Extinction Rebellion returns; plus talking ESG investing with CalSTRS' Kirsty Jenkinson

Welcome to Callaway Climate Insights. This week introduces our Sustainability Stars series by Marsha Vande Berg. Please share far and wide.

Above: Extinction Rebellion U.K. Sept. 1 rally in Parliament Square, London. Photo: Jamie Lowe/Extinction Rebellion.

Sen. Joe Biden’s repeated assertion this week that he won’t ban fracking speaks to two troubling themes: an economic back-footing for the Democrats as campaign season enters the home stretch, and how quickly climate change can be thrown under the bus for political expediency when ESG leaders aren’t looking.

Anybody watching the Democrats maneuver on the climate crisis in the past few months could expect Biden would be non-committal on fracking, especially since it was hastily added back to the Democratic platform over the summer after initially being left out. That President Trump’s goading would force him to deny it speaks to the political concern over losing ANY more jobs during the pandemic and specifically fracking jobs in swing state Pennsylvania. The Bureau of Labor Statistics estimates about 26,000 fracking jobs in Pennsylvania out of a total of 636,000 nationwide. More than enough to swing the vote.

It also sadly illustrates how quickly climate change can be discarded as an urgent priority, even as politicians and central bankers call for green recoveries, corporate leaders pledge to meet impossible goals, and climate disasters such as wildfires and hurricanes rage across our news screens. Looking at Hurricane Laura’s destruction last weekend, has anything really changed since the country pledged to rebuild New Orleans after Hurricane Katrina 15 years ago yesterday?

The long-dormant Extinction Rebellion resurfaced earlier today, masks and all, as the U.K. Parliament began its fall session, against the backdrop of a major study showing how far ESG supporters of the transition to clean energy still need to go. The study by Oxford University showed that only one in 10 of the world’s electric utilities was prioritizing renewable energy over fossil fuels, despite global calls to reduce greenhouse gas emissions. A speech by UN Secretary General Antonio Guterres last week also mentioned that economic recovery spending by governments was running more than twice the rate toward fossil fuels than renewable energy plans — and seven times in India.

These challenges illustrate how important it is for the investment community to keep moving toward its ESG goals, creating new renewable jobs and funding climate transition and adaptation strategies. To highlight the people behind these efforts, Callaway Climate Insights this week introduces Sustainability Stars, a series by noted pension and international economics expert Marsha Vande Berg. Her first interview, with Kirsty Jenkinson of CalSTRS, and more insights, below. . . .

And don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Sustainability stars: CalSTRS’ Kirsty Jenkinson

. . . . Kirsty Jenkinson runs a $6 billion public equity sustainable portfolio for the California State Teachers’ Retirement System (CalSTRS). Here in our first Sustainability Stars interview, she tells Marsha Vande Berg, former CEO of the Pacific Pension and Investment Institute and sustainable economics expert, how she got into the business and why it needs more creative executives to face its challenges.

Here’s an excerpt from the interview.

How do you explain the value proposition of sustainability investing?

Jenkinson: Our world is being reshaped by sustainability-related factors as our global population grows and rightfully demands higher standards of living. We have to find ways to use our resources more efficiently, decarbonize the economy — and it’s imperative we do so in ways that are equitable at the same time. These shifts create tremendous opportunities and some risks for us as investors. . . .

. . . . Worse than Covid. That’s how European Central Bank board member Isabel Schnabel characterized the impact of climate change on monetary policy, in a recent interview with Thomson Reuters. Schnabel mused that the ECB could require banks to create climate risk assessments in the future, an idea that some banks are already doing on their own. Adding a green element to the formation of any capital markets union would also make sense, she said, though that project is somewhere below the climate emergency in terms of current priorities . . . .

. . . . Laura’s bill. As tens of thousands remain in searing heat and without power in Louisiana and Texas after Hurricane Laura last weekend, initial estimates for property losses are coming in around $8 billion, the Insurance Journal reports, citing assessments from catastrophe risk modeling firms Air Worldwide and Karen Clark and Co. Wind and storm surge damage also led to about $200 million in losses in the Caribbean, it said. . . .

Drugs, land grabs and coronavirus imperil rainforests

. . . . The twin threats of drug lords and coronavirus are devastating the rainforests of the Miskito Coast on the border of Nicaragua and Honduras, threatening Latin America’s second largest source of carbon-absorbing trees and the beef export industries of the countries to companies like Nestle (NSRGY) and Cargill, writes Michael Molinski. And Covid’s ravaging of local economies is bolstering the drug business at the worst possible time.

