid vaccines. Already at the tipping point of inequality in places such as the U.S. and in Europe, the threat of climate inequality could rip some countries apart from within just as they need to work together.

“Rich people within countries will be better able to mitigate the impacts than poor people,” Peter Howard, economics director at the Institute, said in an interview. “There’s pretty good evidence that the U.S. would see the same type of impact.”

Against this backdrop, the present administration’s push to make fighting climate change a jobs priority takes on a new urgency.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Tuesday’s insights: In new green recovery, is there a role for old labor? Plus, Citi’s transition team.

. . . . Creating thousands of new jobs in a green transition to clean energy sounds great, but is there a role for old labor practices? Two new projects aim to find out. A massive wind project off the coast of Long Island and a jobs training law in Illinois both promise to put union jobs at the forefront of their green efforts. The projects will test the limits of new technologies to solve inequality. Read more here. . . .

. . . . Citi CEO Jane Fraser is keeping her promise to put climate change at the top of the banking giant’s priorities, with a new investment banking group announced Tuesday to help clients transition to clean energy. The plan is a bet by Citi, one of the largest financiers of polluters, that helping its fossil fuel clients change focus will be more profitable than ditching them for other industries. Expect more investment banks to develop transition spearheads like this rather than issuing broad statements of compliance. Read more here. . . .

. . . . The decision by Volkswagen to ramp up electric vehicles to compete with Tesla is real, but count me suspicious about the brand name change to Voltswagen just days ahead of April Fool’s Day. Certainly this is a company whose history — including recently — might necessitate a name change, but this one has marketing magic all over it. . . .

. . . . Terra Alpha Investments, the Washington D.C. asset manager with a focus on climate transition investments, is joining the Net Zero Initiative, the international effort by more than 70 fund managers (with $32 trillion under management) to move toward zero carbon in 2050 or sooner. Terra Alpha’s Tim Dunn, profiled by Callaway Climate Insights last month, is among the more active advocates of the Paris Agreement in the business, assessing every potential investment by its plans to meet the Paris goals, among other things. . . .

. . . . WealthAsia Media announced its 5th Annual Benchmark Fund of the Year Awards for Singapore last night and BNP Paribas Asset Management was named Grand Provider of the Year. FSSA Investment Managers won brand of the year. Elsa Pau, the founder of WealthAsia Media, said only about half of Singapore currently meets the Paris Agreement’s short-term pathway to emission reductions but that both of the winners went beyond walking the walk. BNP has been at the forefront of the fund industry’s green transition in recent months. . . .

. . . . Fascinating Q&A last week between John Furlow, part of the U.S. State Department Team that negotiated the Paris Agreement, and The Signal, a new digital newsletter by J.J. Gould, former digital editor for The Atlantic. In particular, Furlow’s thoughts on how the U.S. military thinks about climate change and why it’s so important the U.S. is back in the Paris universe. . . .

. . . . And finally, one group applauding President Biden’s efforts to create more jobs as part of a green recovery are the descendants of former president Franklin Delano Roosevelt and his cabinet, who sent Biden a letter commending his Civilian Climate Corp. initiative, among others. Kind of cool when the New Deal descendants sign on to the green new deal. . . .

South Dakota wildfire forces closure of Mount Rushmore

The Schroeder Fire has burned more than 800 acres in the Black Hills near Rapid City, S.D. The blaze has forced evacuations in the area and, on Tuesday, the closure of Mount Rushmore National Memorial.

News briefs: Molson vows to brew up green power

The single most important thing for avoiding a climate disaster is cutting carbon pollution from the current 51 billion tons per year to zero, says philanthropist and technologist Bill Gates. Introducing the concept of the “green premium” — the higher price of zero-emission products like electric cars, artificial meat or sustainable aviation fuel — Gates identifies the breakthroughs and investments we need to reduce the cost of clean tech, decarbonize the economy and create a pathway to a clean and prosperous future for all. Watch the video.

Editor’s picks:

Molson commits to brewing with green power

BlackRock picks Bodnar for sustainability spot

Cherry trees blossom earlier this year than in past millennium

Data driven: China’s battery of EVs

. . . . Electric and hybrid-electric vehicles sales in China are expected to soar to 80% of new vehicles sales by 2035 following the nation’s aim to phase out combustion vehicle sales by the same year, says energy and natural resources consulting firm Wood Mackenzie. The bulk of those vehicles are expected to be battery-electric vehicles, with a small share coming from fuel-cell vehicles powered by green fuels like hydrogen. To support the electric boom, the two largest utility companies in China, State Grid Corporation of China and China Southern Power Grid have already spent nearly $1 billion on a charging infrastructure, with China Southern Power Grid pledged an additional $3.6 billion over the next four years. As a result, China is expected to house the second largest market for charging infrastructure, behind only the combined sum of the EU. — George Barker