Nicaragua’s rainforests were already damaged by two back-to-back wars in the 1970s and 1980s. In 1969, 76% of Nicaragua was covered by forests. Now, its forest cover is less than 25%, according to Global Forest Watch. Its indigenous regions have been badly hit, with deforestation rates as high as 27% since 2000. Much of the deforestation has been illegally cut from areas like the Bosawás Biosphere Reserve, a rainforest preserve on the border between Nicaragua and Honduras which has been on the UNESCO list since 1997 and is the second largest rainforest in the Western Hemisphere, next to the Amazon.

“Not only have we had problems from illegal settlers and drug traffickers who are cutting down our forests, Covid-19 has had a drastic effect on the rainforests and the Miskito people,” said Brooklyn Rivera, the indigenous leader of the Miskito peoples who himself contracted the coronavirus in May. . . .

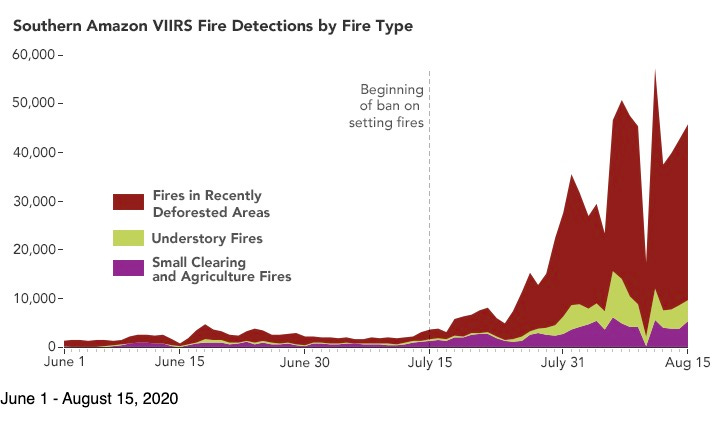

Data driven: 500 major fires detected in Brazilian Amazon this year

Above: VIIRS fire data comes from NASA EOSDIS/LANCE and GIBS/Worldview.

. . . . Some 516 major fires, most of them illegal, covering 912,863 acres, were detected between May 28 and Aug. 25, 2020, with the Amazon fire season not even half over, and expected to run at least through September, Liz Kimbrough writes in a special report from Mongabay.org. Over half of these fires occurred in just the past two weeks, according to satellite data analysis. Of those fires, 12% were within intact forests, while the rest were in recently deforested areas where the cut trees were allowed to dry out before being lit on fire to convert the former rainforest to cattle pasture and croplands. . . .

News briefs: BNP faces loss of clients on coal policy; plus, the wolverines are back

Editor’s picks:

BNP Paribas may lose up to 50% of power clients due to coal policy

Barclays: Challenges of switching to ‘green finance’

Wolverines return to Mount Rainier after 100 years

Latest findings: New research, studies and papers

Watch this: Our Changing Climate looks at our global freshwater crisis. Specifically, the video investigates how droughts in California and the Amazon lead to water scarcity for local residents, wildfires, and changing landscapes.

U.S. plans research centers for AI, quantum information science

The U.S. plans to invest $765 million over the next 5 years in a dozen scientific centers dedicated to the study of artificial intelligence (AI) and quantum information science (QIS), the federal officials announced. Private tech companies such as IBM (IBM), Google (GOOGL), and Intel (INTC) will also contribute to the twin pushes, which call for a total of more than $1 billion in research investment. Seven of the centers will be based at universities and focus on various applications of AI, Science magazine reports. Each AI center will focus on a particular application. For example, the University of Oklahoma, Norman, will host NSF’s Institute for Research on Trustworthy AI in Weather, Climate, and Coastal Oceanography. NSF envisions investing an additional $300 million in grants to support AI work. The five other centers, to be funded by the Department of Energy (DOE) and located at its national laboratories, will focus on different aspects of QIS.

How can green differentiated capital requirements affect climate risks?

From the abstract: Using an ecological macrofinancial model, the authors explore the potential impact of the green supporting factor (GSF) and the dirty penalizing factor (DPF) on climate-related financial risks. Their main findings include: GDCRs can reduce the pace of global warming and decrease thereby the physical financial risks; DPF increases the capital of banks and reduces their credit provision, making them less fragile; and both DPF and GSF generate some transition risks

Authors: Yannis Dafermos, SOAS University of London; Maria Nikolaidi, University of Greenwich.

Available at SSRN.

Citizen science projects help researchers track climate hazards

As climate change fuels natural disasters and more extreme events around the world, citizen scientists are being sought to help researchers track these changes in real time, Discover magazine reports. “Through these science projects and online events, both kids and adults can learn about weather, climate change and more, all while contributing to real-world research,” the magazine notes, citing five opportunities to participate, including NASA's GLOBE Observer; and the CoCoRaHS rain, hail and snow network. Learn more about projects like this at scistarter.org.